Answered step by step

Verified Expert Solution

Question

1 Approved Answer

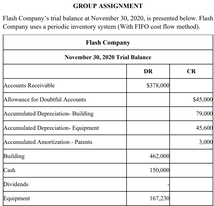

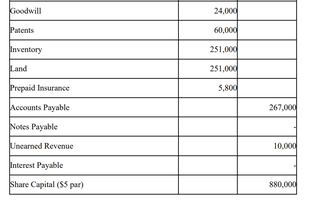

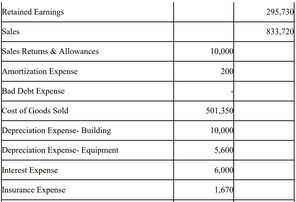

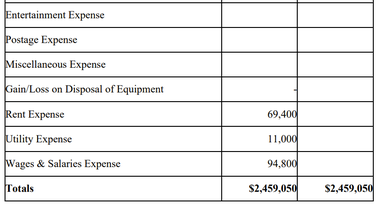

4. Prepare an adjusted trial balance as of December 2020. 5. Generate income statement, statement of owners equity and classified balance sheet for the year

4. Prepare an adjusted trial balance as of December 2020.

5. Generate income statement, statement of owners equity and classified balance sheet for the year ended December 31, 2020. (Note: November 30, 2020 Trial Balance represents the accumulated revenue and expenses of the first 11 months in 2020. Tax rate: 0% - There is no tax expense).

6. Journalize and post-closing entries in the same T accounts in requirement #1 above. 7. Prepare a post-closing trial balance as at December 2020

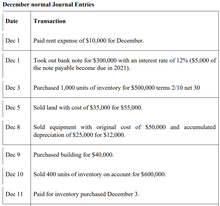

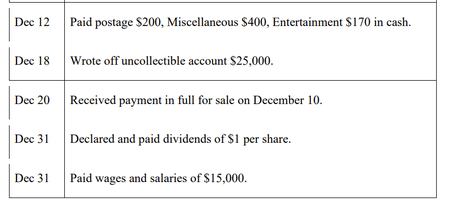

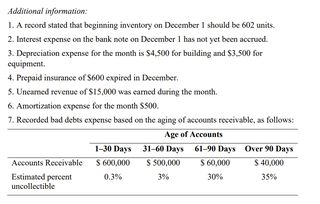

CR GROUP ASSIGNMENT Flash Company's trial balance at November 30, 2030, is presented below. Flash Company uses a periodic inventory system (With FIFO cost flow method) Flash Company November 2012 Trial Balance DR het Ree 5378.000 Allower Dell S45.00 precumulated Depecice Building 79.000 ecumulated Decent 45. Accumulated America Patent Sood 460,000 150,00 Canh idende 167.220 Goodwill 24,000 Patents 60,000 251,000 Inventory Land 251.000 Prepaid Insurance 5.800 Accounts Payable 267.000 Notes Payable 10.000 Unearned Revenue Interest Payable Share Capital (55 par) 880,000 Retained Earnings 295.730 Sales 833.720 Sales Returns & Allowances 10.000 200 Amortization Expense Bad Debt Expense Kost of Goods Sold 501,350 Depreciation Expense- Building Depreciation Expense-Equipment 10,000 5.600 Interest Expense 6.000 Insurance Expense 1.670 Entertainment Expense Postage Expense Miscellaneous Expense Gain/Loss on Disposal of Equipment Rent Expense 69.400 Utility Expense 11,000 Wages & Salaries Expense 94,800 Totals $2,459,050 $2,459,050 December normal Jornal Entries Date Trama Dec Paid rent expense of 10.000 for December DI Tookout bank of $200,000 with an interest rate 125 (55.000 the note payable become due in 2021) Dec 3 $ Purchased 1,000 units of inventory for $500,000 term 10 net 30 De Sold land without of 535.000 for 585.000 Des Sold equipment with original cost of $50,000 and accumulated depreciation of 25.000 for $12.000. De 9 Puchared building for 540,000 Dec 10 Sold 400 units of inventory of S00.000 Dec 11 Paid for inventory purchased December Dec 12 Paid postage $200, Miscellaneous $400, Entertainment $170 in cash. Dec 18 Wrote off uncollectible account $25,000. Dec 20 Received payment in full for sale on December 10. Dec 31 Declared and paid dividends of $1 per share. Dec 31 Paid wages and salaries of $15,000. Additional information: 1. A record stated that beginning inventory on December I should be 602 units. 2. Interest expense on the bank note on December 1 has not yet been accrued. 3. Depreciation expense for the month is $4.500 for building and $3.500 for equipment 4. Prepaid insurance of S600 expired in December 5. Uneamed revenue of $15,000 was camod during the month. 6. Amortization expense for the month $500. 7. Recorded bad debes expense based on the aging of accounts receivable, as follows: Age of Accounts 1-30 Days 31-60 Days 61-90 Days Over 90 Days Accounts Receivable $600,000 $ 500,000 $ 60,000 $ 40,000 Estimated percent 0.3% 396 30% 35% uncollectible CR GROUP ASSIGNMENT Flash Company's trial balance at November 30, 2030, is presented below. Flash Company uses a periodic inventory system (With FIFO cost flow method) Flash Company November 2012 Trial Balance DR het Ree 5378.000 Allower Dell S45.00 precumulated Depecice Building 79.000 ecumulated Decent 45. Accumulated America Patent Sood 460,000 150,00 Canh idende 167.220 Goodwill 24,000 Patents 60,000 251,000 Inventory Land 251.000 Prepaid Insurance 5.800 Accounts Payable 267.000 Notes Payable 10.000 Unearned Revenue Interest Payable Share Capital (55 par) 880,000 Retained Earnings 295.730 Sales 833.720 Sales Returns & Allowances 10.000 200 Amortization Expense Bad Debt Expense Kost of Goods Sold 501,350 Depreciation Expense- Building Depreciation Expense-Equipment 10,000 5.600 Interest Expense 6.000 Insurance Expense 1.670 Entertainment Expense Postage Expense Miscellaneous Expense Gain/Loss on Disposal of Equipment Rent Expense 69.400 Utility Expense 11,000 Wages & Salaries Expense 94,800 Totals $2,459,050 $2,459,050 December normal Jornal Entries Date Trama Dec Paid rent expense of 10.000 for December DI Tookout bank of $200,000 with an interest rate 125 (55.000 the note payable become due in 2021) Dec 3 $ Purchased 1,000 units of inventory for $500,000 term 10 net 30 De Sold land without of 535.000 for 585.000 Des Sold equipment with original cost of $50,000 and accumulated depreciation of 25.000 for $12.000. De 9 Puchared building for 540,000 Dec 10 Sold 400 units of inventory of S00.000 Dec 11 Paid for inventory purchased December Dec 12 Paid postage $200, Miscellaneous $400, Entertainment $170 in cash. Dec 18 Wrote off uncollectible account $25,000. Dec 20 Received payment in full for sale on December 10. Dec 31 Declared and paid dividends of $1 per share. Dec 31 Paid wages and salaries of $15,000. Additional information: 1. A record stated that beginning inventory on December I should be 602 units. 2. Interest expense on the bank note on December 1 has not yet been accrued. 3. Depreciation expense for the month is $4.500 for building and $3.500 for equipment 4. Prepaid insurance of S600 expired in December 5. Uneamed revenue of $15,000 was camod during the month. 6. Amortization expense for the month $500. 7. Recorded bad debes expense based on the aging of accounts receivable, as follows: Age of Accounts 1-30 Days 31-60 Days 61-90 Days Over 90 Days Accounts Receivable $600,000 $ 500,000 $ 60,000 $ 40,000 Estimated percent 0.3% 396 30% 35% uncollectible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started