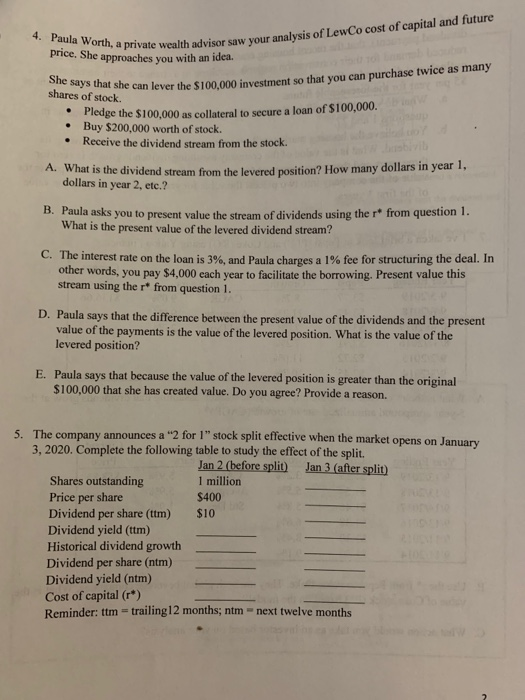

4. Paula Worth, a private wealth advisor saw your analysis of LewCo cost of capital and future price. She approaches you with an idea. She says that she can lever the $100,000 investment so that you can purchase twice as many shares of stock. Pledge the $100,000 as collateral to secure a loan of $100,000. Buy $200,000 worth of stock. Receive the dividend stream from the stock. A. What is the dividend stream from the levered position? How many dollars in year I, dollars in year 2, etc.? B. Paula asks you to present value the stream of dividends using the r* from question 1. What is the present value of the levered dividend stream? C. The interest rate on the loan is 3 %, and Paula charges a 1% fee for structuring the deal. In other words, you pay $4,000 cach vear to facilitate the borrowing. Present value this stream using the r* from question 1. D. Paula says that the difference between the present value of the dividends and the present value of the payments is the value of the levered position. What is the value of the levered position? E. Paula says that because the value of the levered position is greater than the original $100,000 that she has created value. Do you agree? Provide a reason. 5. The company announces a "2 for 1" stock split effective when the market opens on January 3, 2020. Complete the following table to study the effect of the split. Jan 2 (before split) 1 million Jan 3 (after split) Shares outstanding Price per share Dividend per share (ttm) Dividend yield (ttm) $400 $10 Historical dividend growth Dividend per share (ntm) Dividend yield (ntm) Cost of capital (r*) Reminder: ttm = trailing12 months; ntm next twelve months 4. Paula Worth, a private wealth advisor saw your analysis of LewCo cost of capital and future price. She approaches you with an idea. She says that she can lever the $100,000 investment so that you can purchase twice as many shares of stock. Pledge the $100,000 as collateral to secure a loan of $100,000. Buy $200,000 worth of stock. Receive the dividend stream from the stock. A. What is the dividend stream from the levered position? How many dollars in year I, dollars in year 2, etc.? B. Paula asks you to present value the stream of dividends using the r* from question 1. What is the present value of the levered dividend stream? C. The interest rate on the loan is 3 %, and Paula charges a 1% fee for structuring the deal. In other words, you pay $4,000 cach vear to facilitate the borrowing. Present value this stream using the r* from question 1. D. Paula says that the difference between the present value of the dividends and the present value of the payments is the value of the levered position. What is the value of the levered position? E. Paula says that because the value of the levered position is greater than the original $100,000 that she has created value. Do you agree? Provide a reason. 5. The company announces a "2 for 1" stock split effective when the market opens on January 3, 2020. Complete the following table to study the effect of the split. Jan 2 (before split) 1 million Jan 3 (after split) Shares outstanding Price per share Dividend per share (ttm) Dividend yield (ttm) $400 $10 Historical dividend growth Dividend per share (ntm) Dividend yield (ntm) Cost of capital (r*) Reminder: ttm = trailing12 months; ntm next twelve months