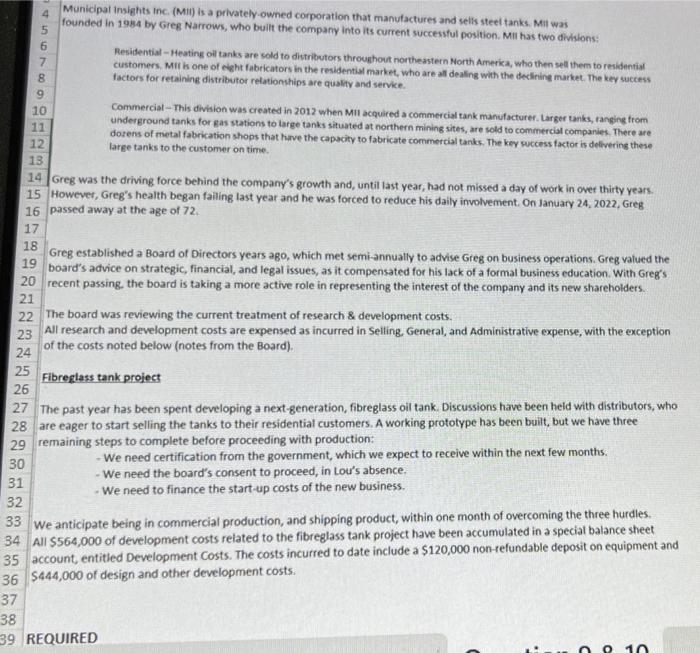

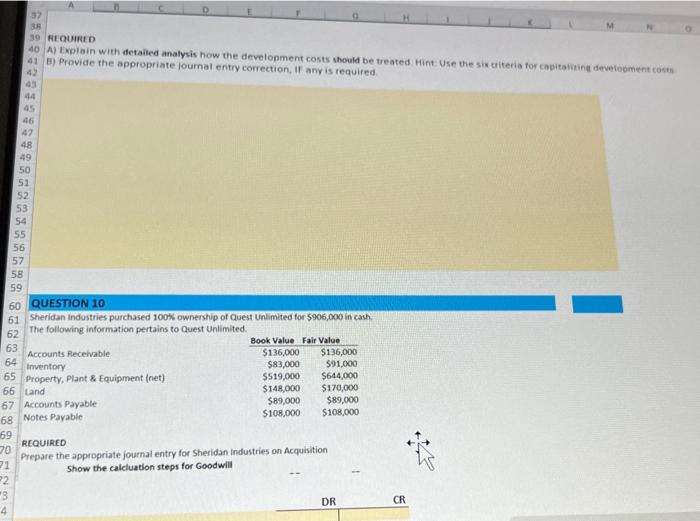

4 Municipal insights inc. (MiI) is a privately-owned corporation that manutactures and selis steel tanks, Mil was founded in 1984 by Greg Narrows, who buitt the company into its current successful position. Mil has two divilons: Residential - Meating oil tanks are cold to distributors throughout northeastern North Amerika, who then sell them to residential customers. Mil ib one of eight fabricators in the residential market, who are al dealing whit the dedining market. The key success factors for retaining distributor relationships are quality and service. Commercial - This division was created in 2012 when MII acquired a commercial tank manufacturer. Larger tanks, ranging trom underground tanks for gas stations to large tanks situated at northern mining sites, are sold to commerciat companies. There are dotens of metal fabrication shops that hive the capacity to fabricate commercial tanks. The key ruccess factor is defiverins these laree tanks to the customer on time. Greg was the driving force behind the company's growth and, until last year, had not missed a day of work in over thirty years. However, Greg's health began failing last year and he was forced to reduce his daily involvement. On January 24, 2022, Greg passed away at the age of 72 . Greg established a Board of Directors years ago, which met semi-annually to advise Greg on business operations. Greg valued the board's advice on strategic, financial, and legal issues, as it compensated for his lack of a formal business education. With Greg's recent passing. the board is taking a more active role in representing the interest of the company and its new shareholders. The board was reviewing the current treatment of research & development costs. All research and development costs are expensed as incurred in Selling, General, and Administrative expense, with the exception of the costs noted below (notes from the Board). Fibreglass tank project The past year has been spent developing a next-generation, fibreglass oil tank. Discussions have been held with distributors, who are eager to start selling the tanks to their residentiat customers. A working prototype has been built, but we have three remaining steps to complete before proceeding with production: - We need certification from the government, which we expect to receive within the next few months. - We need the board's consent to proceed, in Lou's absence. - We need to finance the start-up costs of the new business. We anticipate being in commercial production, and shipping product, within one month of overcoming the three hurdles. All $564,000 of development costs related to the fibreglass tank project have been accumulated in a speciat balance sheet ccount, entitled Development Costs. The costs incurred to date include a $120,000 non-refundable deposit on equipment and 444,000 of design and other development costs. 39. RE QumRto A) Diplain with detailed analysis how the develomment costs should be treated Hint: Use the six criteria for capitalitina devetooment costh. B) Provide the appropriate journal entry correction, If any is required QUESTION 10 Sheridan industries purchased 100W ownershlp of Quest Unlimited for $906,000 in cash. The following information pertains to Quest Unlimited. RRQUIRED Prepare the appropriate journal entry for Sheridan industries on Acquisition Show the calcluation steps for Goodwili 4 Municipal insights inc. (MiI) is a privately-owned corporation that manutactures and selis steel tanks, Mil was founded in 1984 by Greg Narrows, who buitt the company into its current successful position. Mil has two divilons: Residential - Meating oil tanks are cold to distributors throughout northeastern North Amerika, who then sell them to residential customers. Mil ib one of eight fabricators in the residential market, who are al dealing whit the dedining market. The key success factors for retaining distributor relationships are quality and service. Commercial - This division was created in 2012 when MII acquired a commercial tank manufacturer. Larger tanks, ranging trom underground tanks for gas stations to large tanks situated at northern mining sites, are sold to commerciat companies. There are dotens of metal fabrication shops that hive the capacity to fabricate commercial tanks. The key ruccess factor is defiverins these laree tanks to the customer on time. Greg was the driving force behind the company's growth and, until last year, had not missed a day of work in over thirty years. However, Greg's health began failing last year and he was forced to reduce his daily involvement. On January 24, 2022, Greg passed away at the age of 72 . Greg established a Board of Directors years ago, which met semi-annually to advise Greg on business operations. Greg valued the board's advice on strategic, financial, and legal issues, as it compensated for his lack of a formal business education. With Greg's recent passing. the board is taking a more active role in representing the interest of the company and its new shareholders. The board was reviewing the current treatment of research & development costs. All research and development costs are expensed as incurred in Selling, General, and Administrative expense, with the exception of the costs noted below (notes from the Board). Fibreglass tank project The past year has been spent developing a next-generation, fibreglass oil tank. Discussions have been held with distributors, who are eager to start selling the tanks to their residentiat customers. A working prototype has been built, but we have three remaining steps to complete before proceeding with production: - We need certification from the government, which we expect to receive within the next few months. - We need the board's consent to proceed, in Lou's absence. - We need to finance the start-up costs of the new business. We anticipate being in commercial production, and shipping product, within one month of overcoming the three hurdles. All $564,000 of development costs related to the fibreglass tank project have been accumulated in a speciat balance sheet ccount, entitled Development Costs. The costs incurred to date include a $120,000 non-refundable deposit on equipment and 444,000 of design and other development costs. 39. RE QumRto A) Diplain with detailed analysis how the develomment costs should be treated Hint: Use the six criteria for capitalitina devetooment costh. B) Provide the appropriate journal entry correction, If any is required QUESTION 10 Sheridan industries purchased 100W ownershlp of Quest Unlimited for $906,000 in cash. The following information pertains to Quest Unlimited. RRQUIRED Prepare the appropriate journal entry for Sheridan industries on Acquisition Show the calcluation steps for Goodwili