Question

(4 points) Suppose that if the carburetors were purchased, Troy Engines, Ltd., would decrease its short-run profits by $160,000 per month. However, the firm could

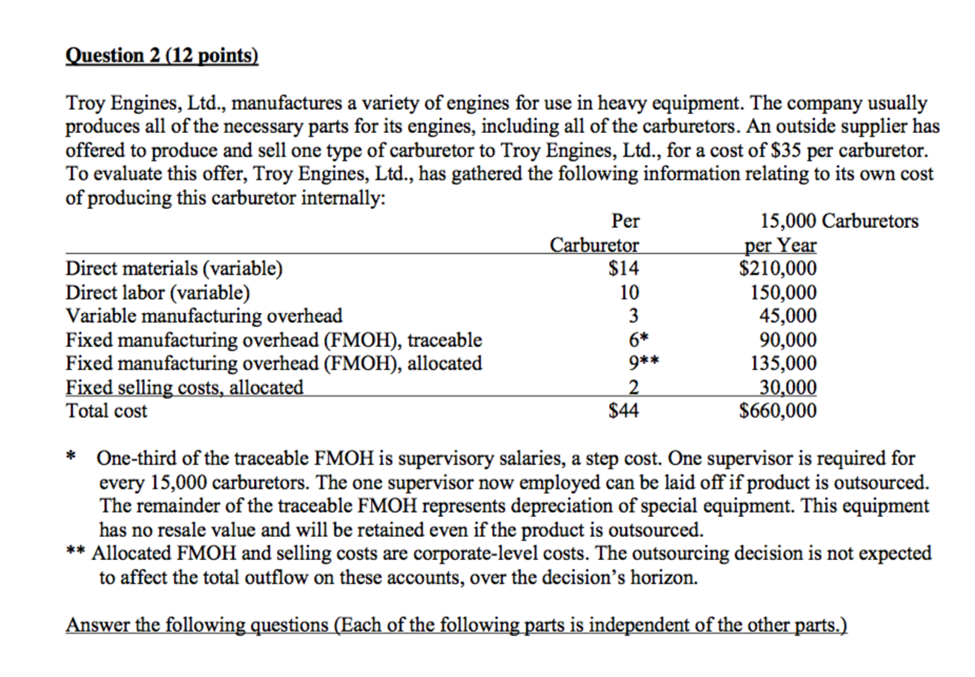

(4 points) Suppose that if the carburetors were purchased, Troy Engines, Ltd., would decrease its short-run profits by $160,000 per month. However, the firm could use the freed up capacity to launch a new product. On a per unit basis, this new product would sell for $15/unit but costs $14 per unit to make and sell. This cost of $14 per unit is made up of (i) the total inventoriable cost of $9 per unit which includes allocated fixed manufacturing costs of $3 per unit, and (ii) total selling costs of $5 per unit which includes fixed selling costs of $1 per unit. At what sales volume (for the new product) would it be profitable for Troy Engines Ltd., to purchase rather than make the carburetors? Show all computations.

(4 points) Suppose that if the carburetors were purchased, Troy Engines, Ltd., would decrease its short-run profits by $160,000 per month. However, the firm could use the freed up capacity to launch a new product. On a per unit basis, this new product would sell for $15/unit but costs $14 per unit to make and sell. This cost of $14 per unit is made up of (i) the total inventoriable cost of $9 per unit which includes allocated fixed manufacturing costs of $3 per unit, and (ii) total selling costs of $5 per unit which includes fixed selling costs of $1 per unit. At what sales volume (for the new product) would it be profitable for Troy Engines Ltd., to purchase rather than make the carburetors? Show all computations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started