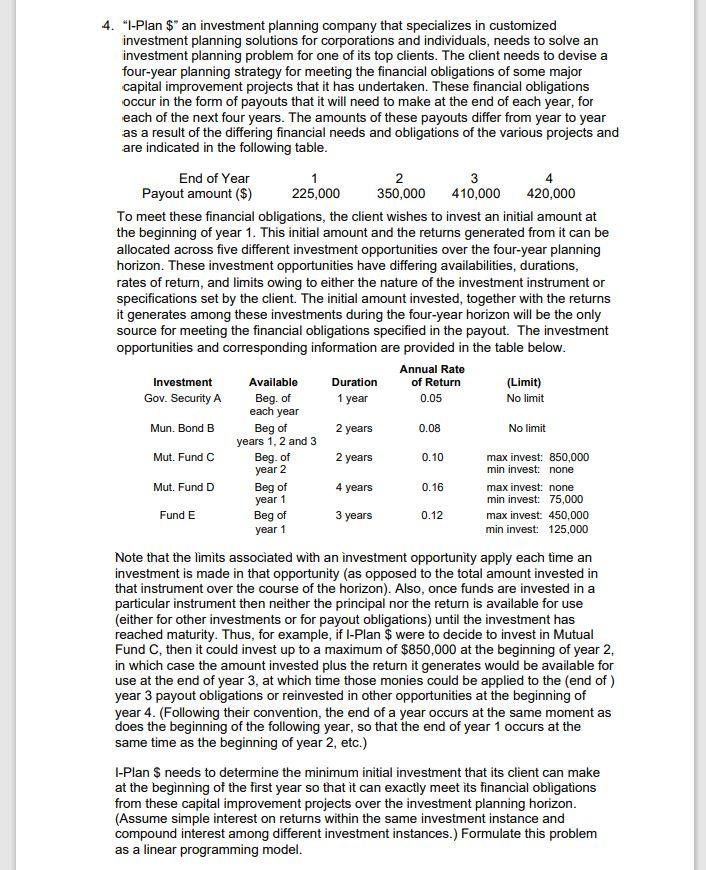

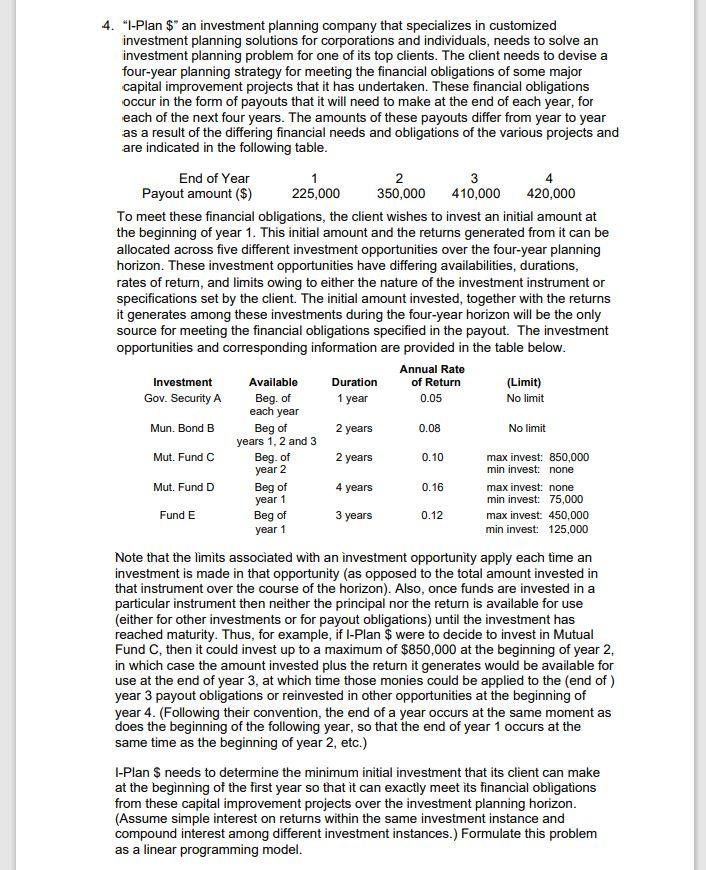

4. "-Plan $ an investment planning company that specializes in customized investment planning solutions for corporations and individuals, needs to solve an investment planning problem for one of its top clients. The client needs to devise a four-year planning strategy for meeting the financial obligations of some major capital improvement projects that it has undertaken. These financial obligations occur in the form of payouts that it will need to make at the end of each year, for each of the next four years. The amounts of these payouts differ from year to year as a result of the differing financial needs and obligations of the various projects and are indicated in the following table. End of Year 1 2 3 Payout amount ($) 225,000 350,000 410,000 420,000 To meet these financial obligations, the client wishes to invest an initial amount at the beginning of year 1. This initial amount and the returns generated from it can be allocated across five different investment opportunities over the four-year planning horizon. These investment opportunities have differing availabilities, durations, rates of return, and limits owing to either the nature of the investment instrument or specifications set by the client. The initial amount invested, together with the returns it generates among these investments during the four-year horizon will be the only source for meeting the financial obligations specified in the payout. The investment opportunities and corresponding information are provided in the table below. Annual Rate Investment Available Duration of Return (Limit) Gov. Security A Beg. of 1 year 0.05 No limit each year Mun. Bond B Beg of 2 years 0.08 No limit years 1, 2 and 3 Mut. Fund C Beg. of 2 years 0.10 max invest: 850,000 year 2 min invest: none Mut. Fund D Beg of 4 years 0.16 max invest: none min invest: 75,000 Fund E 3 years 0.12 max invest: 450,000 min invest: 125,000 Note that the limits associated with an investment opportunity apply each time an investment is made in that opportunity (as opposed to the total amount invested in that instrument over the course of the horizon). Also, once funds are invested in a particular instrument then neither the principal nor the return is available for use (either for other investments or for payout obligations) until the investment has reached maturity. Thus, for example, if I-Plan $ were to decide to invest in Mutual Fund C, then it could invest up to a maximum of $850,000 at the beginning of year 2, in which case the amount invested plus the return it generates would be available for use at the end of year 3, at which time those monies could be applied to the end of) year 3 payout obligations or reinvested in other opportunities at the beginning of year 4. (Following their convention, the end of a year occurs at the same moment as does the beginning of the following year, so that the end of year 1 occurs at the same time as the beginning of year 2, etc.) I-Plan $ needs to determine the minimum initial investment that its client can make at the beginning of the first year so that it can exactly meet its financial obligations from these capital improvement projects over the investment planning horizon. (Assume simple interest on returns within the same investment instance and compound interest among different investment instances.) Formulate this problem as a linear programming model. year 1 Beg of year 1 4. "-Plan $ an investment planning company that specializes in customized investment planning solutions for corporations and individuals, needs to solve an investment planning problem for one of its top clients. The client needs to devise a four-year planning strategy for meeting the financial obligations of some major capital improvement projects that it has undertaken. These financial obligations occur in the form of payouts that it will need to make at the end of each year, for each of the next four years. The amounts of these payouts differ from year to year as a result of the differing financial needs and obligations of the various projects and are indicated in the following table. End of Year 1 2 3 Payout amount ($) 225,000 350,000 410,000 420,000 To meet these financial obligations, the client wishes to invest an initial amount at the beginning of year 1. This initial amount and the returns generated from it can be allocated across five different investment opportunities over the four-year planning horizon. These investment opportunities have differing availabilities, durations, rates of return, and limits owing to either the nature of the investment instrument or specifications set by the client. The initial amount invested, together with the returns it generates among these investments during the four-year horizon will be the only source for meeting the financial obligations specified in the payout. The investment opportunities and corresponding information are provided in the table below. Annual Rate Investment Available Duration of Return (Limit) Gov. Security A Beg. of 1 year 0.05 No limit each year Mun. Bond B Beg of 2 years 0.08 No limit years 1, 2 and 3 Mut. Fund C Beg. of 2 years 0.10 max invest: 850,000 year 2 min invest: none Mut. Fund D Beg of 4 years 0.16 max invest: none min invest: 75,000 Fund E 3 years 0.12 max invest: 450,000 min invest: 125,000 Note that the limits associated with an investment opportunity apply each time an investment is made in that opportunity (as opposed to the total amount invested in that instrument over the course of the horizon). Also, once funds are invested in a particular instrument then neither the principal nor the return is available for use (either for other investments or for payout obligations) until the investment has reached maturity. Thus, for example, if I-Plan $ were to decide to invest in Mutual Fund C, then it could invest up to a maximum of $850,000 at the beginning of year 2, in which case the amount invested plus the return it generates would be available for use at the end of year 3, at which time those monies could be applied to the end of) year 3 payout obligations or reinvested in other opportunities at the beginning of year 4. (Following their convention, the end of a year occurs at the same moment as does the beginning of the following year, so that the end of year 1 occurs at the same time as the beginning of year 2, etc.) I-Plan $ needs to determine the minimum initial investment that its client can make at the beginning of the first year so that it can exactly meet its financial obligations from these capital improvement projects over the investment planning horizon. (Assume simple interest on returns within the same investment instance and compound interest among different investment instances.) Formulate this problem as a linear programming model. year 1 Beg of year 1