Answered step by step

Verified Expert Solution

Question

1 Approved Answer

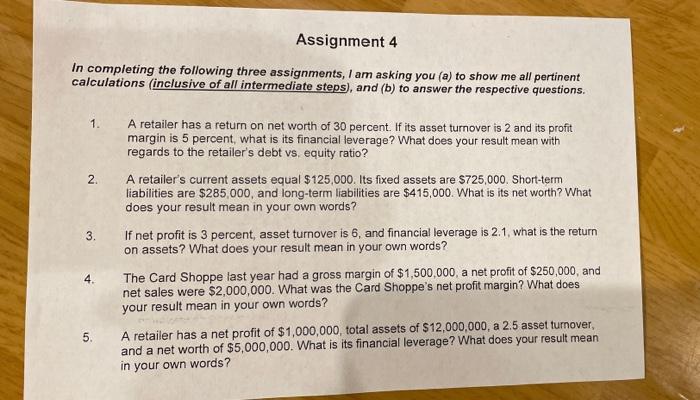

#4, please! Thanks Assignment 4 In completing the following three assignments, I am asking you (a) to show me all pertinent calculations (inclusive of all

#4, please! Thanks

Assignment 4 In completing the following three assignments, I am asking you (a) to show me all pertinent calculations (inclusive of all intermediate steps), and (b) to answer the respective questions. 1. A retailer has a return on net worth of 30 percent. If its asset turnover is 2 and its profit margin is 5 percent, what is its financial leverage? What does your result mean with regards to the retailer's debt vs, equity ratio? A retailer's current assets equal $125,000. Its fixed assets are $725,000. Short-term liabilities are $285,000, and long-term liabilities are $415,000. What is its net worth? What does your result mean in your own words? 2. re 3. If net profit is 3 percent, asset turnover is 6, and financial leverage is 2.1, what is on assets? What does your result mean in your own words? The Card Shoppe last year had a gross margin of $1,500,000, a net profit of $250,000, and net sales were $2,000,000. What was the Card Shoppe's net profit margin? What does your result mean in your own words? A retailer has a net profit of $1,000,000, total assets of $12,000,000, a 2.5 asset turnover, and a net worth of $5,000,000. What is its financial leverage? What does your result mean in your own words? 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started