Answered step by step

Verified Expert Solution

Question

1 Approved Answer

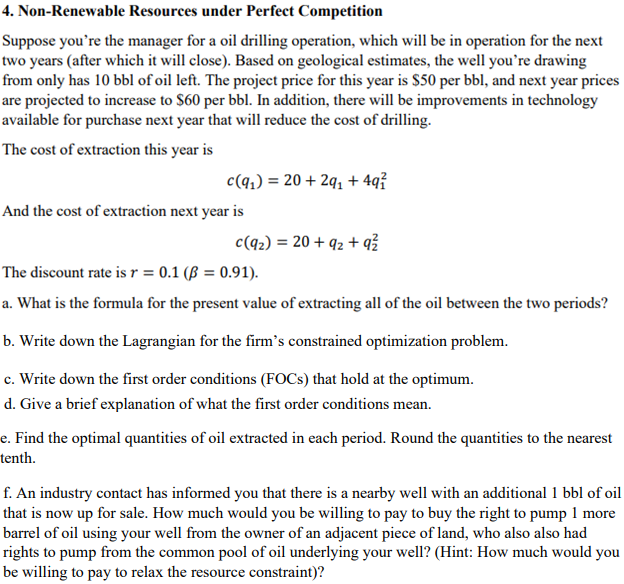

4. Non-Renewable Resources under Perfect Competition Suppose you're the manager for a oil drilling operation, which will be in operation for the next two

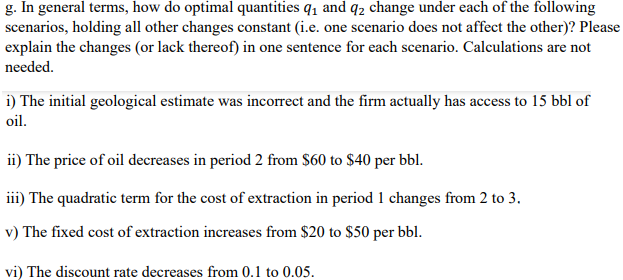

4. Non-Renewable Resources under Perfect Competition Suppose you're the manager for a oil drilling operation, which will be in operation for the next two years (after which it will close). Based on geological estimates, the well you're drawing from only has 10 bbl of oil left. The project price for this year is $50 per bbl, and next year prices are projected to increase to $60 per bbl. In addition, there will be improvements in technology available for purchase next year that will reduce the cost of drilling. The cost of extraction this year is c(9) = 20 + 2q +49 And the cost of extraction next year is c(92) = 20 +9 +9 The discount rate is r = 0.1 ( = 0.91). a. What is the formula for the present value of extracting all of the oil between the two periods? b. Write down the Lagrangian for the firm's constrained optimization problem. c. Write down the first order conditions (FOCs) that hold at the optimum. d. Give a brief explanation of what the first order conditions mean. e. Find the optimal quantities of oil extracted in each period. Round the quantities to the nearest tenth. f. An industry contact has informed you that there is a nearby well with an additional 1 bbl of oil that is now up for sale. How much would you be willing to pay to buy the right to pump 1 more barrel of oil using your well from the owner of an adjacent piece of land, who also also had rights to pump from the common pool of oil underlying your well? (Hint: How much would you be willing to pay to relax the resource constraint)? g. In general terms, how do optimal quantities q and q2 change under each of the following scenarios, holding all other changes constant (i.e. one scenario does not affect the other)? Please explain the changes (or lack thereof) in one sentence for each scenario. Calculations are not needed. i) The initial geological estimate was incorrect and the firm actually has access to 15 bbl of oil. ii) The price of oil decreases in period 2 from $60 to $40 per bbl. iii) The quadratic term for the cost of extraction in period 1 changes from 2 to 3. v) The fixed cost of extraction increases from $20 to $50 per bbl. vi) The discount rate decreases from 0.1 to 0.05.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a The formula for the present value of extracting all of the oil between the two periods can be calculated using the discounted cash flow DCF approach ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started