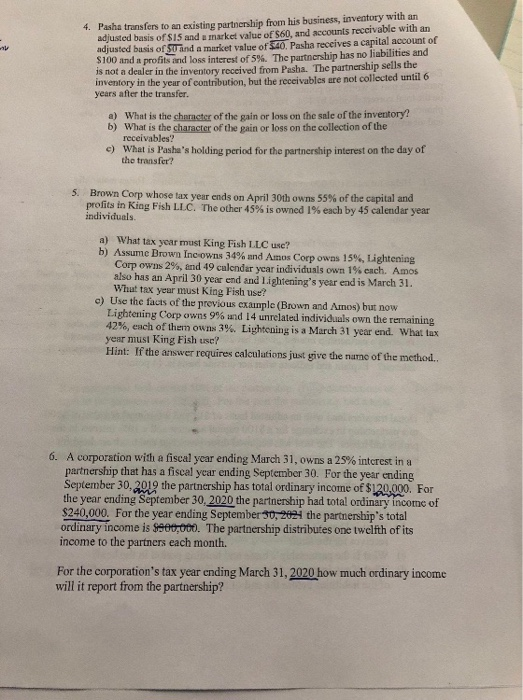

4. Pasha transfers to an existing partnership from his business, inventory with an adjusted basis of $15 and a market value of $60, and accounts receivable with an adjusted basis of u and a market value of St. Pasha receives a capital account of $100 and a profits and loss interest of 5%. The partnership has no liabilities and is not a dealer in the inventory received from Pasha. The partnership sells the inventory in the year of contribution, but the receivables are not collected until 6 years after the transfer. a) What is the character of the gain or loss on the sale of the inventory? b) What is the character of the pain or loss on the collection of the receivables? e) What is Pasha's holding period for the partnership interest on the day of the transfer? 5. Brown Corp whose tax year ends on April 30th owns 55% of the capital and profits in King Fish LLC. The other 45% is owned 1% each by 45 calendar year individuals. a) What tax year must King Fish LLC use? b) Assume Brown Inc owns 34% und Amos Corp owns 15%, Lightening Corp owns 29, and 49 calendar year individuals own 1% cach. Amos also has an April 30 year end and Lightening's year end is March 31. Whut tax yeur must King Fish use? c) Use the facts of the previous example (Brown and Amos) but now Lightening Corp owns 9% and 14 unrelated individuals own the remaining 42%, each of them owns 3%. Lightening is a March 31 year end. What lax year must King Fish use? Hint: If the answer requires calculations just give the name of the method. 6. A corporation with a fiscal year ending March 31, owns a 25% interest in a partnership that has a fiscal year ending September 30. For the year ending September 30, 2019 the partnership has total ordinary income of $120.000. For the year ending September 30, 2020 the partnership had total ordinary income of $240,000. For the year ending September 30, 2021 the partnership's total ordinary income is $900,000. The partnership distributes one twelfth of its income to the partners each month. For the corporation's tax year ending March 31, 2020 how much ordinary income will it report from the partnership