Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. On Lanuary 1, 2020, Alaska Freight Transportation Cornpany purchased a used aircrat at a cost of $50,500,000. Alaska Freight expects the plano to remain

4.

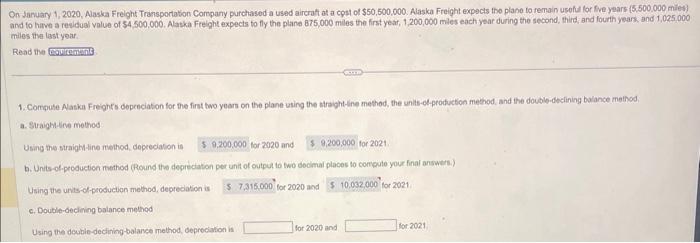

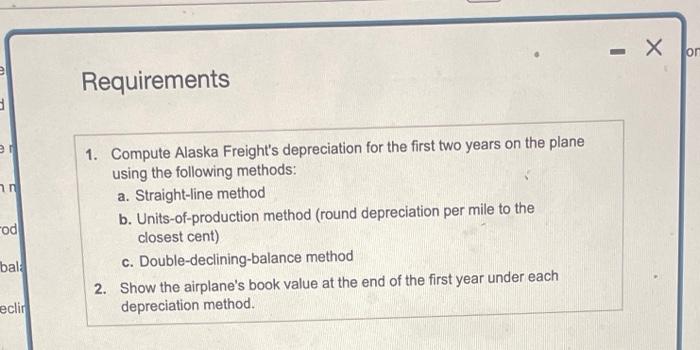

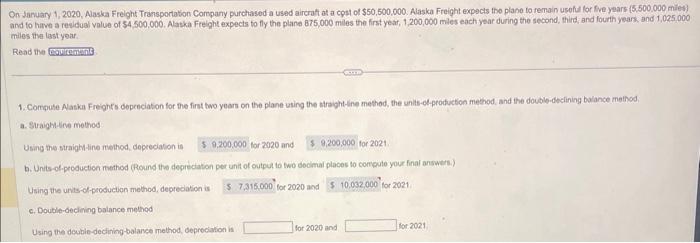

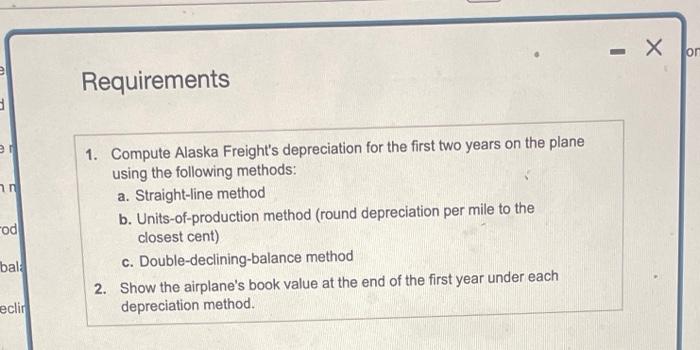

On Lanuary 1, 2020, Alaska Freight Transportation Cornpany purchased a used aircrat at a cost of $50,500,000. Alaska Freight expects the plano to remain useful tor five years (5.500.000 mies) and to have a requdual value of $4,500,000. Alaska Freight expects to fly the plane 875,000 miles the first year, 1,200,000 miles each year during the second, thind; and fourth years, and 1,025,000 miles the last year. Read the 1. Compute Aaska Freights dopenciaton for the fint two yoars on the plane using the streght-ine method, the units-ed-protuction method, and the double-declining balance method. a. Straighiline method Using the straight-line method, depreciabion is for 2020 and for2021 b. Units of-peceuction meethod (Round the depredaton per unit of output to two docmal places to compute your final answers.) Using the unts-d-peoducion method, depredaton is for 2020 and for 2021 c. Double-declining balance method Using the dewbie-dectiniog-bolance method, depreciation is for 2020 and lor 2001 Requirements 1. Compute Alaska Freight's depreciation for the first two years on the plane using the following methods: a. Straight-line method b. Units-of-production method (round depreciation per mile to the closest cent) c. Double-declining-balance method 2. Show the airplane's book value at the end of the first year under each depreciation method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started