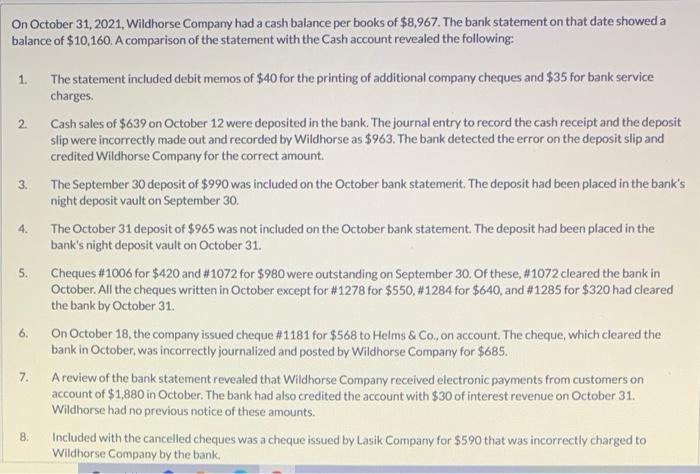

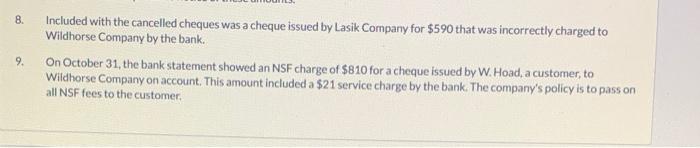

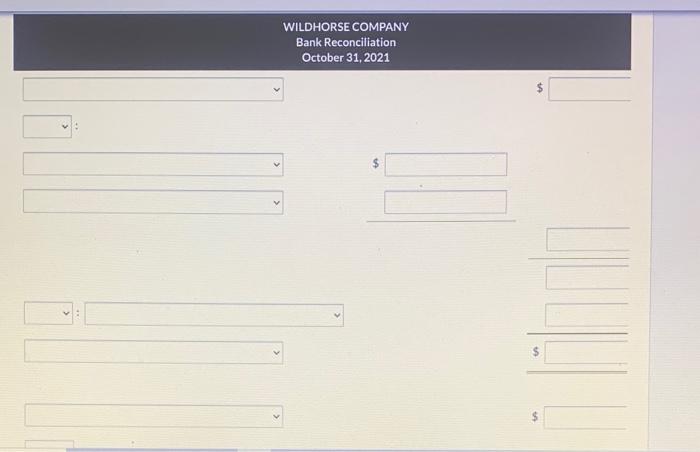

4. On October 31, 2021, Wildhorse Company had a cash balance per books of $8,967. The bank statement on that date showed a balance of $10,160. A comparison of the statement with the Cash account revealed the following: 1. The statement included debit memos of $40 for the printing of additional company cheques and $35 for bank service charges 2 Cash sales of $639 on October 12 were deposited in the bank. The journal entry to record the cash receipt and the deposit slip were incorrectly made out and recorded by Wildhorse as $963. The bank detected the error on the deposit slip and credited Wildhorse Company for the correct amount 3. The September 30 deposit of $990 was included on the October bank statemerit. The deposit had been placed in the bank's night deposit vault on September 30, The October 31 deposit of $965 was not included on the October bank statement. The deposit had been placed in the bank's night deposit vault on October 31. 5. Cheques #1006 for $420 and #1072 for $980 were outstanding on September 30. Of these, #1072 cleared the bank in October. All the cheques written in October except for #1278 for $550, #1284 for $640, and #1285 for $320 had cleared the bank by October 31 On October 18, the company issued cheque #1181 for $568 to Helms & Co., on account. The cheque, which cleared the bank in October, was incorrectly journalized and posted by Wildhorse Company for $685. 7. A review of the bank statement revealed that Wildhorse Company received electronic payments from customers on account of $1,880 in October. The bank had also credited the account with $30 of interest revenue on October 31. Wildhorse had no previous notice of these amounts. Included with the cancelled cheques was a cheque issued by Lasik Company for $590 that was incorrectly charged to Wildhorse Company by the bank. 6. 8. 8. Included with the cancelled cheques was a cheque issued by Lasik Company for $590 that was incorrectly charged to Wildhorse Company by the bank. On October 31, the bank statement showed an NSF charge of $810 for a cheque issued by W. Hoad, a customer, to Wildhorse Company on account. This amount included a $21 service charge by the bank. The company's policy is to pass on all NSF fees to the customer, 9. WILDHORSE COMPANY Bank Reconciliation October 31, 2021 > V C 1 > >