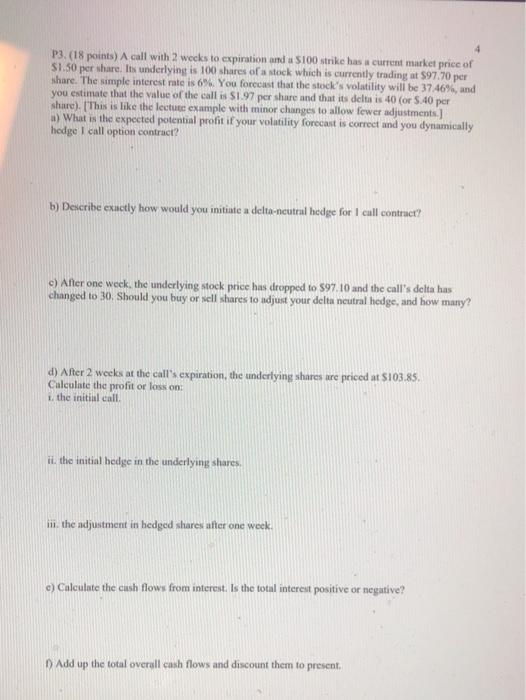

4 P3.(18 points) A call with 2 weeks to expiration and a $100 strike has a current market price of $1.50 per share. Its underlying is 100 shares of a stock which is currently trading at $97.70 per share. The simple interest rate is 6%. You forecast that the stock's volatility will be 37.46%, and you estimate that the value of the call is SI 97 per share and that it delta is 40 (or 5.40 per share). (This is like the lecture example with minor changes to allow fewer adjustments) .) What is the expected potential profit if your volatility forecast is correct and you dynamically hedge I call option contract? b) Describe exactly how would you initiate a delta-neutral hedge for I call contract? c) After one week, the underlying stock price has dropped to $97.10 and the call's delta has changed to 30. Should you buy or sell shares to adjust your delta neutral hedge, and how many? d) After 2 weeks at the call's expiration, the underlying shares are priced at $103.85. Calculate the profit or loss on 1. the initial call il the initial hedge in the underlying shares in the adjustment in hedged shares after one week. e) Calculate the cash flows from interest. Is the total interest positive or negative? Add up the total overall cash flows and discount them to present 4 P3.(18 points) A call with 2 weeks to expiration and a $100 strike has a current market price of $1.50 per share. Its underlying is 100 shares of a stock which is currently trading at $97.70 per share. The simple interest rate is 6%. You forecast that the stock's volatility will be 37.46%, and you estimate that the value of the call is SI 97 per share and that it delta is 40 (or 5.40 per share). (This is like the lecture example with minor changes to allow fewer adjustments) .) What is the expected potential profit if your volatility forecast is correct and you dynamically hedge I call option contract? b) Describe exactly how would you initiate a delta-neutral hedge for I call contract? c) After one week, the underlying stock price has dropped to $97.10 and the call's delta has changed to 30. Should you buy or sell shares to adjust your delta neutral hedge, and how many? d) After 2 weeks at the call's expiration, the underlying shares are priced at $103.85. Calculate the profit or loss on 1. the initial call il the initial hedge in the underlying shares in the adjustment in hedged shares after one week. e) Calculate the cash flows from interest. Is the total interest positive or negative? Add up the total overall cash flows and discount them to present