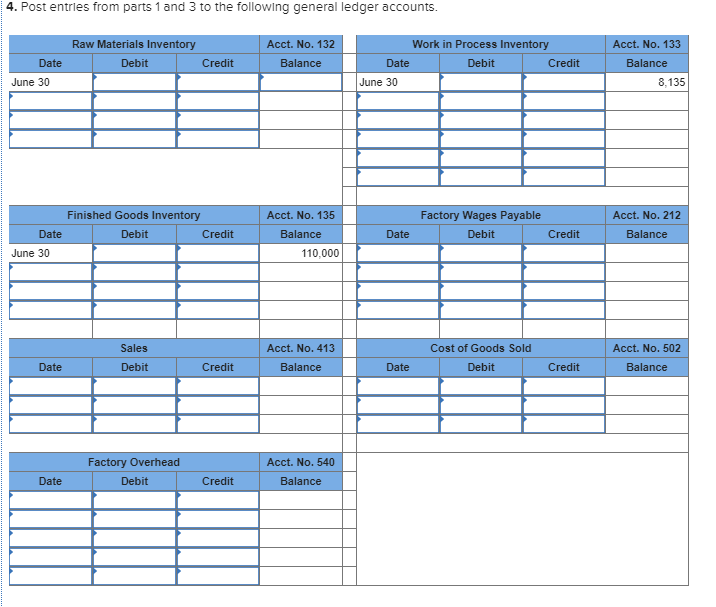

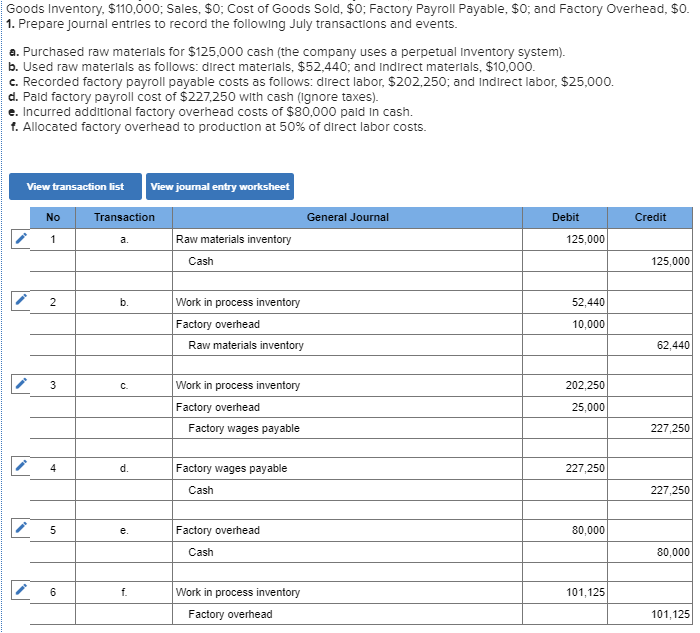

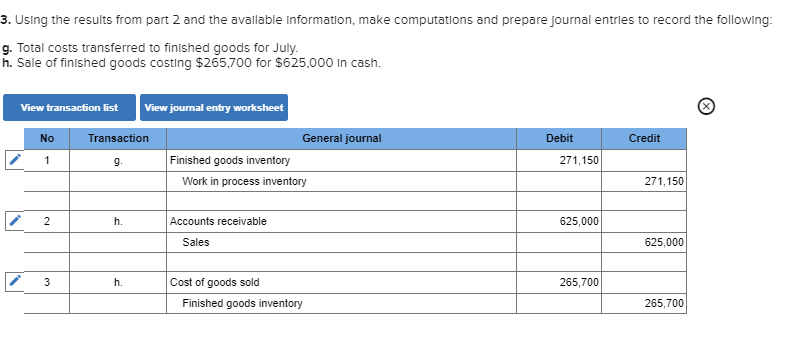

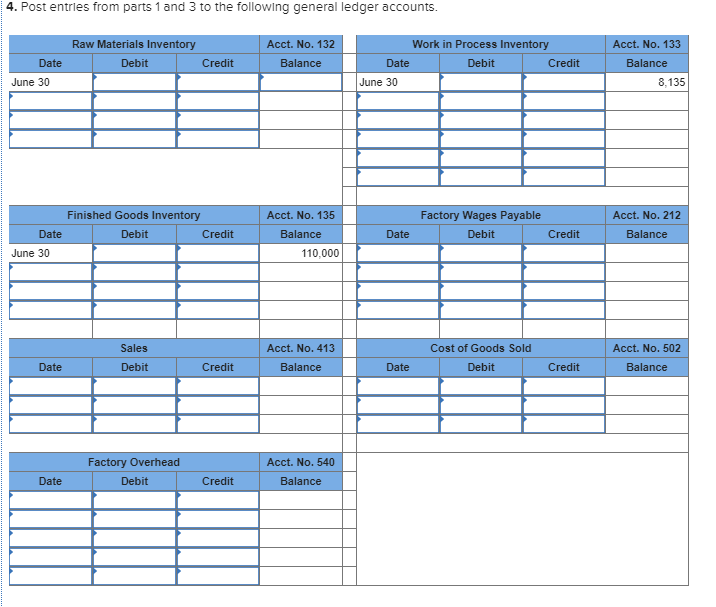

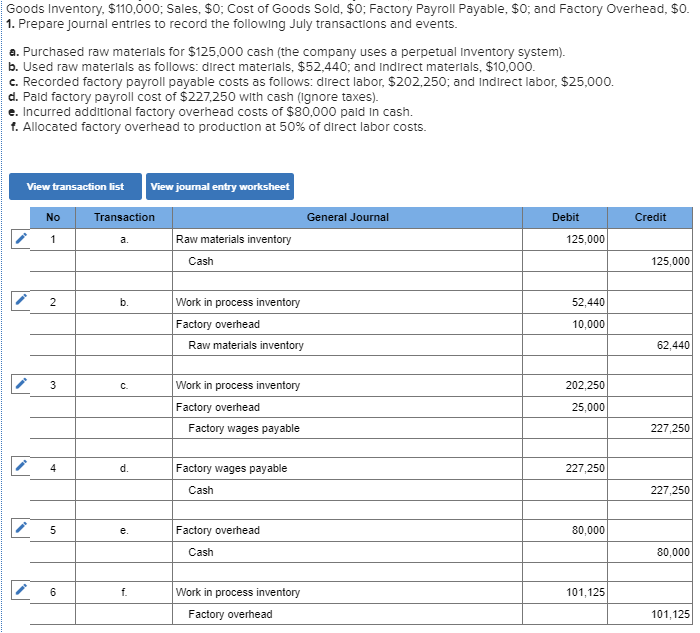

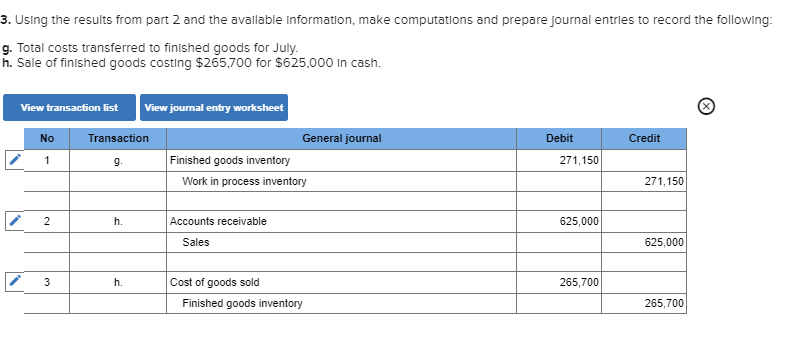

4. Post entries from parts 1 and 3 to the following general ledger accounts. Raw Materials Inventory Acct. No. 132 Work in Process Inventory Acct. No. 133 Date Debit Credit Balance Date Debit Credit Balance June 30 June 30 8,135 Finished Goods Inventory Debit Acct. No. 135 Factory Wages Payable Debit Acct. No. 212 Date Credit Date Credit June 30 110,000 Sales Acct. No. 413 Cost of Goods Sold Acct. No. 502 Date Date Debit Credit Debit Credit Factory Overhead Acct. No. 540 Date Debit Credit Balance Goods Inventory, $110,000; Sales, $0; Cost of Goods Sold, $0; Factory Payroll Payable, $0; and Factory Overhead, $O 1. Prepare Journal entries to record the following July transactions and events a. Purchased raw materlals for $125,000 cash (the company uses a perpetual Inventory system). b. Used raw materlals as follows: direct materlals, $52,440; and Indirect materials, $10,000. c. Recorded factory payroll payable costs as follows: direct labor, $202,250; and Indlrect labor, $25,000. d. Pald factory payroll cost of $227,250 with cash (Ignore taxes). e. Incurred additional factory overhead costs of $80,000 pald In cash. f. Allocated factory overhead to production at 50% of direct labor costs View transaction listView journal entry worksheet No Transaction General Journal Debit Credit Raw materials inventory 125,000 Cash 125,000 Work in process inventory 52.440 Factory overhead 10,000 Raw materials inventory 62.440 Work in process inventory 202,250 C- Factory overhead 25,000 Factory wages payable 227,250 d. Factory wages payable 227,250 Cash 227,250 Factory overhead 80,000 Cash 80,000 101,125 Work in process inventory 101,125 Factory overhead 3. Using the results from part 2 and the avallable Information, make computations and prepare journal entries to record the followlng g. Total costs transferred to finished goods for July. h. Sale of finished goods costing $265.700 for $625,000 In cash. View transaction list view journal entry worksheet NoTransaction General journal Debit Credit Finished goods inventory 271,150 271,150 Work in process inventory h. Accounts receivable 625,000 Sales 625,000 h. Cost of goods sold 265,700 Finished goods inventory 265,700