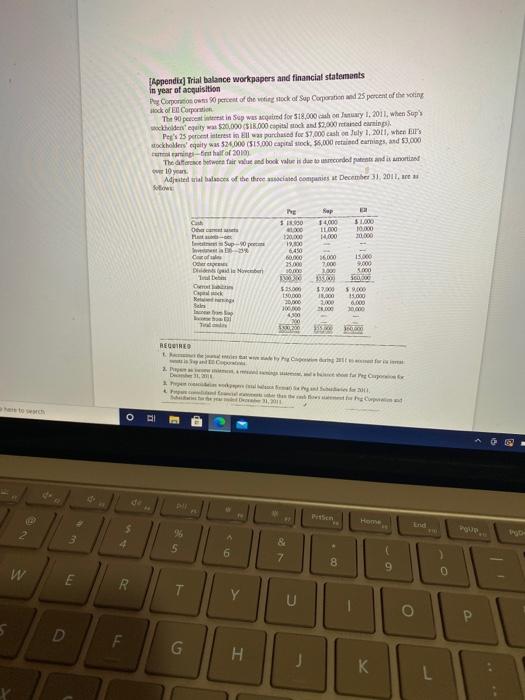

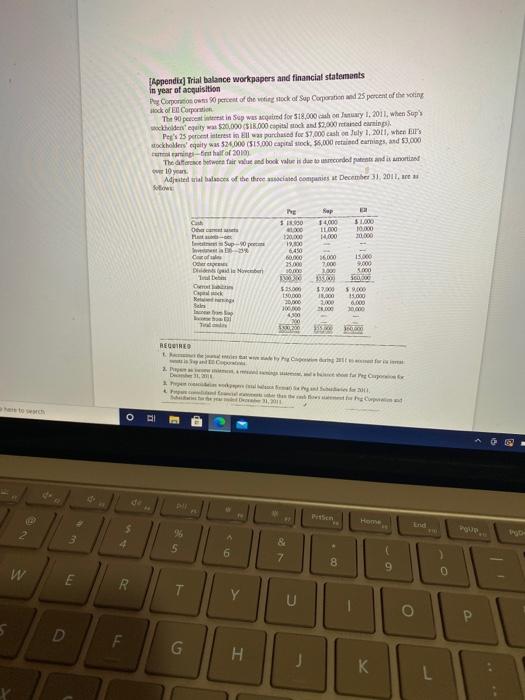

4. On January 2, 2008, Heinreich Co. paid $500,000 for 25% of the voting common stock of Jones Corp. At the time of the investment, Jones had net assets with a book value and fair value of $1,800,000. During 2008, Jones incurred a net loss of $60,000 and paid dividends of $100,000. Any excess cost over book value is attributable to goodwill with an indefinite life. What is the balance in Heinreich's investment account at December 31, 2008? Appendix] Trial balance workpapers and financial statements in year of acquisition The Companion percent of the wing stock of Sap Com od 25 percent of the song Hock of El Corporation The 90 percent in Sup was equired for $18.000 cashewy 1. 2011, when Sop wekidesegaty w $20.000 ($1.000 capital mack and $2.000 and earnings) Personrest in all was purchased for $7,000 cash on July 1, 2011, when it's stockholders' cquity 526.000 (515.000 capital stock 6.000 retained earnings, and 3.000 in-thof 2010 The are betwee fair value and book valuri de recorded and is not w 10 years Adjusters of the three cated companies at December 31, 2011, Soon PE $30 Cush Oh Rap 14,000 Ito 14.00 $1.000 10.000 0.000 Supp 15.00 9.000 Cow Orch Die Tuleb 000 120.000 19.00 6450 25.000 30.00 1 S2000 150000 2000 100 40 16.000 7.000 2.800 33 17.30 18.00 1,200 DOC SE0D 59.000 15.000 Bar That al 20,000 3 BEGUIRED C 2. Properti Dec Pet 2011 O . 5 3 5 6 & 7 8 9 W 0 E R T U o P 5 D G . K L 4. On January 2, 2008, Heinreich Co. paid $500,000 for 25% of the voting common stock of Jones Corp. At the time of the investment, Jones had net assets with a book value and fair value of $1,800,000. During 2008, Jones incurred a net loss of $60,000 and paid dividends of $100,000. Any excess cost over book value is attributable to goodwill with an indefinite life. What is the balance in Heinreich's investment account at December 31, 2008? Appendix] Trial balance workpapers and financial statements in year of acquisition The Companion percent of the wing stock of Sap Com od 25 percent of the song Hock of El Corporation The 90 percent in Sup was equired for $18.000 cashewy 1. 2011, when Sop wekidesegaty w $20.000 ($1.000 capital mack and $2.000 and earnings) Personrest in all was purchased for $7,000 cash on July 1, 2011, when it's stockholders' cquity 526.000 (515.000 capital stock 6.000 retained earnings, and 3.000 in-thof 2010 The are betwee fair value and book valuri de recorded and is not w 10 years Adjusters of the three cated companies at December 31, 2011, Soon PE $30 Cush Oh Rap 14,000 Ito 14.00 $1.000 10.000 0.000 Supp 15.00 9.000 Cow Orch Die Tuleb 000 120.000 19.00 6450 25.000 30.00 1 S2000 150000 2000 100 40 16.000 7.000 2.800 33 17.30 18.00 1,200 DOC SE0D 59.000 15.000 Bar That al 20,000 3 BEGUIRED C 2. Properti Dec Pet 2011 O . 5 3 5 6 & 7 8 9 W 0 E R T U o P 5 D G . K L