Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pat's Pots is a company that makes pottery. She uses only two inputs to make the pots she produces and sells. Those two inputs

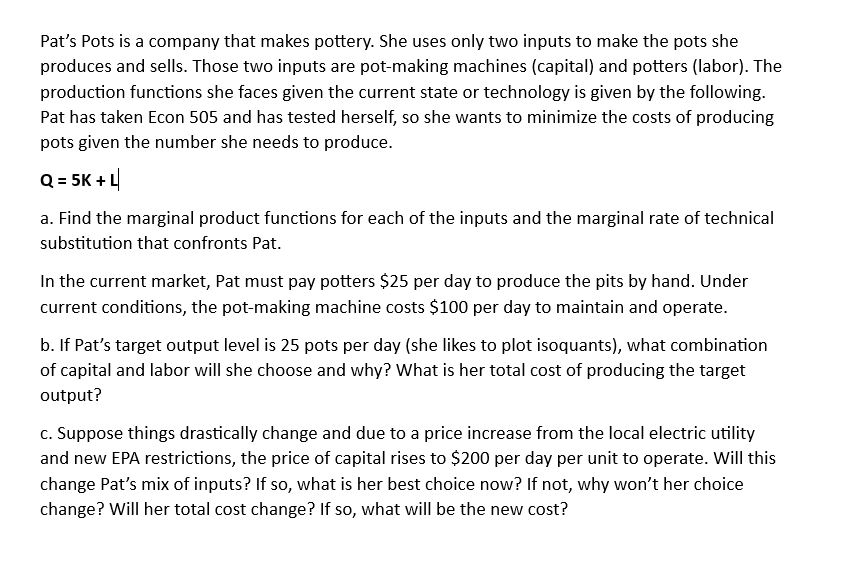

Pat's Pots is a company that makes pottery. She uses only two inputs to make the pots she produces and sells. Those two inputs are pot-making machines (capital) and potters (labor). The production functions she faces given the current state or technology is given by the following. Pat has taken Econ 505 and has tested herself, so she wants to minimize the costs of producing pots given the number she needs to produce. Q = 5K+ L a. Find the marginal product functions for each of the inputs and the marginal rate of technical substitution that confronts Pat. In the current market, Pat must pay potters $25 per day to produce the pits by hand. Under current conditions, the pot-making machine costs $100 per day to maintain and operate. b. If Pat's target output level is 25 pots per day (she likes to plot isoquants), what combination of capital and labor will she choose and why? What is her total cost of producing the target output? c. Suppose things drastically change and due to a price increase from the local electric utility and new EPA restrictions, the price of capital rises to $200 per day per unit to operate. Will this change Pat's mix of inputs? If so, what is her best choice now? If not, why won't her choice change? Will her total cost change? If so, what will be the new cost?

Step by Step Solution

★★★★★

3.57 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Given the production function Q 5K L Marginal product of capital MPK MP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started