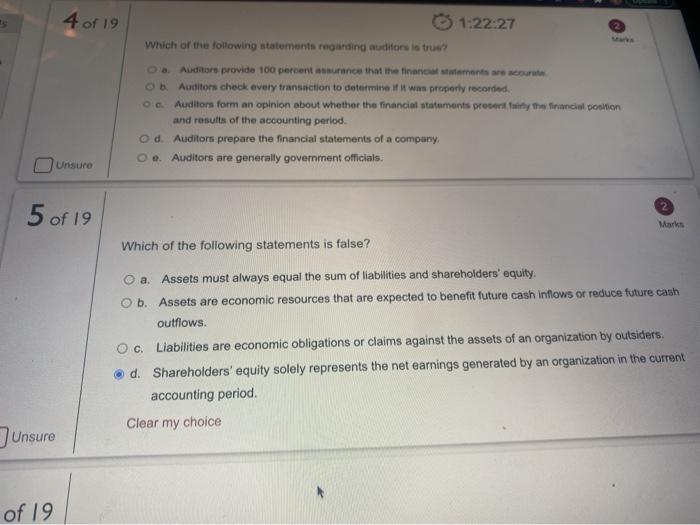

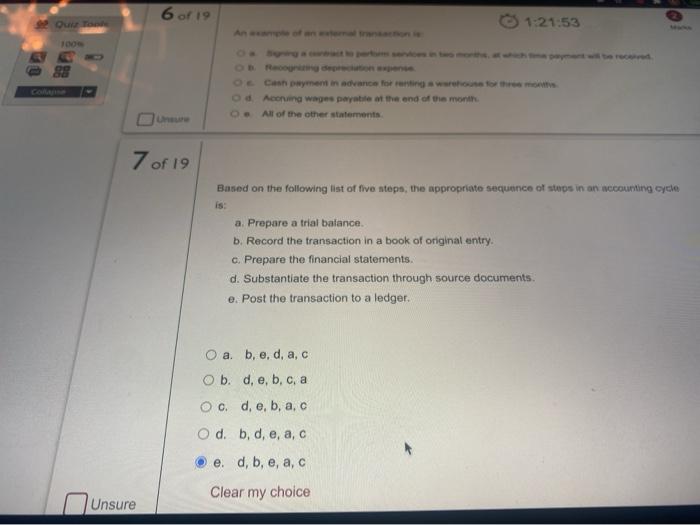

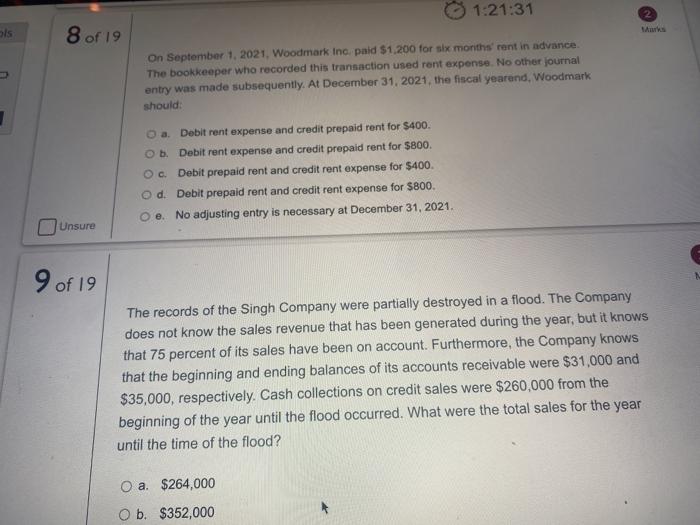

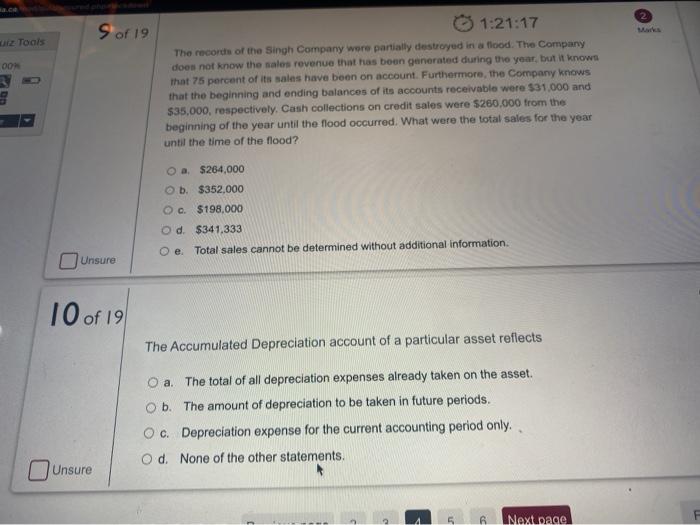

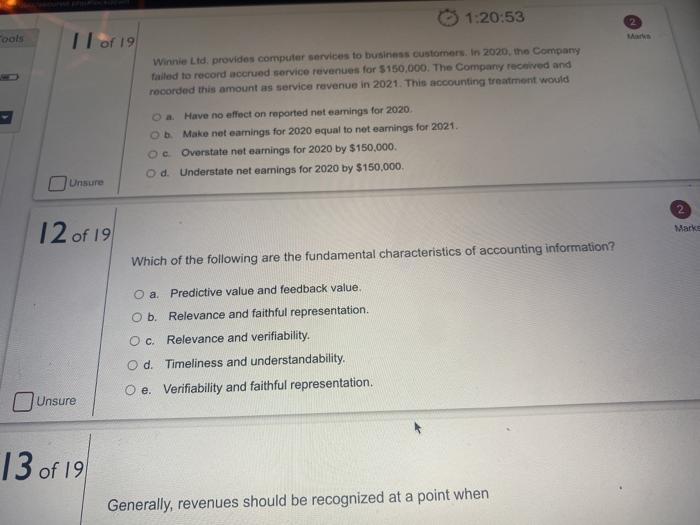

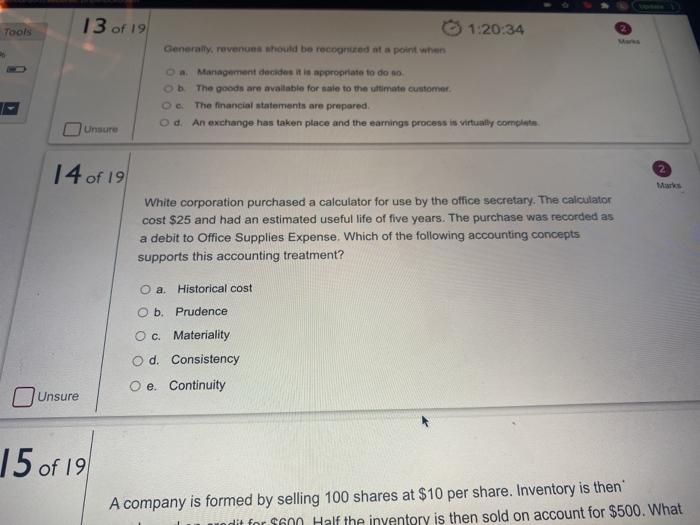

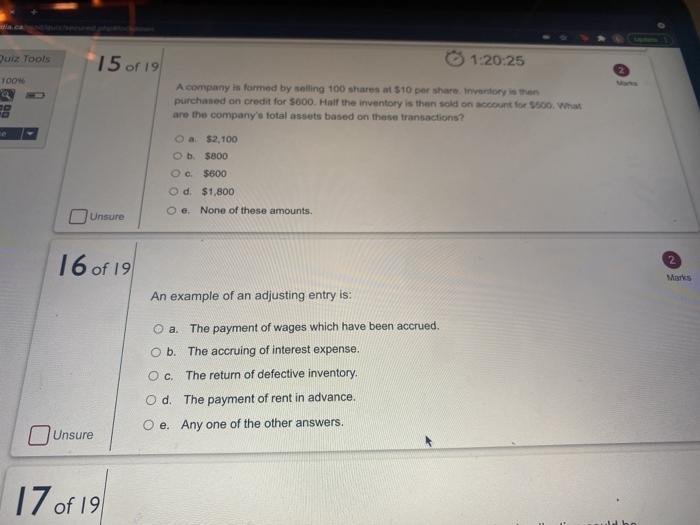

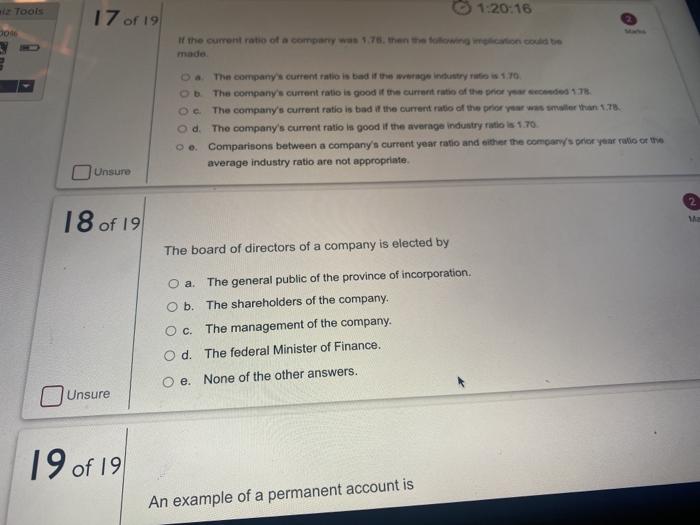

4 of 19 0 1:22:27 Which of the following statements regarding auditor is true Auditors provide 100 percent assurance that the financements are con Ob Auditors check every transaction to determine it was property recorded OcAuditors form an opinion about whether the financial statements present in the financial position and results of the accounting period. Od Auditors prepare the financial statements of a company Oe. Auditors are generally government officials Unsure 5 of 19 Marks Which of the following statements is false? O a. Assets must always equal the sum of liabilities and shareholders' equity. Ob. Assets are economic resources that are expected to benefit future cash inflows or reduce futute cash outflows. Oc. Liabilities are economic obligations or claims against the assets of an organization by outsiders. d. Shareholders' equity solely represents the net earnings generated by an organization in the current accounting period Clear my choice unsure of 19 6 of 19 2 O 1:21:53 1000 Od Accuma wages payable at the end of the month All of the other statements 7 of 19 Based on the following list of five step, the appropriate sequence of steps in an accounting cycle is a. Prepare a trial balance b. Record the transaction in a book of original entry. c. Prepare the financial statements. d. Substantiate the transaction through source documents. e. Post the transaction to a ledger. O a. b, c, d, a, c O b. d, e, b, c, a oc. d, e, b, a, c O d. b, d, e, a, e. d, b, e, a, c Clear my choice Unsure O 1:21:31 sis 8 of 19 On September 1, 2021, Woodmark Ino paid $1.200 for six months rent in advance. The bookkeeper who recorded this transaction used rent expense. No other journal entry was made subsequently. At December 31, 2021, the fiscal yearend, Woodmark should 1 a. Debit rent expense and credit prepaid rent for $400. b. Debit rent expense and credit prepaid rent for $800. OC. Debit prepaid rent and credit rent expense for $400. Od Debit prepaid rent and credit rent expense for $800. O e. No adjusting entry is necessary at December 31, 2021. Unsure 9 of 19 The records of the Singh Company were partially destroyed in a flood. The Company does not know the sales revenue that has been generated during the year, but it knows that 75 percent of its sales have been on account. Furthermore, the Company knows that the beginning and ending balances of its accounts receivable were $31.000 and $35,000, respectively. Cash collections on credit sales were $260,000 from the beginning of the year until the flood occurred. What were the total sales for the year until the time of the flood? O a. $264,000 O b. $352,000 ce 9 of 19 Tools 00 1:21:17 The records of the Singh Company were partially destroyed in a flood. The Company does not know the sales revenue that has been generated during the year, but it knows That 75 percent of its sales have been on account. Furthermore, the Company knows that the beginning and ending balances of its accounts receivable were $31.000 and $35,000, respectively. Cash collections on credit sales were $260,000 from the beginning of the year until the flood occurred. What were the total sales for the year until the time of the flood? 8 a $264,000 Ob. $352,000 Oo. $198.000 Od $341,333 O e Total sales cannot be determined without additional information. Unsure 10 of 19 The Accumulated Depreciation account of a particular asset reflects O a. The total of all depreciation expenses already taken on the asset. O b. The amount of depreciation to be taken in future periods. O c. Depreciation expense for the current accounting period only. Od. None of the other statements. Unsure Next page 1:20:53 "ools Il of 19 Winnie Ltd, provides computer services to business customers. In 2020, the Company failed to record accrued service revenues for $150,000. The Company received and recorded this amount as service revenue in 2021. This accounting treatment would O a Have no effect on reported net earnings for 2020 Ob Make net earnings for 2020 equal to net earnings for 2021. Oc Overstate net earnings for 2020 by $150.000 O d. Understate net earnings for 2020 by $150,000 Unsure 2 12 of 19 Marke Which of the following are the fundamental characteristics of accounting information? O a Predictive value and feedback value. O b. Relevance and faithful representation O c. Relevance and verifiability. Od Timeliness and understandability. O e. Verifiability and faithful representation. Unsure 13 of 19 Generally, revenues should be recognized at a point when 13 of 19 Tools 1:20:34 Generally revenues should be recognized at a point when Da Management decides it is appropriate to do so Ob The goods are available for sale to the ultimate customer. The financial statements are prepared Od An exchange has taken place and the earnings process is virtually completa Unsure 14 of 19 White corporation purchased a calculator for use by the office secretary. The calculator cost $25 and had an estimated useful life of five years. The purchase was recorded as a debit to Office Supplies Expense. Which of the following accounting concepts supports this accounting treatment? O a. Historical cost O b. Prudence O c. Materiality O d. Consistency Oe. Continuity unsure 15 of 19 A company is formed by selling 100 shares at $10 per share. Inventory is then dit for $600 Half the inventory is then sold on account for $500. What QUI Tools 15 of 19 01:20:25 TOON Acompany is formed by selling 100 shares at $10 per share. Invertory is the purchased on credit for 5000. Half the inventory is the sold on account for 500 Wh are the company's total assets based on these transactions? F8 a $2,100 Ob $800 Oc$600 Od $1,800 G. None of these amounts. Unsure 16 of 19 2 An example of an adjusting entry is: O a. The payment of wages which have been accrued. O b. The accruing of interest expense. Oc. The return of defective inventory. O d. The payment of rent in advance. O e. Any one of the other answers. Unsure 17 of 19 Tools 17 of 19 1:20:16 If the current ratio of a company was 176. then the towing coat made The company's current ratio is bad if the verge intry is 1.70 OD The company's current ratio is good if the current ratio of the prior years 178 Oc. The company's current ratio is bad if the current ratio of the prior your smarta 1.78 d. The company's current ratio is good if the average industry ratios 1.70 Oo. Comparisons between a company's current year ratio and either the company's prior yene ratio of the average industry ratio are not appropriate Unsure 18 of 19 We The board of directors of a company is elected by O a. The general public of the province of incorporation O b. The shareholders of the company. c. The management of the company. Od. The federal Minister of Finance. Oe. None of the other answers. Unsure 19 of 19 An example of a permanent account is