Answered step by step

Verified Expert Solution

Question

1 Approved Answer

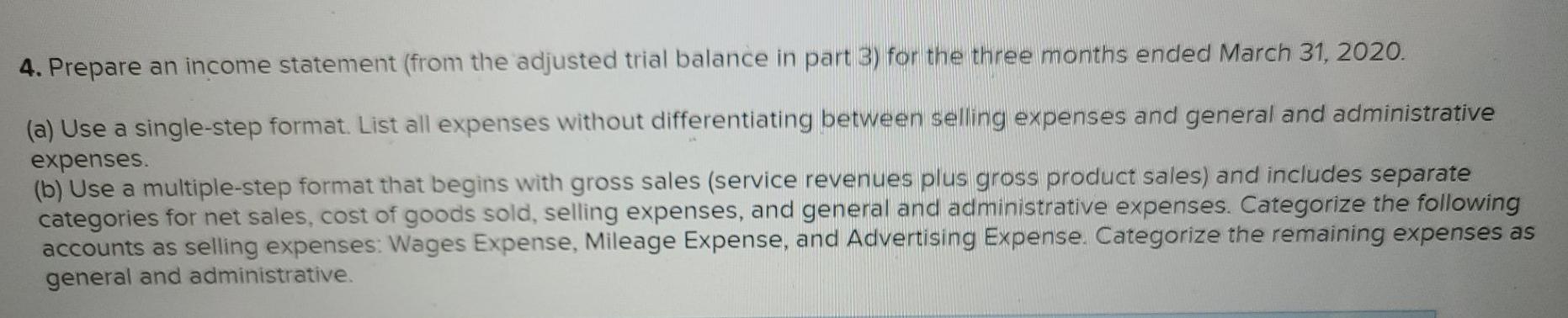

4. Prepare an income statement (from the adjusted trial balance in part 3) for the three months ended March 31, 2020. (a) Use a single-step

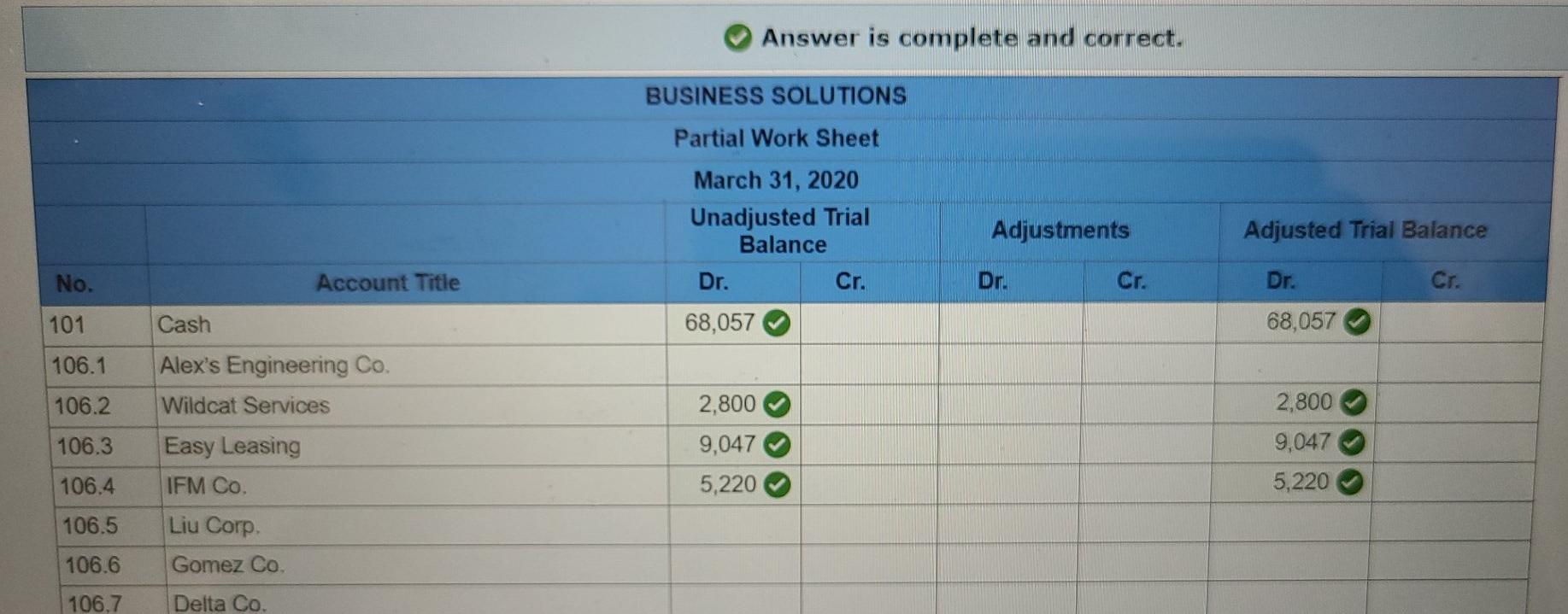

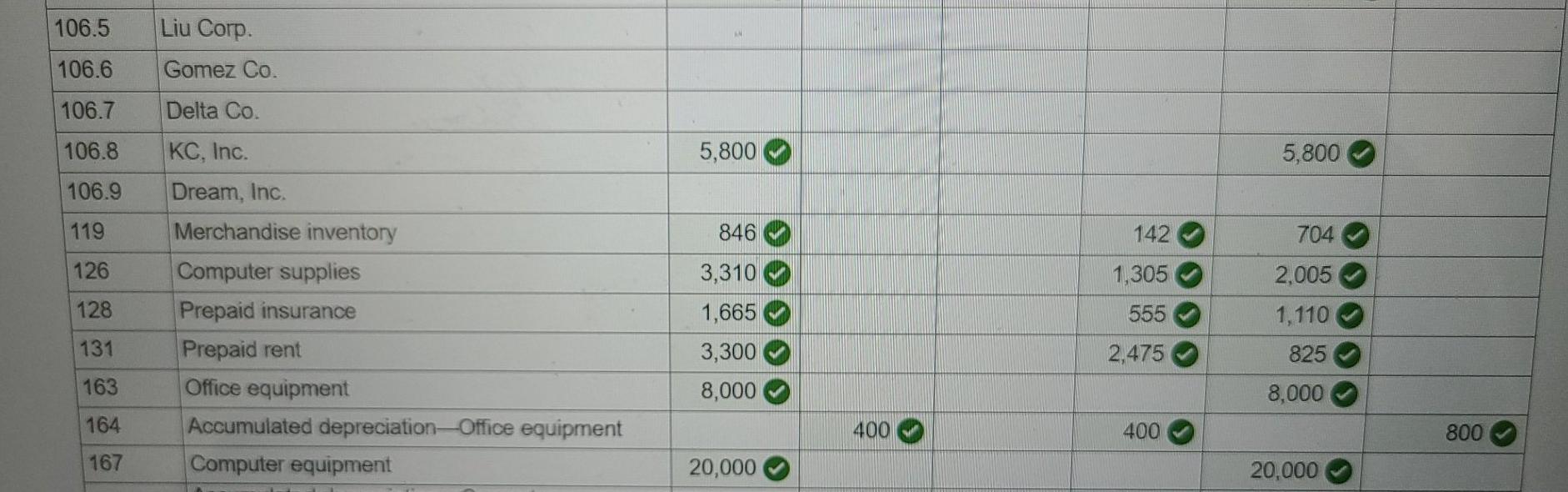

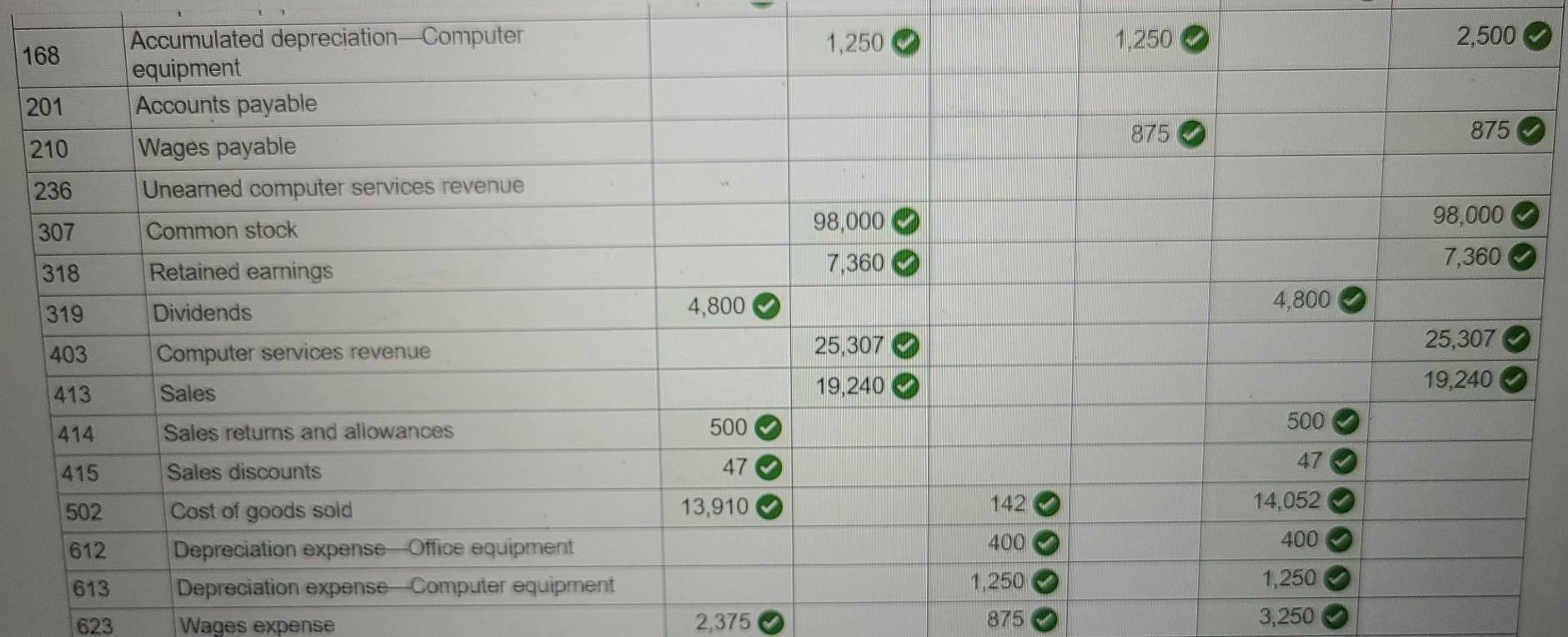

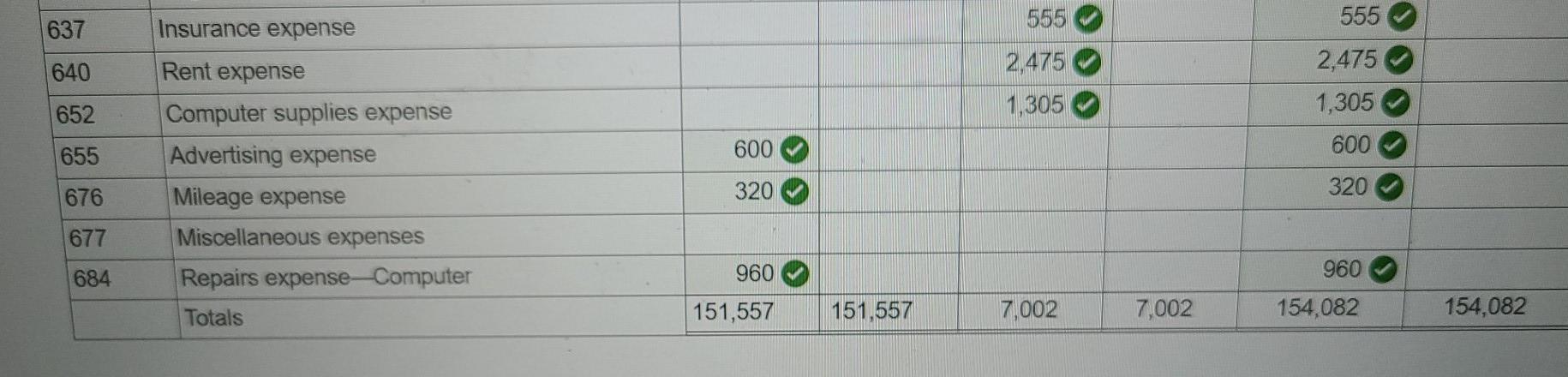

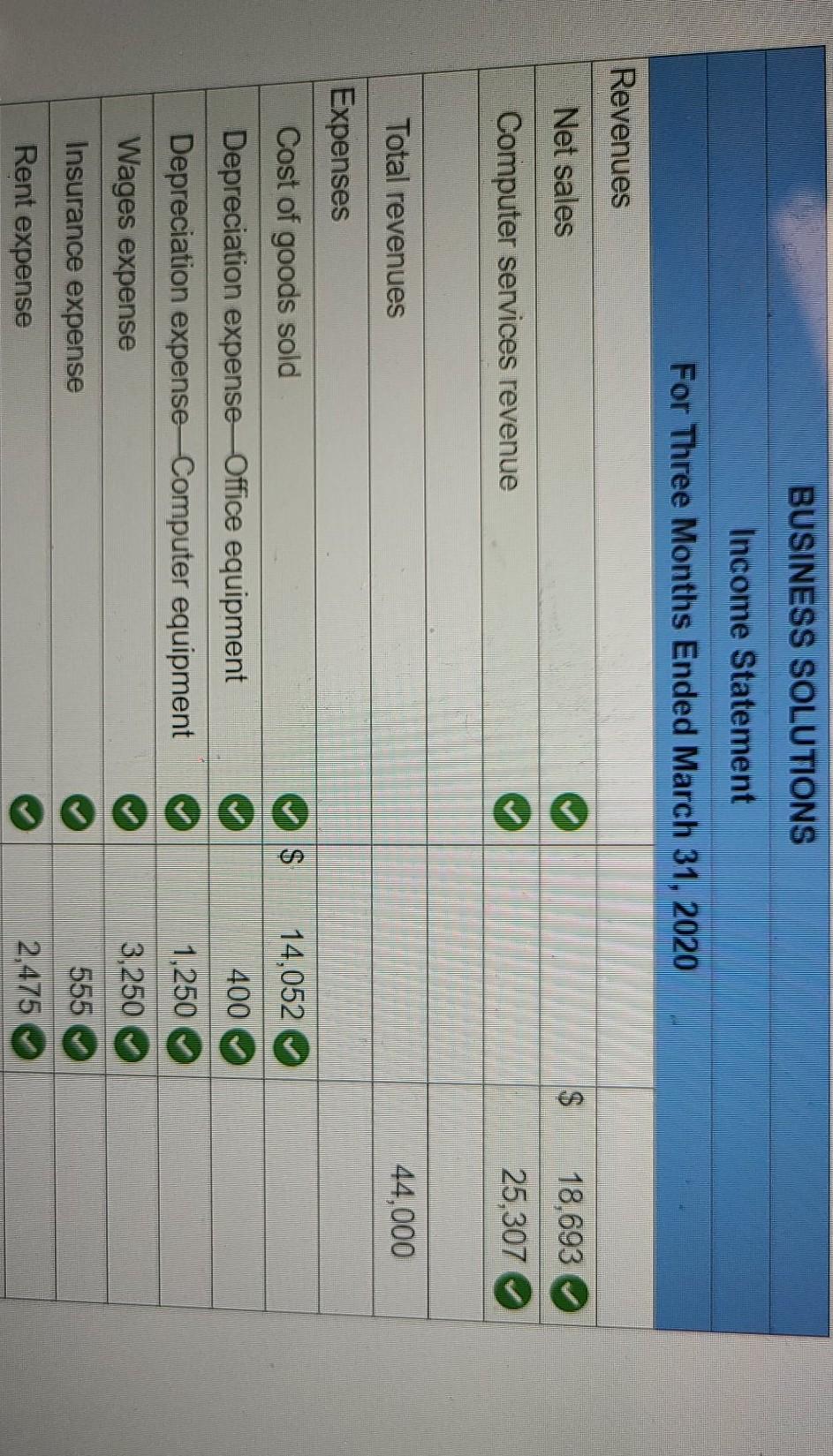

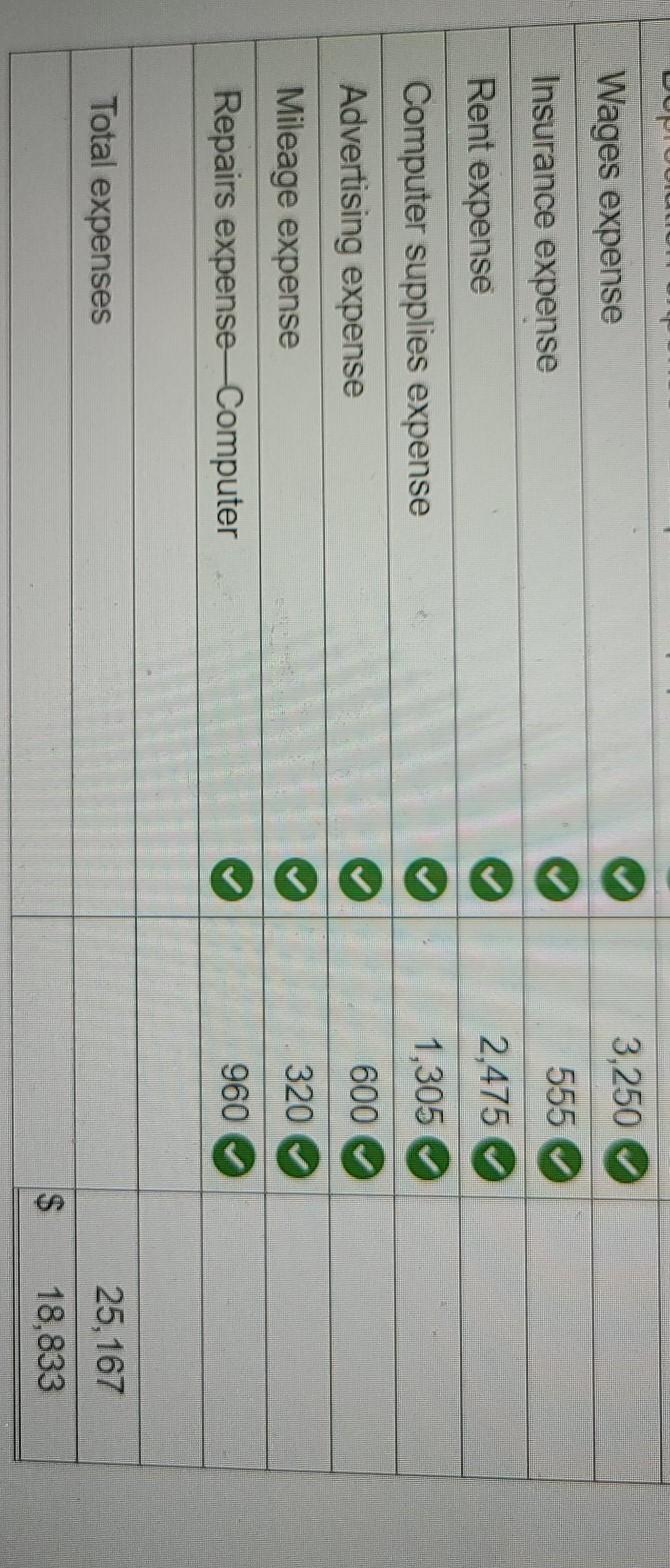

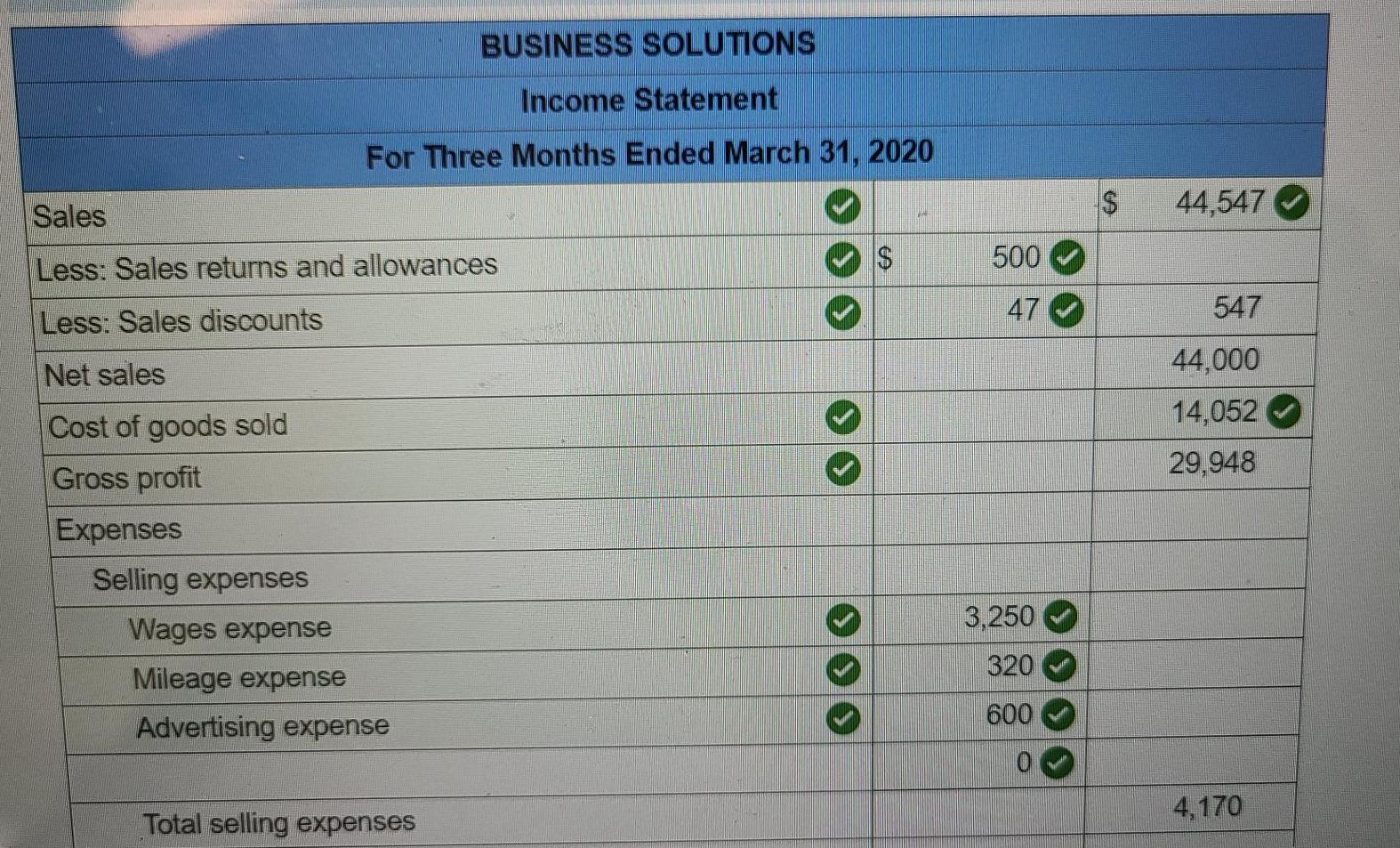

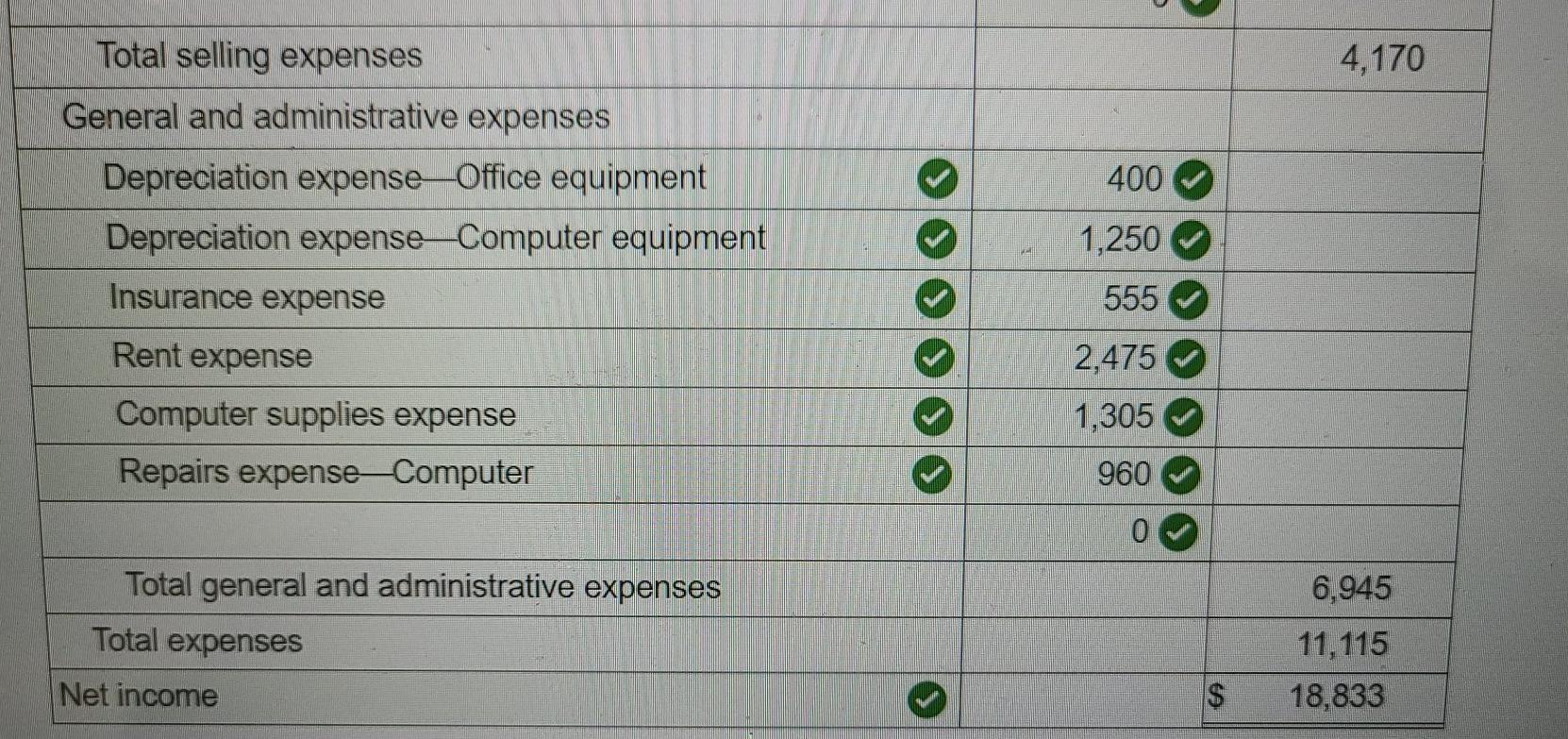

4. Prepare an income statement (from the adjusted trial balance in part 3) for the three months ended March 31, 2020. (a) Use a single-step format. List all expenses without differentiating between selling expenses and general and administrative expenses. (b) Use a multiple-step format that begins with gross sales (service revenues plus gross product sales) and includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. Categorize the following accounts as selling expenses: Wages Expense, Mileage Expense, and Advertising Expense. Categorize the remaining expenses as general and administrative. Answer is complete and correct. BUSINESS SOLUTIONS Partial Work Sheet March 31, 2020 Unadjusted Trial Balance Dr. Cr. Adjustments Adjusted Trial Balance No. Account Title Dr. Cr. Dr. Cr. 101 Cash 68,057 68,057 106.1 Alex's Engineering Co. Wildcat Services 106.2 2,800 106.3 Easy Leasing IFM Co. 9,047 5,220 2,800 9,047 5,220 106.4 106.5 Liu Corp Gomez Co. 106.6 106.7 Delta Co. 106.5 Liu Corp. 106.6 Gomez Co. 106.7 Delta Co. 106.8 5,800 5,800 106.9 119 846 142 704 2,005 126 1,305 128 KC, Inc. Dream, Inc. Merchandise inventory Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation - Office equipment Computer equipment 555 1,110 3,310 1,665 3,300 8,000 131 2,475 825 163 8,000 164 400 400 800 167 20,000 20,000 - 1,250 1,250 168 2,500 201 875 875 210 236 Accumulated depreciationComputer equipment Accounts payable Wages payable Unearned computer services revenue Common stock Retained earnings Dividends Computer services revenue Sales 307 98,000 7,360 98,000 7,360 318 319 4,800 4,800 25,307 403 25,307 19,240 19,240 413 414 500 500 Sales returns and allowances 415 47 47 Sales discounts 502 142 13,910 14,052 612 400 400 Cost of goods sold Depreciation expense Office equipment Depreciation expense Computer equipment Wages expense 613 1,250 1,250 623 2,375 875 3,250 555 555 637 640 2,475 1,305 2,475 1,305 652 Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer 655 600 600 676 320 320 677 684 960 960 Totals 151,557 151,557 7,002 7,002 154,082 154,082 Required 4A Required 4B Prepare an income statement (from the adjusted trial balance in part 3) for the three months ended March 31, 2020. (a) Use a single-step format. List all expenses without differentiating between selling expenses and general and administrative expenses. Show less A BUSINESS SOLUTIONS Income Statement For Three Months Ended March 31, 2020 Revenues Net sales $ 18,693 Computer services revenue 25,307 Total revenues 44,000 S 14,052 Expenses Cost of goods sold Depreciation expense-Office equipment Depreciation expense Computer equipment Wages expense Insurance expense OOO 400 1,250 3,250 555 Rent expense 2,475 LUL 3,250 555 2,475 Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Repairs expense Computer 1,305 600 320 960 Total expenses 25,167 18,833 $ Required 4A Required 4B Prepare an income statement (from the adjusted trial balance in part 3) for the three months ended March 31, 2020. (b) Use a multiple-step format that begins with gross sales (service revenues plus gross product sales) and includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. Categorize the following accounts as selling expenses: Wages Expense, Mileage Expense, and Advertising Expense. Categorize the remaining expenses as general and administrative. Show less A BUSINESS SOLUTIONS Income Statement For Three Months Ended March 31, 2020 S Sales 44,547 Less: Sales returns and allowances $ 500 47 547 Less: Sales discounts 44,000 Net sales 14,052 29,948 Cost of goods sold Gross profit Expenses Selling expenses Wages expense Mileage expense Advertising expense 3,250 320 600 4,170 Total selling expenses 4,170 400 1,250 Total selling expenses General and administrative expenses Depreciation expense_Office equipment Depreciation expense Computer equipment Insurance expense Rent expense Computer supplies expense Repairs expense Computer 555 2,475 1,305 960 0 6,945 Total general and administrative expenses Total expenses Net income 11,115 18,833 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started