Answered step by step

Verified Expert Solution

Question

1 Approved Answer

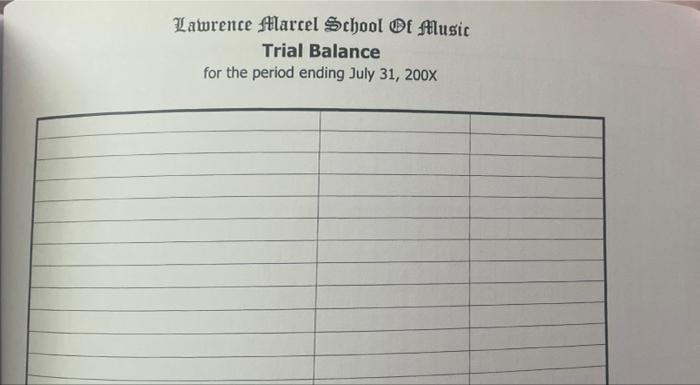

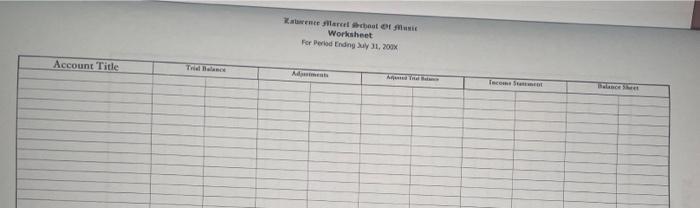

4. Prepare a trial balance on the sheet provided for the trial balance 5. Complete the worksheet using the adjusting entries provided I am only

4. Prepare a trial balance on the sheet provided for the trial balance

5. Complete the worksheet using the adjusting entries provided

I am only looking for answers to these two questions -- all other problems are down below as well for reference.

***proper format is shown at the very bottom for these two problems, please use that format to avoid confusion***

Trial balance format:

Worksheet format:

Thank you!!

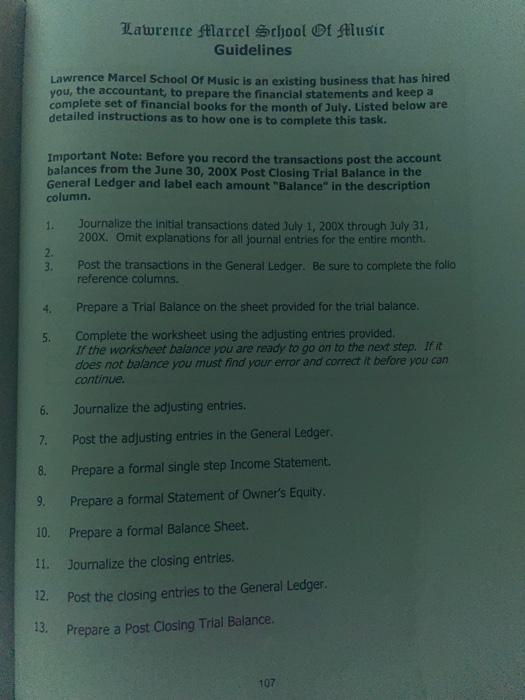

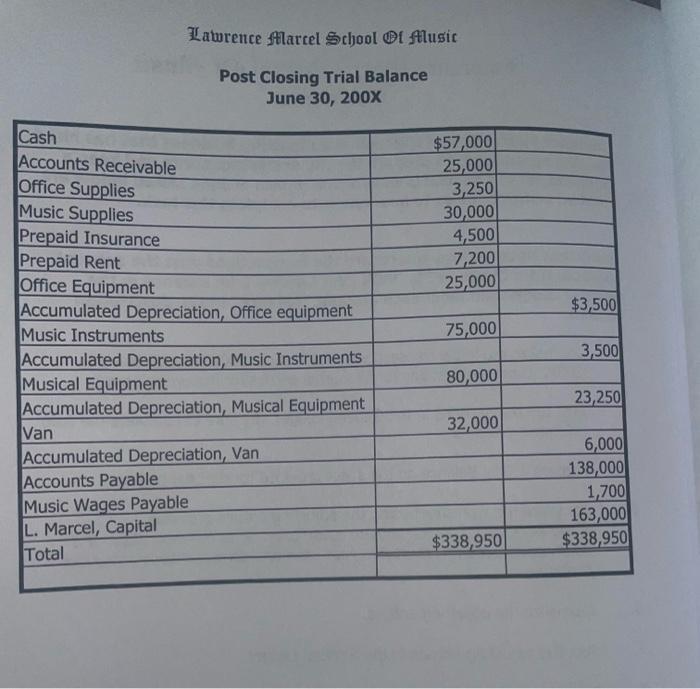

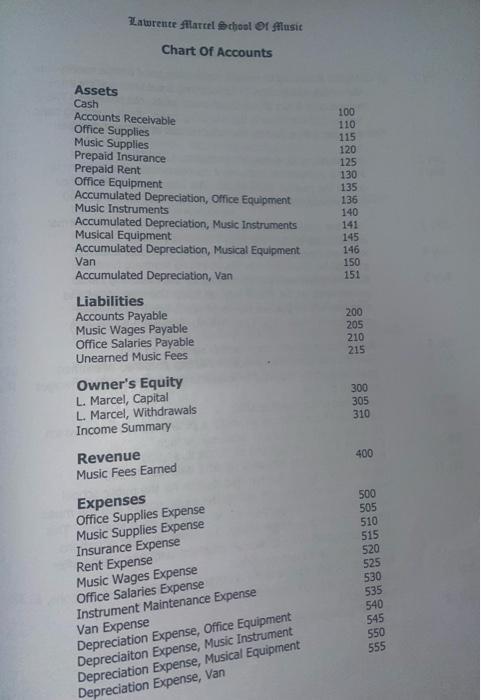

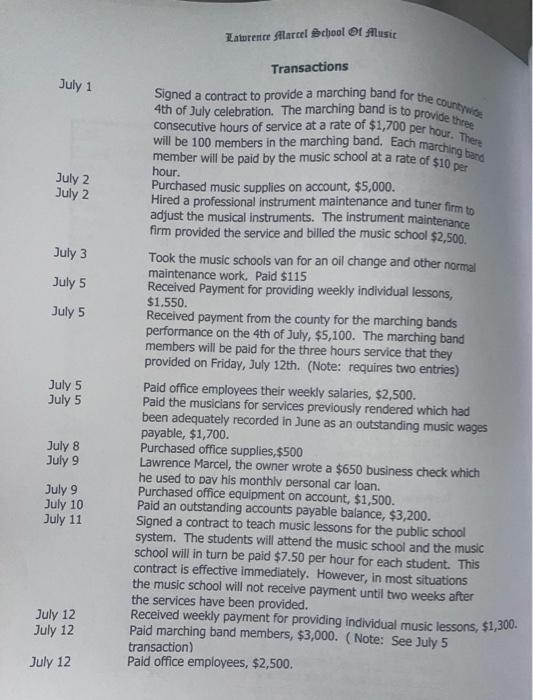

Lawrence Marcel School Of Music Guidelines Lawrence Marcel School of Music is an existing business that has hired you, the accountant, to prepare the financial statements and keep a complete set of financial books for the month of July. Listed below are detailed instructions as to how one is to complete this task. Important Note: Before you record the transactions post the account balances from the June 30, 200x Post Closing Trial Balance in the General Ledger and label each amount "Balance" in the description column. 1. 2. 3. Journalize the initial transactions dated July 1, 200X through July 31, 200x. Omit explanations for all journal entries for the entire month. Post the transactions in the General Ledger. Be sure to complete the folio reference columns 4. Prepare a Trial Balance on the sheet provided for the trial balance. 5. Complete the worksheet using the adjusting entries provided. If the worksheet balance you are ready to go on to the next step. Irit does not balance you must find your error and correct it before you can continue. 6. Journalize the adjusting entries. 7: Post the adjusting entries in the General Ledger. 8. Prepare a formal single step Income Statement. 9. Prepare a formal Statement of Owner's Equity. 10. Prepare a formal Balance Sheet. 11. Journalize the closing entries, 12. Post the closing entries to the General Ledger 13. Prepare a Post Closing Trial Balance. 107 Lawrence Marcel School Of Music Post Closing Trial Balance June 30, 200X $57,000 25,000 3,250 30,000 4,500 7,200 25,000 $3,500 Cash Accounts Receivable Office Supplies Music Supplies Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation, Office equipment Music Instruments Accumulated Depreciation, Music Instruments Musical Equipment Accumulated Depreciation, Musical Equipment Van Accumulated Depreciation, Van Accounts Payable Music Wages Payable L. Marcel, Capital 75,000 3,500 80,000 23,250 32,000 6,000 138,000 1,700 163,000 $338,950 $338,950 Total Lawrente Alarcel School of Musit Chart Of Accounts 100 110 115 120 125 130 135 136 140 Assets Cash Accounts Receivable Office Supplies Music Supplies Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation, Office Equipment Music Instruments Accumulated Depreciation, Music Instruments Musical Equipment Accumulated Depreciation, Musical Equipment Van Accumulated Depreciation, Van Liabilities Accounts Payable Music Wages Payable Office Salaries Payable 141 145 146 150 151 200 205 210 215 Unearned Music Fees 300 305 Owner's Equity L. Marcel, Capital L. Marcel, Withdrawals Income Summary 310 400 Revenue Music Fees Earned Expenses Office Supplies Expense Music Supplies Expense Insurance Expense Rent Expense Music Wages Expense Office Salaries Expense Instrument Maintenance Expense Van Expense Depreciation Expense, Office Equipment Depreciaiton Expense, Music Instrument Depreciation Expense, Musical Equipment Depreciation Expense, Van 500 505 510 515 520 525 530 535 540 545 550 555 Laturence Marcel School Of fluit Transactions July 1 July 2 July 2 July 3 July 5 July 5 Signed a contract to provide a marching band for the county 4th of July celebration. The marching band is to provide three consecutive hours of service at a rate of $1,700 per hour. There will be 100 members in the marching band. Each marching and member will be paid by the music school at a rate of $10 per hour. Purchased music supplies on account, $5,000. Hired a professional instrument maintenance and tuner firm to adjust the musical instruments. The instrument maintenance firm provided the service and billed the music school $2,500 Took the music schools van for an oil change and other normal maintenance work. Paid $115 Received Payment for providing weekly individual lessons, $1.550 Received payment from the county for the marching bands performance on the 4th of July, $5,100. The marching band members will be paid for the three hours service that they provided on Friday, July 12th. (Note: requires two entries) Pald office employees their weekly salaries, $2,500. Paid the musicians for services previously rendered which had been adequately recorded in June as an outstanding music wages payable, $1,700. Purchased office supplies,$500 Lawrence Marcel, the owner wrote a $650 business check which he used to pay his monthly personal car loan. Purchased office equipment on account, $1,500. Paid an outstanding accounts payable balance, $3,200. Signed a contract to teach music lessons for the public school system. The students will attend the music school and the music school will in turn be paid $7.50 per hour for each student. This contract is effective immediately. However, in most situations the music school will not receive payment until two weeks after the services have been provided. Received weekly payment for providing individual music lessons, $1,300. Paid marching band members, $3,000. (Note: See July 5 transaction) Paid office employees, $2,500. July 5 July 5 July 8 July 9 July 9 July 10 July 11 July 12 July 12 July 12 Lawrence Alarcel School Ot Alusic July 15 July 15 July 16 July 17 July 18 Transactions Entered into an agreement to provide daily musical interludes for an office complex at a rate of $1,750 per 5 work day week. Received four weeks advanced payment and began services today. Rented additional space in their current office complex at a rate of $1,000 per month. Paid three months rent. Received a $3,700 payment on the outstanding accounts receivable balance. Provided services and collected $5,000. Provided services that total $7,500. Collected $2,500 and billed the customer for the remainder. Paid Office employees, $2,500. Received weekly payments for providing individual lessons, $1.900. Received payment on previously billed account, $4,500. Paid $10,000 on the outstanding accounts payable balance. Provided services and collected $3,100. Received payment from previously billed customer, $2,100. Paid office employees, $2,500. July 19 July 19 July 22 July 23 July 24 July 25 July 26 July 26 Received payment for providing indivdual weekly lessons, $3,200. July 29 Provided services and billed the customer, $1,400. Provided services and collected $2,300. July 31 Lawrence Marcel School of Music ADJUSTING ENTRIES July 31, 200x a. a. Office Equipment b. C. Record the monthly depreciation on the assets as listed below: 500 Music Instruments 200 Musical Equipment 950 Van 600 The weekly payroll of the office employees is $2,500. The office employees are paid on a weekly basis. Wednesday, July 31, 200X is the end of the monthly accounting cycle. The prepaid insurance balance is the sum of three different policies. The first policy had a balance of $1,000 and it had five months of coverage remaining at the beginning of this monthly cycle. The second policy's balance of $2,400 represents the remaining portion of a three year policy of which one year had already elapsed at the beginning of this month. $1,100 is the balance of the third policy at the beginning of the month. $350 of the third policy's cost was used during the current period. (Note: Please use only one adjusting entry to adjust the Prepaid Insurance account) The June 30, 200X $7,200 account balance for prepaid rent is the cost of 9 months rent. Also, $500 of the prepaid rent in the July 15th transaction had been used. The Lawrence Marcel School of Music provided 100 hours of service to the public school students at the $7.50 per hour rate agreed to on July 11th. As of July 31st they had not received payment from the public school system for these services. Also, the music school had provided individual lessons totaling $2,000 on Monday, Tuesday and Wednesday of the July 29th week. They will receive payment for these lessons on Friday, August 2, 200X. And thirdly, two weeks of musical interludes have been provided at the office complex as agreed upon in the July 15th transaction. An examination of the Office Supplies account reveals that there is 2100 of office supplies on hand. $5,500 of music supplies were used this period. d. e. f. 9. Lawrence Marcel School Of Music Trial Balance for the period ending July 31, 200x Zencefilerce belofte Worksheet For Period Ending 31, 2018 Account Title M Lawrence Marcel School Of Music Guidelines Lawrence Marcel School of Music is an existing business that has hired you, the accountant, to prepare the financial statements and keep a complete set of financial books for the month of July. Listed below are detailed instructions as to how one is to complete this task. Important Note: Before you record the transactions post the account balances from the June 30, 200x Post Closing Trial Balance in the General Ledger and label each amount "Balance" in the description column. 1. 2. 3. Journalize the initial transactions dated July 1, 200X through July 31, 200x. Omit explanations for all journal entries for the entire month. Post the transactions in the General Ledger. Be sure to complete the folio reference columns 4. Prepare a Trial Balance on the sheet provided for the trial balance. 5. Complete the worksheet using the adjusting entries provided. If the worksheet balance you are ready to go on to the next step. Irit does not balance you must find your error and correct it before you can continue. 6. Journalize the adjusting entries. 7: Post the adjusting entries in the General Ledger. 8. Prepare a formal single step Income Statement. 9. Prepare a formal Statement of Owner's Equity. 10. Prepare a formal Balance Sheet. 11. Journalize the closing entries, 12. Post the closing entries to the General Ledger 13. Prepare a Post Closing Trial Balance. 107 Lawrence Marcel School Of Music Post Closing Trial Balance June 30, 200X $57,000 25,000 3,250 30,000 4,500 7,200 25,000 $3,500 Cash Accounts Receivable Office Supplies Music Supplies Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation, Office equipment Music Instruments Accumulated Depreciation, Music Instruments Musical Equipment Accumulated Depreciation, Musical Equipment Van Accumulated Depreciation, Van Accounts Payable Music Wages Payable L. Marcel, Capital 75,000 3,500 80,000 23,250 32,000 6,000 138,000 1,700 163,000 $338,950 $338,950 Total Lawrente Alarcel School of Musit Chart Of Accounts 100 110 115 120 125 130 135 136 140 Assets Cash Accounts Receivable Office Supplies Music Supplies Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation, Office Equipment Music Instruments Accumulated Depreciation, Music Instruments Musical Equipment Accumulated Depreciation, Musical Equipment Van Accumulated Depreciation, Van Liabilities Accounts Payable Music Wages Payable Office Salaries Payable 141 145 146 150 151 200 205 210 215 Unearned Music Fees 300 305 Owner's Equity L. Marcel, Capital L. Marcel, Withdrawals Income Summary 310 400 Revenue Music Fees Earned Expenses Office Supplies Expense Music Supplies Expense Insurance Expense Rent Expense Music Wages Expense Office Salaries Expense Instrument Maintenance Expense Van Expense Depreciation Expense, Office Equipment Depreciaiton Expense, Music Instrument Depreciation Expense, Musical Equipment Depreciation Expense, Van 500 505 510 515 520 525 530 535 540 545 550 555 Laturence Marcel School Of fluit Transactions July 1 July 2 July 2 July 3 July 5 July 5 Signed a contract to provide a marching band for the county 4th of July celebration. The marching band is to provide three consecutive hours of service at a rate of $1,700 per hour. There will be 100 members in the marching band. Each marching and member will be paid by the music school at a rate of $10 per hour. Purchased music supplies on account, $5,000. Hired a professional instrument maintenance and tuner firm to adjust the musical instruments. The instrument maintenance firm provided the service and billed the music school $2,500 Took the music schools van for an oil change and other normal maintenance work. Paid $115 Received Payment for providing weekly individual lessons, $1.550 Received payment from the county for the marching bands performance on the 4th of July, $5,100. The marching band members will be paid for the three hours service that they provided on Friday, July 12th. (Note: requires two entries) Pald office employees their weekly salaries, $2,500. Paid the musicians for services previously rendered which had been adequately recorded in June as an outstanding music wages payable, $1,700. Purchased office supplies,$500 Lawrence Marcel, the owner wrote a $650 business check which he used to pay his monthly personal car loan. Purchased office equipment on account, $1,500. Paid an outstanding accounts payable balance, $3,200. Signed a contract to teach music lessons for the public school system. The students will attend the music school and the music school will in turn be paid $7.50 per hour for each student. This contract is effective immediately. However, in most situations the music school will not receive payment until two weeks after the services have been provided. Received weekly payment for providing individual music lessons, $1,300. Paid marching band members, $3,000. (Note: See July 5 transaction) Paid office employees, $2,500. July 5 July 5 July 8 July 9 July 9 July 10 July 11 July 12 July 12 July 12 Lawrence Alarcel School Ot Alusic July 15 July 15 July 16 July 17 July 18 Transactions Entered into an agreement to provide daily musical interludes for an office complex at a rate of $1,750 per 5 work day week. Received four weeks advanced payment and began services today. Rented additional space in their current office complex at a rate of $1,000 per month. Paid three months rent. Received a $3,700 payment on the outstanding accounts receivable balance. Provided services and collected $5,000. Provided services that total $7,500. Collected $2,500 and billed the customer for the remainder. Paid Office employees, $2,500. Received weekly payments for providing individual lessons, $1.900. Received payment on previously billed account, $4,500. Paid $10,000 on the outstanding accounts payable balance. Provided services and collected $3,100. Received payment from previously billed customer, $2,100. Paid office employees, $2,500. July 19 July 19 July 22 July 23 July 24 July 25 July 26 July 26 Received payment for providing indivdual weekly lessons, $3,200. July 29 Provided services and billed the customer, $1,400. Provided services and collected $2,300. July 31 Lawrence Marcel School of Music ADJUSTING ENTRIES July 31, 200x a. a. Office Equipment b. C. Record the monthly depreciation on the assets as listed below: 500 Music Instruments 200 Musical Equipment 950 Van 600 The weekly payroll of the office employees is $2,500. The office employees are paid on a weekly basis. Wednesday, July 31, 200X is the end of the monthly accounting cycle. The prepaid insurance balance is the sum of three different policies. The first policy had a balance of $1,000 and it had five months of coverage remaining at the beginning of this monthly cycle. The second policy's balance of $2,400 represents the remaining portion of a three year policy of which one year had already elapsed at the beginning of this month. $1,100 is the balance of the third policy at the beginning of the month. $350 of the third policy's cost was used during the current period. (Note: Please use only one adjusting entry to adjust the Prepaid Insurance account) The June 30, 200X $7,200 account balance for prepaid rent is the cost of 9 months rent. Also, $500 of the prepaid rent in the July 15th transaction had been used. The Lawrence Marcel School of Music provided 100 hours of service to the public school students at the $7.50 per hour rate agreed to on July 11th. As of July 31st they had not received payment from the public school system for these services. Also, the music school had provided individual lessons totaling $2,000 on Monday, Tuesday and Wednesday of the July 29th week. They will receive payment for these lessons on Friday, August 2, 200X. And thirdly, two weeks of musical interludes have been provided at the office complex as agreed upon in the July 15th transaction. An examination of the Office Supplies account reveals that there is 2100 of office supplies on hand. $5,500 of music supplies were used this period. d. e. f. 9. Lawrence Marcel School Of Music Trial Balance for the period ending July 31, 200x Zencefilerce belofte Worksheet For Period Ending 31, 2018 Account Title MStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started