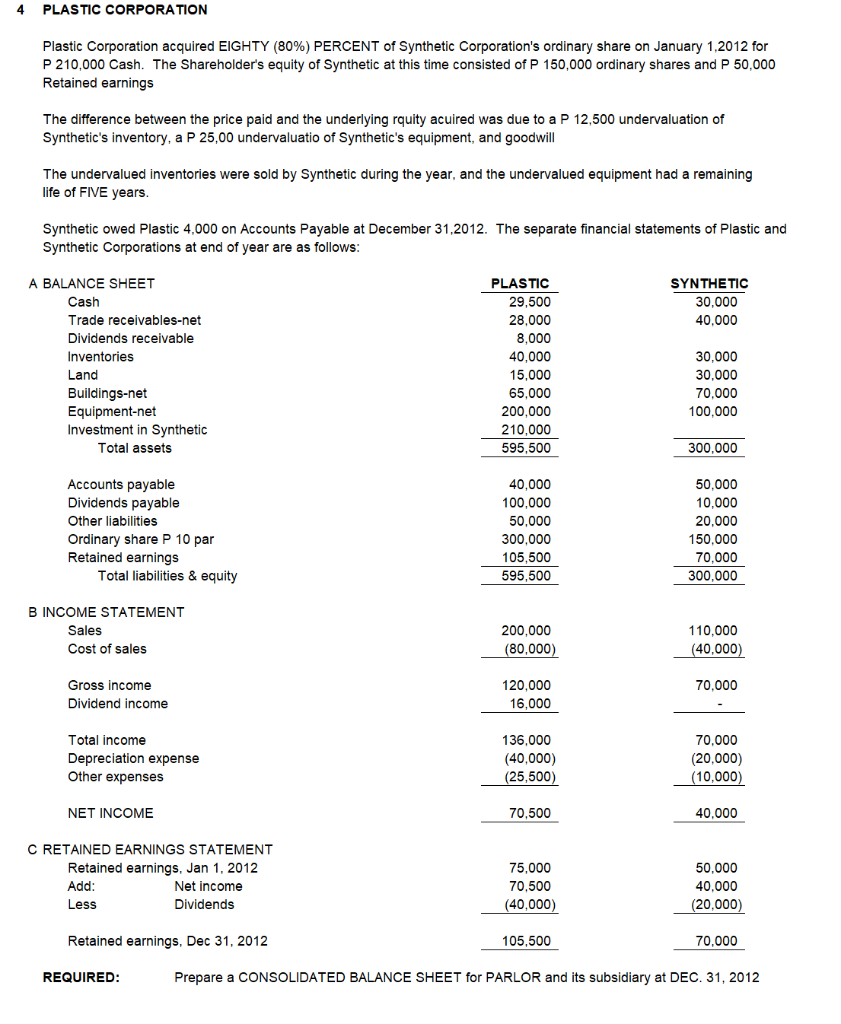

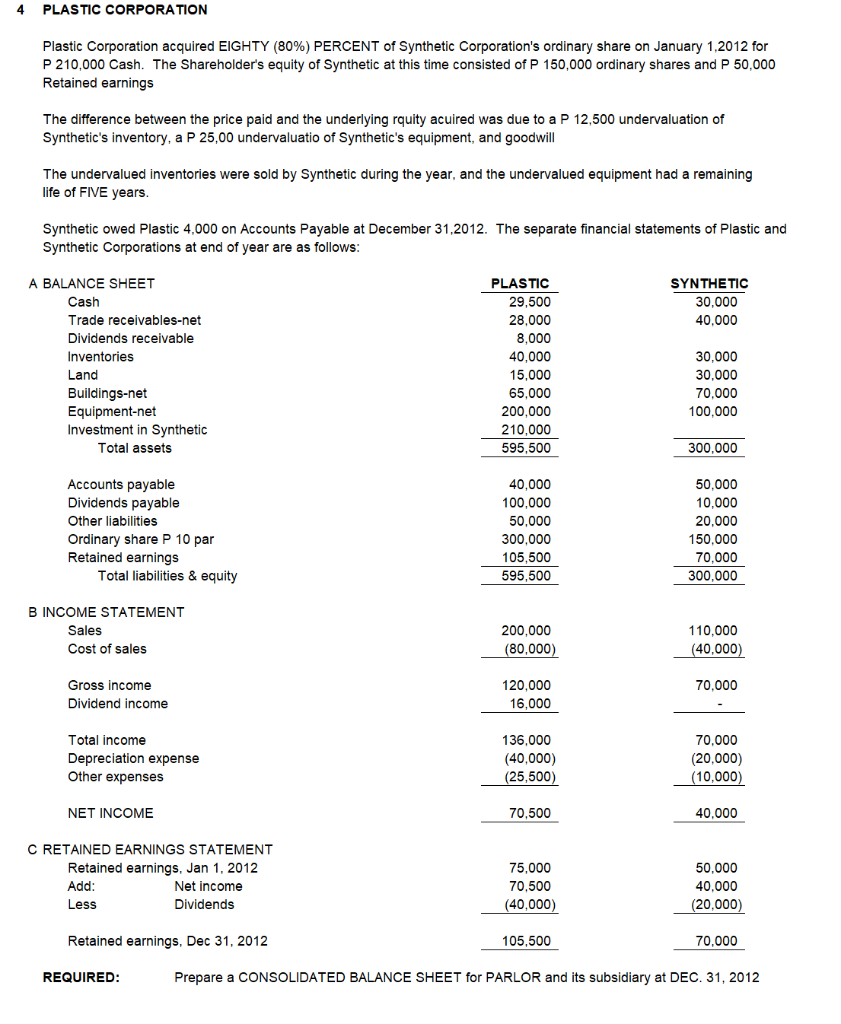

4 PLASTIC CORPORATION Plastic Corporation acquired EIGHTY (80%) PERCENT of Synthetic Corporation's ordinary share on January 1,2012 for P210,000 Cash. The Shareholder's equity of Synthetic at this time consisted of P 150,000 ordinary shares and P 50,000 Retained earnings The difference between the price paid and the underlying rquity acuired was due to a P 12,500 undervaluation of Synthetic's inventory, a P 25,00 undervaluatio of Synthetic's equipment, and goodwill The undervalued inventories were sold by Synthetic during the year, and the undervalued equipment had a remaining life of FIVE years. Synthetic owed Plastic 4,000 on Accounts Payable at December 31,2012. The separate financial statements of Plastic and Synthetic Corporations at end of year are as follows: SYNTHETIC 30,000 40,000 A BALANCE SHEET Cash Trade receivables-net Dividends receivable Inventories Land Buildings-net Equipment-net Investment in Synthetic Total assets PLASTIC 29,500 28,000 8,000 40,000 15.000 65,000 200,000 210,000 595,500 30,000 30.000 70,000 100,000 300,000 Accounts payable Dividends payable Other liabilities Ordinary share P 10 par Retained earnings Total liabilities & equity 40,000 100,000 50,000 300,000 105,500 595,500 50,000 10,000 20.000 150,000 70,000 300,000 B INCOME STATEMENT Sales Cost of sales 200,000 (80,000) 110,000 (40,000) 70,000 Gross income Dividend income 120,000 16,000 Total income Depreciation expense Other expenses 136,000 (40,000) (25,500) 70,000 (20,000) (10,000) NET INCOME 70,500 40.000 C RETAINED EARNINGS STATEMENT Retained earnings, Jan 1, 2012 Add: Net income Less Dividends 75,000 70.500 (40,000) 50,000 40.000 (20,000) Retained earnings, Dec 31, 2012 105,500 70,000 REQUIRED: Prepare a CONSOLIDATED BALANCE SHEET for PARLOR and its subsidiary at DEC. 31, 2012 4 PLASTIC CORPORATION Plastic Corporation acquired EIGHTY (80%) PERCENT of Synthetic Corporation's ordinary share on January 1,2012 for P210,000 Cash. The Shareholder's equity of Synthetic at this time consisted of P 150,000 ordinary shares and P 50,000 Retained earnings The difference between the price paid and the underlying rquity acuired was due to a P 12,500 undervaluation of Synthetic's inventory, a P 25,00 undervaluatio of Synthetic's equipment, and goodwill The undervalued inventories were sold by Synthetic during the year, and the undervalued equipment had a remaining life of FIVE years. Synthetic owed Plastic 4,000 on Accounts Payable at December 31,2012. The separate financial statements of Plastic and Synthetic Corporations at end of year are as follows: SYNTHETIC 30,000 40,000 A BALANCE SHEET Cash Trade receivables-net Dividends receivable Inventories Land Buildings-net Equipment-net Investment in Synthetic Total assets PLASTIC 29,500 28,000 8,000 40,000 15.000 65,000 200,000 210,000 595,500 30,000 30.000 70,000 100,000 300,000 Accounts payable Dividends payable Other liabilities Ordinary share P 10 par Retained earnings Total liabilities & equity 40,000 100,000 50,000 300,000 105,500 595,500 50,000 10,000 20.000 150,000 70,000 300,000 B INCOME STATEMENT Sales Cost of sales 200,000 (80,000) 110,000 (40,000) 70,000 Gross income Dividend income 120,000 16,000 Total income Depreciation expense Other expenses 136,000 (40,000) (25,500) 70,000 (20,000) (10,000) NET INCOME 70,500 40.000 C RETAINED EARNINGS STATEMENT Retained earnings, Jan 1, 2012 Add: Net income Less Dividends 75,000 70.500 (40,000) 50,000 40.000 (20,000) Retained earnings, Dec 31, 2012 105,500 70,000 REQUIRED: Prepare a CONSOLIDATED BALANCE SHEET for PARLOR and its subsidiary at DEC. 31, 2012