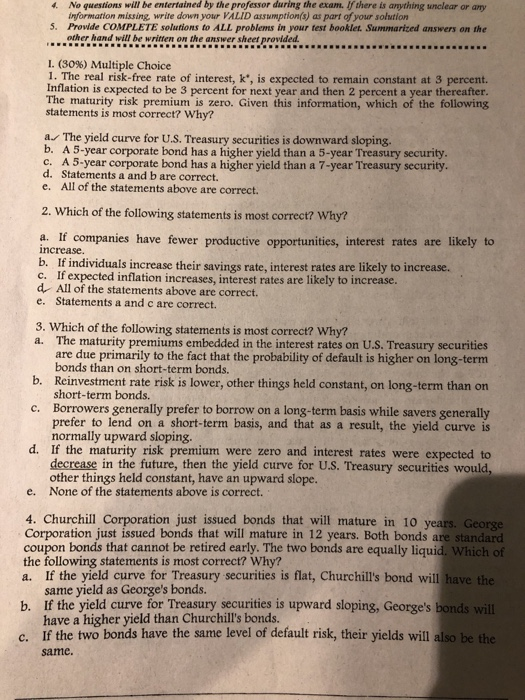

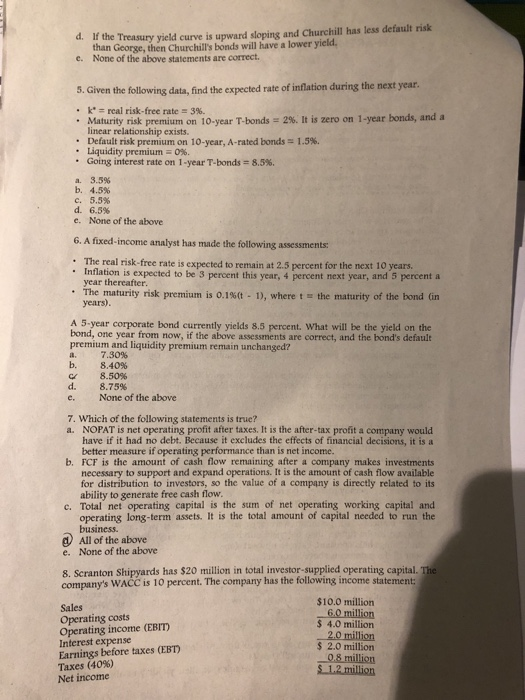

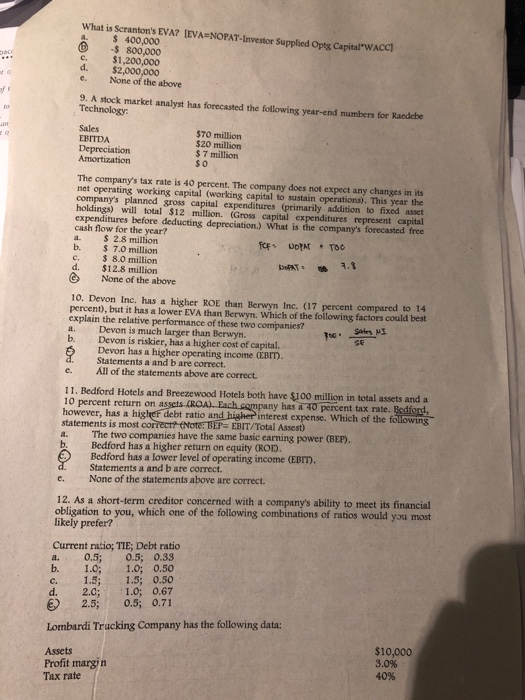

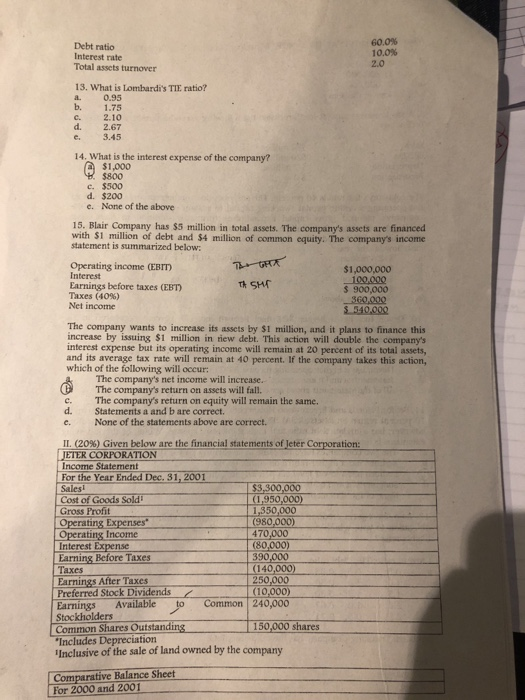

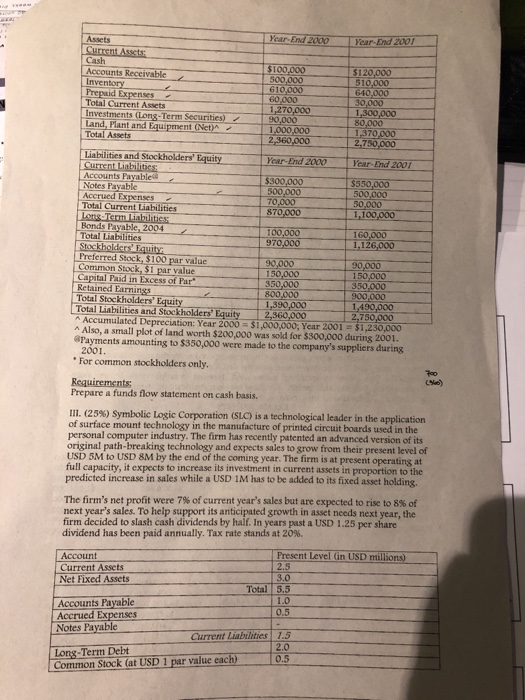

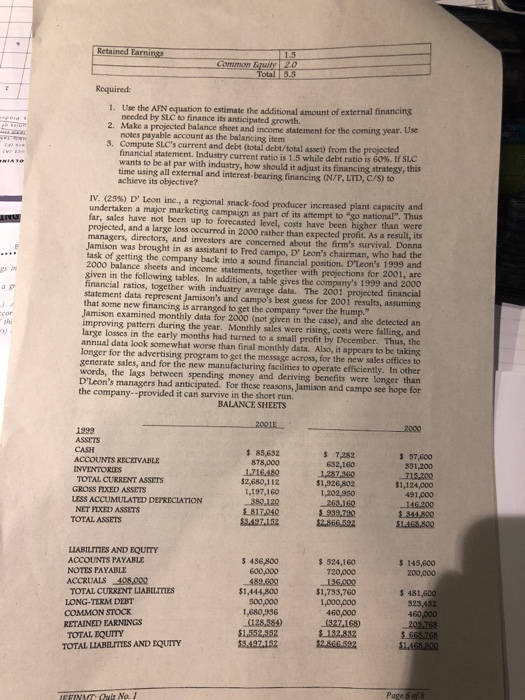

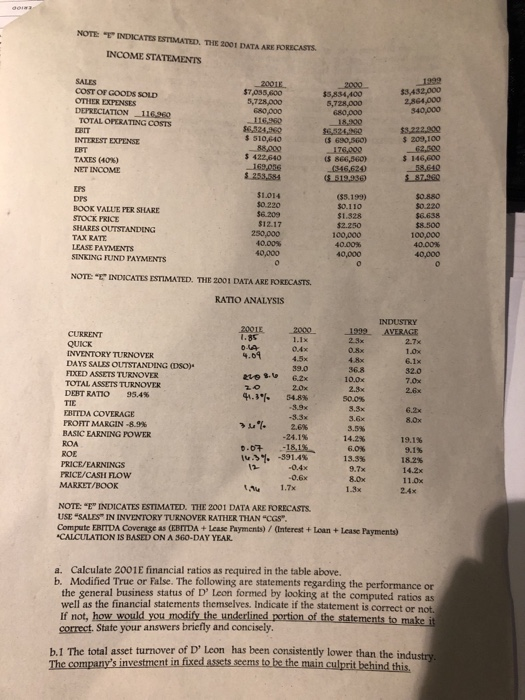

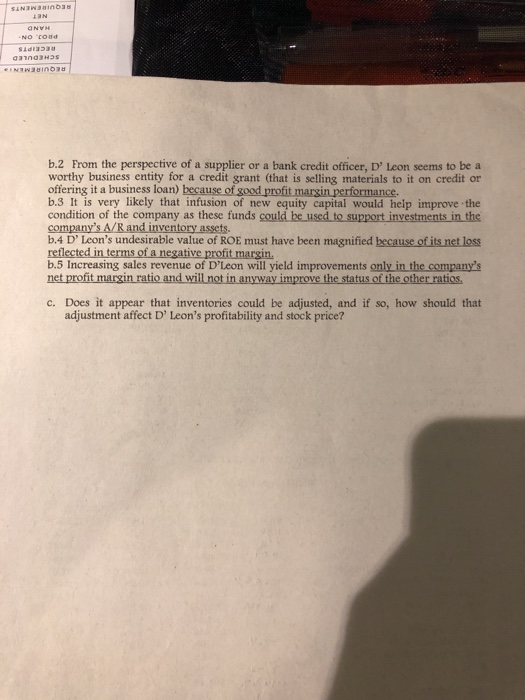

4 No guestions will be entertained by the professor during the exam. If there is anything unclear or any information missing write down your VALID assumption(s) as part of your solution Provide COMPLETE solutions to ALL problems in your test booklet. Summarized answers on the 5. answer sheet provided. I. (30%) Multiple Choice 1. The real risk-free rate of interest, k', is expected to remain constant at 3 percent. Inflation is expected to be 3 percent for next year and then 2 percent a year thereafter The maturity risk premium is zero. Given this information, which of the following statements is most correct? Why? a. The yield curve for U.S. Treasury securities is downward sloping b. A 5-year corporate bond has a higher yield than a 5-year Treasury security. c. A 5-year corporate bond has a higher yield than a 7-year Treasury security. d. Statements a and b are correct. e. All of the statements above are correct. 2. Which of the following statements is most correct? Why? a. If companies have fewer productive opportunities, interest rates are likely to increase. b. If individuals increase their savings rate, interest rates are likely to increase. c. If expected inflation increases, interest rates are likely to increase. d. All of the statements above are correct e. Statements a and c are correct. 3. Which of the following statements is most correct? Why? The maturity premiums embedded in the interest rates on US. Treasury securities are due primarily to the fact that the probability of default is higher on long-term bonds than on short-term bonds. b. Reinvestment rate risk is lower, other things held constant, on long-term than on short-term bonds. Borrowers generally prefer to borrow on a long-term basis while savers generally prefer to lend on a short-term basis, and that as a result, the yield curve is normally upward sloping c. d. If the maturity risk premium were zero and interest rates were expected to decrease in the future, then the yield curve for U.s. Treasury securities would, other things held constant, have an upward slope. None of the statements above is correct. e. 4. Churchill Corporation just issued bonds that will mature in 10 years. George Corporation just issued bonds that will mature in 12 years. Both bonds are standard coupon bonds that cannot be retired early. The two bonds are equally liquid a. If the yield curve for Treasury securities is flat, Churchill's bond will b. If the yield curve for Treasury securities is upward sloping, George's bon c. If the two bonds have the same level of default risk, their yields will also the following statements is most correct? Why? same yield as George's bonds have a higher yield than Churchill's bonds. same. d. If the Treasury yield curve is upward sloping and Churchill has less default risk e. None of the above statements are correct. tha n George, then Churchill's bonds will have a lower yield . Given * k* real risk-free rate 3%. . Maturity risk premium on 10-year T-bonds-296. It is zero on 1-year bonds, and a the following data,find the expected rate of inflation during the next year linear relationship exists. Default risk premium on 10-year, A-rated bonds 1.5%. Liquidity premium-0% * Going interest rate on 1-year T-bonds = 8.5%. a. 3.5% b. 4.5% c. 5.5% d. 6.5% e. None of the above 6. A fixed-income analyst has made the following assessments: The real nsk-free rate is expected to remain at 2.5 percent for the next 10 years. Inflation is expected to be 3 percent this year, 4 percent next year, and 5 percent a year thereafter -The maturity risk premium is 0.1%(-1), where t-the maturity of the bond (in years) A 5-year corporate bond currently yields 8.5 percent. What will be the yield on the bond, one year from now, if the above assessments are correct, and the bond's default premium and liquidity premium remain unchanged? a. 7.30% b, 8.40% d. e. 8.50% 8.75% None of the above 7. Which of the following statements is true? a. NOPAT is net operating profit after taxes. It is the after-tax profit a company would have if it had no debt. Because it excludes the effects of financial decisions, it is a better measure if operating performance than is net income. b. FCF is the amount of cash flow remaining after a company makes investments necessary to support and expand operations. It is the amount of cash flow available for distribution to investors, so the value of a company is directly related to its ability to generate free cash flow c. Total net operating capital is the sum of net operating working capital and operating long-term assets. It is the total amount of capital needed to run the business. All of the above e. None of the above 8. Scranton Shipyards has $20 million in total investor-supplied operating capital company's WACC is 10 percent. The company has the following income statement Sales Operating costs Operating income (EBIT Interest expense Earnings before taxes (EBT) Taxes (40%) Net income $10.0 million $ 4.0 million 2.0 million Assets Year-End 2000 Year-End 2001 Accounts Receivable 510,000 30,000 80 ventory Prepaid Expenses 60 1,270,000 Total Current Assets Investments (Long-Term Securities)90,000 Land, Plant and Equipment (Net)A 1.000,000 370 2,750,000 Linbilities and Slockholders' Equity Year End 2000 Year-End 200 Accounts Notes Payable Accrued Expenses 500,000 Total Current Liabilities 70 1,100,000 Bonds Payable, 2004 Total Liabilities 970,000160,000 Preferred Stock, $100 par value Common Stock, $1 par value 90 Capital Paid in Excess of Par 150,000 350 350 .000 1,390,000 Total Stockholders' Total Liabilities and Stockholders Equity 2,360,000 ^ Accumulated Depreciation: Year 2000 $1,000,000; Year 200$1.230,00 AAlso, a small plot of land worth $200,000 was sold for $300,000 during 2001 Payments amounting to $350,000 were made to the company's suppliers during 1,490,000 2,750,000 2001 For common stockholders only CNie) Prepare a funds flow statement on cash basis. 111, (25%) Symbolic Logic Corporation SLO is a technological leader in the application of surface mount technology in the manufacture of printed circuit boards used in the personal computer industry. The firm has recently patented an advanced version of its original path-breaking technology and expects sales to grow from their present level of USD 5M to USD 8M by the end of the coming year. The firm is at present full capacity, it expects to increase its investment in current assets in proportion to the predicted increase in sales while a USD 1M has to be added to its fixed asset holdi operatins at g. The firm's net profit were 7% of current year's sales but are expected to rise to 8% of next year's sales. To help support its anticipated growth in asset needs next year, the firm decided to slash cash dividends by half. In years past a USD 1.25 per share dividend has been paid annually. Tax rate stands at 20%. Present Level in USD millions) Account Current Assets 2.5 3.0 Total 5.5 1.0 0.5 Net Fixed Assets Accounts Payable Accrued Expenses Long-Term Debt Common Stock (at USD 1 par value each) Current Liabilities 1.5 2.0 0.5 Required Use the AFN equation to estimate t needed by SLC to finance its anticipated growth. 1. the additional amount of external financing 2. Make a projected balance sheet and income statement for the coming year notes payable account as the balancing item Compute SLC's current and debt (total debt/total asset) from the financial statement. Industry current ratio is 1.5 while debt ratio wants to be at par with industry, how should it adjust its financing strategy, this 3. is 6O%. If SLC time using all external and interest-bearing financing (N/F, LTD, C/S) to achieve its objective? IV. (25 %) D, Leon inc., a regional snack-food producer increased plant capacity and far, sales have not been up to forecasted level, costs have been higher than were undertaken a major marketing campaign as part of its attempt to "go national". Thus projected, and a large loss occurred in 2000 rather than expected profit. As a resulf, its task of getting the company back into a sound financial position. D'Leons financial ratios, together with industry average managers, directors, and investors are concerned about the firm's survival. Donna Jamison was brought in as assistant to Fred campo, D' Leon's chairman, who had the 2000 balance sheets and income statements, together with projections for 2001, are given in the following tables. In addition, a table gives the company's 1999 and 200 statement data represent Jamison's and campo's best guess for 2001 results, assumins amison examined monthly data for 2000 (not given in the case), and she detected an that some new financing is arranged to get the company "over the hump ing pattern during the year. Monthly sales were rising, costs were falling, and large losses in the early months had turned to a small profit by December. Thus, the annual data look somewhat worse than final monthly data. Also, it appears to be taking longer for the advertising program to get the message generate sales, and for the new manufacturing facilities to operate efficiently. In other words, the lags between spending money and deriving benefits were longer than D'Leon's managers had anticipated. For these reasons, Jamison and campo see hope for the company-provided it can survive in the short run BALANCE SHEETS 2001,- 1999 CASH ACCOUNTS KECEIVABLE 85,632 $ 7,282 632,160 57,000 331,200 TOTAL CURRENT ASSETS GROSS FLXED ASSETS uss ACCUMULATO DORECIATON NET FIXED ASSETS TOTAL ASSETS $1,926,802 1,202950 $1,124,00o 491,000 1,197,160 $3.497,152 LIABILITTES AND EQUITY ACCOUNTS PAYABLE NOTES PAYABLE 436,800 $ 524,160 $ 145,600 720,000 $1,733,760 460,000 200,000 -489800 TOTAL CURRENT LIABILITIES LONG-TERM DEBT $1,444,800 1,680,936 1552,352 $ 481 COMMON STOCK RETAINED EARNINGS TOTAL EQUITY (327,168) TOTAL LIABILITIES AND EQUITY NOTE E INDICATES ESTIMATED. THE 2001 DATA AKE INCOME STATEMENTS COST OF GOODS SOLD OTHER EXPENSES DEPRECIATION 1696 $7,055,600 5,728,000 680,000 116,960 $6524,960 $ 510,640 $5,834,400 2,064,000 TOTAL OPERATING COSTS INTEREST EXPENSE 3 690,560) 176,000 S 866,360) (346,624 $ 209,100 TAXES (40%) NET INCOME $ 146,600 169,056 EPS DPS BOOK VALUE SURE STOCK PRICE SHARES OUTSTANDENG TAX RATTE LEASE PAYMENTS SINKING FUND PAYMENTS $1.014 s0.220 ($5.199) s0.110 $1.328 $0.220 $6.638 $8.500 100,000 $12.17 100,000 40.00% NOTE "E INDICATES ESTIMATED. THE 2001 DATA ARE FOKECASTS. RATIO ANALYSIS 2001E2000 200 1999 AVERAGE CUREENT QUICK INVENTORY TURNOVER DAYS SALES OUTSTANDING (DSo) 6.1x 32.0 39.0 36.8 10.0x FIXED ASSETS TURNOVER TOTAL ASSETS .RNOVEK DO TRATO 95.4% 4.3% 54.8% FBITDA COVERAGE PROFIT MARGIN-89% BASIC EARNING POWER 3.6x 3.5% 14.2% 2.6% -24.1% 0.0 -1818 14.3%--391.4% 4% ROE PRICE/EARNINGS PRICE/CASH FLOW MARKET/BOOK 19.1% 9.1% 18.2% 14.2x 11.0x 24x 1 3.5% 9.7x 0.6x 1.7x NOTE "E INDICATES ESTIMATED. THE 2001 DATA ARE FORECASTS USE "SALES IN INVENTORY TURNOVER RATHER THAN "CGS Compute EBITDA Coverage as (EBITDA+ Lease Payments) /(nterest+ Loan + Lease Payments) CALCULATION IS BASED ON A 360-DAY YEAR a. Calculate 2001E financial ratios as required in the table above. b. Modified True or False. The following are statements regarding the performance or the general business status of D' Leon formed by looking at the computed ratios as well as the financial statements themselves. Indicate if the statement If not, how would you modify the underlined portion of the statements to correct. State your answers briefly and concisely is correct or not. b.1 The total asset turnover of D' Leon has been consistently lower than the NO tOud b.2 From the perspective of a supplier or a bank credit officer, D' Leon seems to be a worthy business entity for a credit grant (that is selling materials to it on credit or offering it a business loan) because of good profit margin performance. b.3 It is very likely that infusion of new equity capital would help improve the condition of the company as these funds could be used to support investments in the assets b.4 D Leon's undesirable value of ROE must have been magnified because of its net loss tas'snereanineg mals revenue of Dviom wlit ield improvements onlz in the. campany's b.5 Increaing sales revenue of D'Leon will yield improvements only in the company' net profit margin ratio and will not in anyway improve the status of the other ratios, c. Does it appear that inventories could be adjusted, and if so, how should that adjustment affect D Leon's profitability and stock price? 4 No guestions will be entertained by the professor during the exam. If there is anything unclear or any information missing write down your VALID assumption(s) as part of your solution Provide COMPLETE solutions to ALL problems in your test booklet. Summarized answers on the 5. answer sheet provided. I. (30%) Multiple Choice 1. The real risk-free rate of interest, k', is expected to remain constant at 3 percent. Inflation is expected to be 3 percent for next year and then 2 percent a year thereafter The maturity risk premium is zero. Given this information, which of the following statements is most correct? Why? a. The yield curve for U.S. Treasury securities is downward sloping b. A 5-year corporate bond has a higher yield than a 5-year Treasury security. c. A 5-year corporate bond has a higher yield than a 7-year Treasury security. d. Statements a and b are correct. e. All of the statements above are correct. 2. Which of the following statements is most correct? Why? a. If companies have fewer productive opportunities, interest rates are likely to increase. b. If individuals increase their savings rate, interest rates are likely to increase. c. If expected inflation increases, interest rates are likely to increase. d. All of the statements above are correct e. Statements a and c are correct. 3. Which of the following statements is most correct? Why? The maturity premiums embedded in the interest rates on US. Treasury securities are due primarily to the fact that the probability of default is higher on long-term bonds than on short-term bonds. b. Reinvestment rate risk is lower, other things held constant, on long-term than on short-term bonds. Borrowers generally prefer to borrow on a long-term basis while savers generally prefer to lend on a short-term basis, and that as a result, the yield curve is normally upward sloping c. d. If the maturity risk premium were zero and interest rates were expected to decrease in the future, then the yield curve for U.s. Treasury securities would, other things held constant, have an upward slope. None of the statements above is correct. e. 4. Churchill Corporation just issued bonds that will mature in 10 years. George Corporation just issued bonds that will mature in 12 years. Both bonds are standard coupon bonds that cannot be retired early. The two bonds are equally liquid a. If the yield curve for Treasury securities is flat, Churchill's bond will b. If the yield curve for Treasury securities is upward sloping, George's bon c. If the two bonds have the same level of default risk, their yields will also the following statements is most correct? Why? same yield as George's bonds have a higher yield than Churchill's bonds. same. d. If the Treasury yield curve is upward sloping and Churchill has less default risk e. None of the above statements are correct. tha n George, then Churchill's bonds will have a lower yield . Given * k* real risk-free rate 3%. . Maturity risk premium on 10-year T-bonds-296. It is zero on 1-year bonds, and a the following data,find the expected rate of inflation during the next year linear relationship exists. Default risk premium on 10-year, A-rated bonds 1.5%. Liquidity premium-0% * Going interest rate on 1-year T-bonds = 8.5%. a. 3.5% b. 4.5% c. 5.5% d. 6.5% e. None of the above 6. A fixed-income analyst has made the following assessments: The real nsk-free rate is expected to remain at 2.5 percent for the next 10 years. Inflation is expected to be 3 percent this year, 4 percent next year, and 5 percent a year thereafter -The maturity risk premium is 0.1%(-1), where t-the maturity of the bond (in years) A 5-year corporate bond currently yields 8.5 percent. What will be the yield on the bond, one year from now, if the above assessments are correct, and the bond's default premium and liquidity premium remain unchanged? a. 7.30% b, 8.40% d. e. 8.50% 8.75% None of the above 7. Which of the following statements is true? a. NOPAT is net operating profit after taxes. It is the after-tax profit a company would have if it had no debt. Because it excludes the effects of financial decisions, it is a better measure if operating performance than is net income. b. FCF is the amount of cash flow remaining after a company makes investments necessary to support and expand operations. It is the amount of cash flow available for distribution to investors, so the value of a company is directly related to its ability to generate free cash flow c. Total net operating capital is the sum of net operating working capital and operating long-term assets. It is the total amount of capital needed to run the business. All of the above e. None of the above 8. Scranton Shipyards has $20 million in total investor-supplied operating capital company's WACC is 10 percent. The company has the following income statement Sales Operating costs Operating income (EBIT Interest expense Earnings before taxes (EBT) Taxes (40%) Net income $10.0 million $ 4.0 million 2.0 million Assets Year-End 2000 Year-End 2001 Accounts Receivable 510,000 30,000 80 ventory Prepaid Expenses 60 1,270,000 Total Current Assets Investments (Long-Term Securities)90,000 Land, Plant and Equipment (Net)A 1.000,000 370 2,750,000 Linbilities and Slockholders' Equity Year End 2000 Year-End 200 Accounts Notes Payable Accrued Expenses 500,000 Total Current Liabilities 70 1,100,000 Bonds Payable, 2004 Total Liabilities 970,000160,000 Preferred Stock, $100 par value Common Stock, $1 par value 90 Capital Paid in Excess of Par 150,000 350 350 .000 1,390,000 Total Stockholders' Total Liabilities and Stockholders Equity 2,360,000 ^ Accumulated Depreciation: Year 2000 $1,000,000; Year 200$1.230,00 AAlso, a small plot of land worth $200,000 was sold for $300,000 during 2001 Payments amounting to $350,000 were made to the company's suppliers during 1,490,000 2,750,000 2001 For common stockholders only CNie) Prepare a funds flow statement on cash basis. 111, (25%) Symbolic Logic Corporation SLO is a technological leader in the application of surface mount technology in the manufacture of printed circuit boards used in the personal computer industry. The firm has recently patented an advanced version of its original path-breaking technology and expects sales to grow from their present level of USD 5M to USD 8M by the end of the coming year. The firm is at present full capacity, it expects to increase its investment in current assets in proportion to the predicted increase in sales while a USD 1M has to be added to its fixed asset holdi operatins at g. The firm's net profit were 7% of current year's sales but are expected to rise to 8% of next year's sales. To help support its anticipated growth in asset needs next year, the firm decided to slash cash dividends by half. In years past a USD 1.25 per share dividend has been paid annually. Tax rate stands at 20%. Present Level in USD millions) Account Current Assets 2.5 3.0 Total 5.5 1.0 0.5 Net Fixed Assets Accounts Payable Accrued Expenses Long-Term Debt Common Stock (at USD 1 par value each) Current Liabilities 1.5 2.0 0.5 Required Use the AFN equation to estimate t needed by SLC to finance its anticipated growth. 1. the additional amount of external financing 2. Make a projected balance sheet and income statement for the coming year notes payable account as the balancing item Compute SLC's current and debt (total debt/total asset) from the financial statement. Industry current ratio is 1.5 while debt ratio wants to be at par with industry, how should it adjust its financing strategy, this 3. is 6O%. If SLC time using all external and interest-bearing financing (N/F, LTD, C/S) to achieve its objective? IV. (25 %) D, Leon inc., a regional snack-food producer increased plant capacity and far, sales have not been up to forecasted level, costs have been higher than were undertaken a major marketing campaign as part of its attempt to "go national". Thus projected, and a large loss occurred in 2000 rather than expected profit. As a resulf, its task of getting the company back into a sound financial position. D'Leons financial ratios, together with industry average managers, directors, and investors are concerned about the firm's survival. Donna Jamison was brought in as assistant to Fred campo, D' Leon's chairman, who had the 2000 balance sheets and income statements, together with projections for 2001, are given in the following tables. In addition, a table gives the company's 1999 and 200 statement data represent Jamison's and campo's best guess for 2001 results, assumins amison examined monthly data for 2000 (not given in the case), and she detected an that some new financing is arranged to get the company "over the hump ing pattern during the year. Monthly sales were rising, costs were falling, and large losses in the early months had turned to a small profit by December. Thus, the annual data look somewhat worse than final monthly data. Also, it appears to be taking longer for the advertising program to get the message generate sales, and for the new manufacturing facilities to operate efficiently. In other words, the lags between spending money and deriving benefits were longer than D'Leon's managers had anticipated. For these reasons, Jamison and campo see hope for the company-provided it can survive in the short run BALANCE SHEETS 2001,- 1999 CASH ACCOUNTS KECEIVABLE 85,632 $ 7,282 632,160 57,000 331,200 TOTAL CURRENT ASSETS GROSS FLXED ASSETS uss ACCUMULATO DORECIATON NET FIXED ASSETS TOTAL ASSETS $1,926,802 1,202950 $1,124,00o 491,000 1,197,160 $3.497,152 LIABILITTES AND EQUITY ACCOUNTS PAYABLE NOTES PAYABLE 436,800 $ 524,160 $ 145,600 720,000 $1,733,760 460,000 200,000 -489800 TOTAL CURRENT LIABILITIES LONG-TERM DEBT $1,444,800 1,680,936 1552,352 $ 481 COMMON STOCK RETAINED EARNINGS TOTAL EQUITY (327,168) TOTAL LIABILITIES AND EQUITY NOTE E INDICATES ESTIMATED. THE 2001 DATA AKE INCOME STATEMENTS COST OF GOODS SOLD OTHER EXPENSES DEPRECIATION 1696 $7,055,600 5,728,000 680,000 116,960 $6524,960 $ 510,640 $5,834,400 2,064,000 TOTAL OPERATING COSTS INTEREST EXPENSE 3 690,560) 176,000 S 866,360) (346,624 $ 209,100 TAXES (40%) NET INCOME $ 146,600 169,056 EPS DPS BOOK VALUE SURE STOCK PRICE SHARES OUTSTANDENG TAX RATTE LEASE PAYMENTS SINKING FUND PAYMENTS $1.014 s0.220 ($5.199) s0.110 $1.328 $0.220 $6.638 $8.500 100,000 $12.17 100,000 40.00% NOTE "E INDICATES ESTIMATED. THE 2001 DATA ARE FOKECASTS. RATIO ANALYSIS 2001E2000 200 1999 AVERAGE CUREENT QUICK INVENTORY TURNOVER DAYS SALES OUTSTANDING (DSo) 6.1x 32.0 39.0 36.8 10.0x FIXED ASSETS TURNOVER TOTAL ASSETS .RNOVEK DO TRATO 95.4% 4.3% 54.8% FBITDA COVERAGE PROFIT MARGIN-89% BASIC EARNING POWER 3.6x 3.5% 14.2% 2.6% -24.1% 0.0 -1818 14.3%--391.4% 4% ROE PRICE/EARNINGS PRICE/CASH FLOW MARKET/BOOK 19.1% 9.1% 18.2% 14.2x 11.0x 24x 1 3.5% 9.7x 0.6x 1.7x NOTE "E INDICATES ESTIMATED. THE 2001 DATA ARE FORECASTS USE "SALES IN INVENTORY TURNOVER RATHER THAN "CGS Compute EBITDA Coverage as (EBITDA+ Lease Payments) /(nterest+ Loan + Lease Payments) CALCULATION IS BASED ON A 360-DAY YEAR a. Calculate 2001E financial ratios as required in the table above. b. Modified True or False. The following are statements regarding the performance or the general business status of D' Leon formed by looking at the computed ratios as well as the financial statements themselves. Indicate if the statement If not, how would you modify the underlined portion of the statements to correct. State your answers briefly and concisely is correct or not. b.1 The total asset turnover of D' Leon has been consistently lower than the NO tOud b.2 From the perspective of a supplier or a bank credit officer, D' Leon seems to be a worthy business entity for a credit grant (that is selling materials to it on credit or offering it a business loan) because of good profit margin performance. b.3 It is very likely that infusion of new equity capital would help improve the condition of the company as these funds could be used to support investments in the assets b.4 D Leon's undesirable value of ROE must have been magnified because of its net loss tas'snereanineg mals revenue of Dviom wlit ield improvements onlz in the. campany's b.5 Increaing sales revenue of D'Leon will yield improvements only in the company' net profit margin ratio and will not in anyway improve the status of the other ratios, c. Does it appear that inventories could be adjusted, and if so, how should that adjustment affect D Leon's profitability and stock price