Answered step by step

Verified Expert Solution

Question

1 Approved Answer

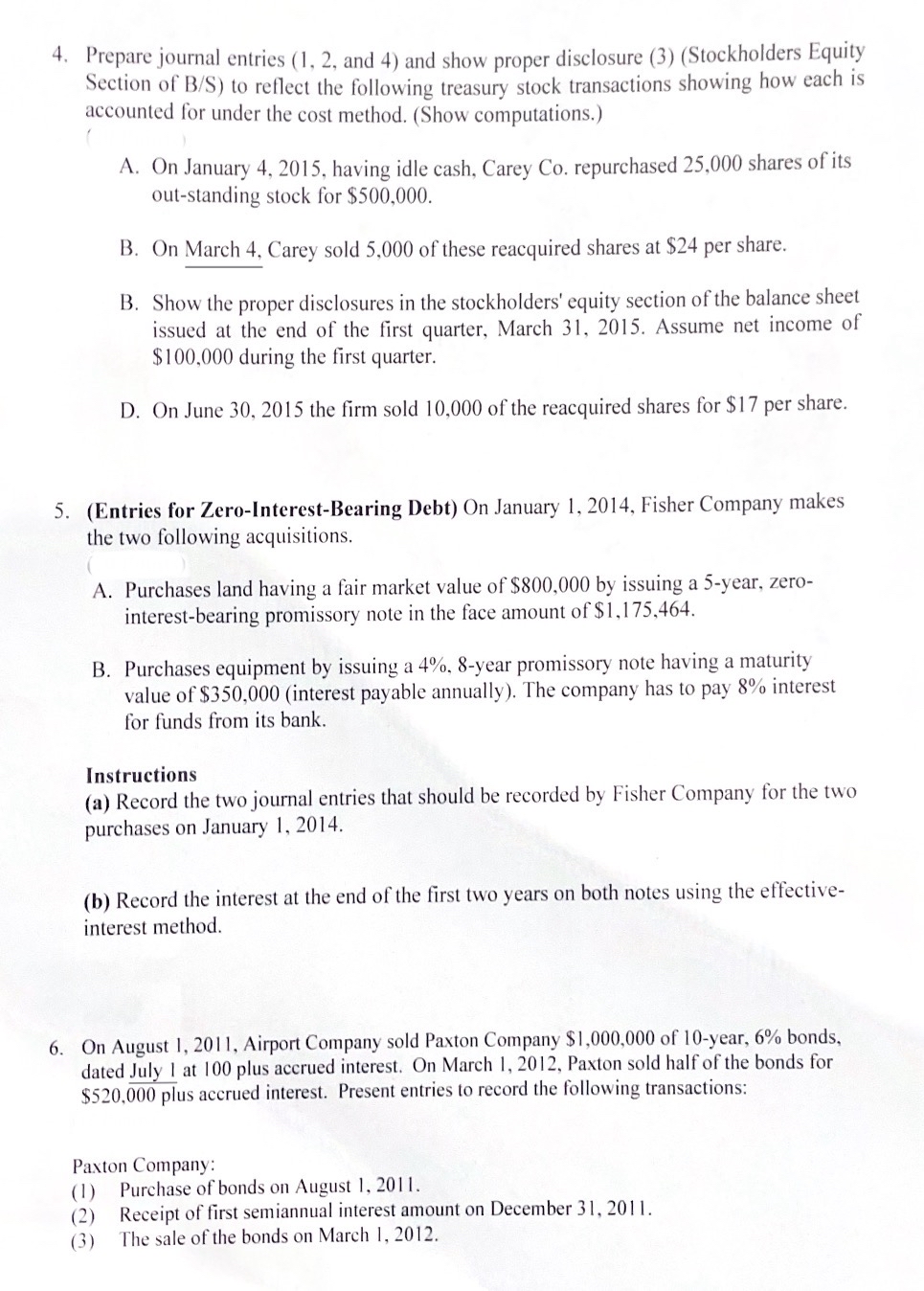

4. Prepare journal entries (1, 2, and 4) and show proper disclosure (3) (Stockholders Equity Section of B/S) to reflect the following treasury stock

4. Prepare journal entries (1, 2, and 4) and show proper disclosure (3) (Stockholders Equity Section of B/S) to reflect the following treasury stock transactions showing how each is accounted for under the cost method. (Show computations.) A. On January 4, 2015, having idle cash, Carey Co. repurchased 25,000 shares of its out-standing stock for $500,000. B. On March 4, Carey sold 5,000 of these reacquired shares at $24 per share. B. Show the proper disclosures in the stockholders' equity section of the balance sheet issued at the end of the first quarter, March 31, 2015. Assume net income of $100,000 during the first quarter. D. On June 30, 2015 the firm sold 10,000 of the reacquired shares for $17 per share. 5. (Entries for Zero-Interest-Bearing Debt) On January 1, 2014, Fisher Company makes the two following acquisitions. ( A. Purchases land having a fair market value of $800,000 by issuing a 5-year, zero- interest-bearing promissory note in the face amount of $1,175,464. B. Purchases equipment by issuing a 4%, 8-year promissory note having a maturity value of $350,000 (interest payable annually). The company has to pay 8% interest for funds from its bank. Instructions (a) Record the two journal entries that should be recorded by Fisher Company for the two purchases on January 1, 2014. (b) Record the interest at the end of the first two years on both notes using the effective- interest method. 6. On August 1, 2011, Airport Company sold Paxton Company $1,000,000 of 10-year, 6% bonds, dated July 1 at 100 plus accrued interest. On March 1, 2012, Paxton sold half of the bonds for $520,000 plus accrued interest. Present entries to record the following transactions: Paxton Company: (1) Purchase of bonds on August 1, 2011. (2) Receipt of first semiannual interest amount on December 31, 2011. (3) The sale of the bonds on March 1, 2012.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started