Question

4. Mrs. Janet is provided with an auto mobile by her employer. The employer acquired the auto mobile in 2015 for $25000 plus $1250

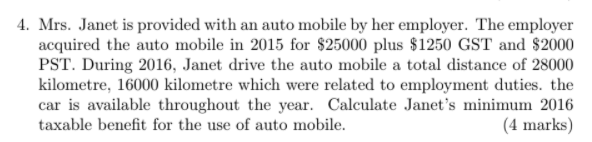

4. Mrs. Janet is provided with an auto mobile by her employer. The employer acquired the auto mobile in 2015 for $25000 plus $1250 GST and $2000 PST. During 2016, Janet drive the auto mobile a total distance of 28000 kilometre, 16000 kilometre which were related to employment duties. the car is available throughout the year. Calculate Janet's minimum 2016 taxable benefit for the use of auto mobile. (4 marks)

Step by Step Solution

3.27 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Puchase price of a car 25000 GST 1250 PST 2000 Total purchase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management Managing Global Supply Chains

Authors: Ray R. Venkataraman, Jeffrey K. Pinto

1st edition

1506302935, 1506302939, 978-1506302935

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App