Answered step by step

Verified Expert Solution

Question

1 Approved Answer

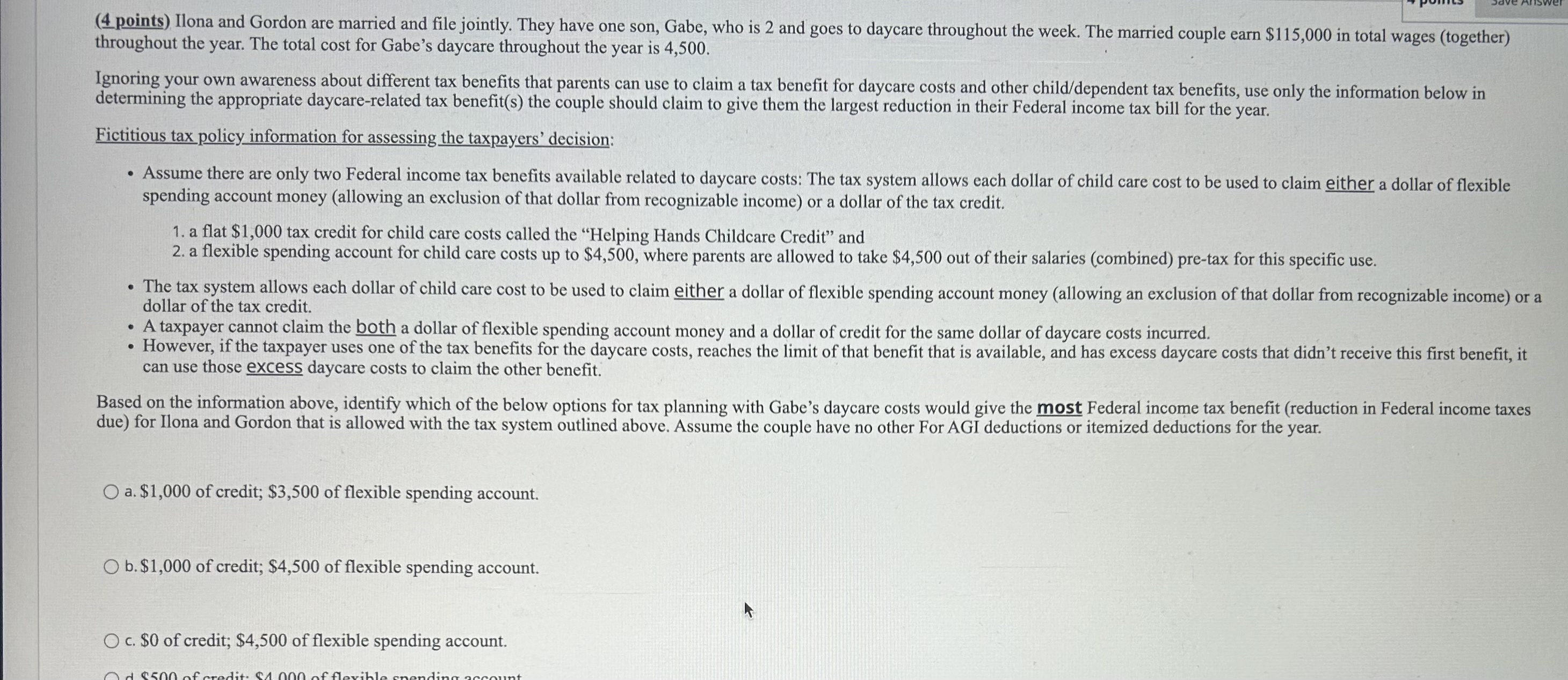

( 4 points ) Ilona and Gordon are married and file jointly. They have one son, Gabe, who is 2 and goes to daycare throughout

points Ilona and Gordon are married and file jointly. They have one son, Gabe, who is and goes to daycare throughout the week. The married couple earn $ in total wages together

throughout the year. The total cost for Gabe's daycare throughout the year is

Ignoring your own awareness about different tax benefits that parents can use to claim a tax benefit for daycare costs and other childdependent tax benefits, use only the information below in

determining the appropriate daycarerelated tax benefits the couple should claim to give them the largest reduction in their Federal income tax bill for the year.

Fictitious tax policy information for assessing the taxpayers' decision:

Assume there are only two Federal income tax benefits available related to daycare costs: The tax system allows each dollar of child care cost to be used to claim either a dollar of flexible

spending account money allowing an exclusion of that dollar from recognizable income or a dollar of the tax credit.

a flat $ tax credit for child care costs called the "Helping Hands Childcare Credit" and

a flexible spending account for child care costs up to $ where parents are allowed to take $ out of their salaries combined pretax for this specific use.

The tax system allows each dollar of child care cost to be used to claim either a dollar of flexible spending account money allowing an exclusion of that dollar from recognizable income or a

dollar of the tax credit.

A taxpayer cannot claim the both a dollar of flexible spending account money and a dollar of credit for the same dollar of daycare costs incurred.

However, if the taxpayer uses one of the tax benefits for the daycare costs, reaches the limit of that benefit that is available, and has excess daycare costs that didn't receive this first benefit, it

can use those excess daycare costs to claim the other benefit.

Based on the information above, identify which of the below options for tax planning with Gabe's daycare costs would give the most Federal income tax benefit reduction in Federal income taxes

due for Ilona and Gordon that is allowed with the tax system outlined above. Assume the couple have no other For AGI deductions or itemized deductions for the year.

a $ of credit; $ of flexible spending account.

b $ of credit; $ of flexible spending account.

c $ of credit; $ of flexible spending account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started