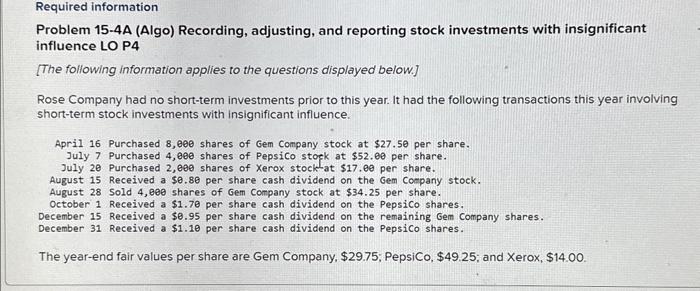

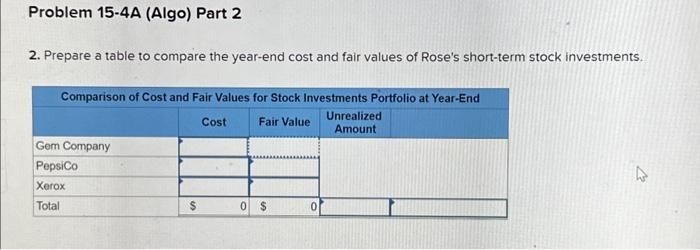

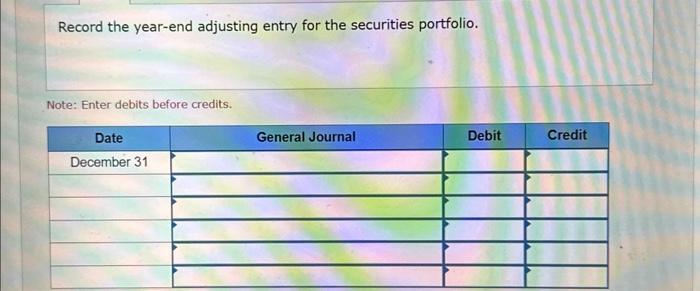

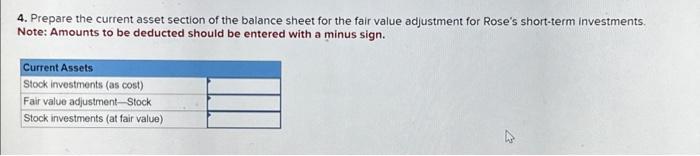

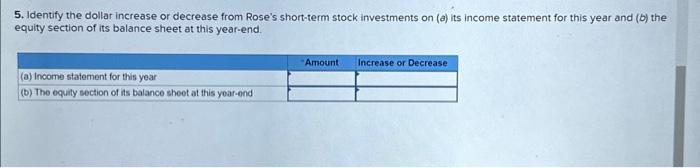

4. Prepare the current asset section of the balance sheet for the fair value adjustment for Rose's short-term investments. Note: Amounts to be deducted should be entered with a minus sign. 2. Prepare a table to compare the year-end cost and fair values of Rose's short-term stock investments. Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 [The following information applies to the questions displayed below.] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence. April 16 Purchased 8,000 shares of Gem Company stock at $27.50 per share. July 7 Purchased 4,000 shares of Pepsico stopk at $52.00 per share. July 20 Purchased 2 , 600 shares of Xerox stock- at $17.00 per share. August 15 Received a $0.80 per share cash dividend on the Gem Coepany stock. August 28 Sold 4 , 800 shares of Gem Company stock at $34.25 per share. October 1 Received a $1.70 per share cash dividend on the Pepsico shares. December 15 Received a $0.95 per share cash dividend on the remaining Gem Company shares. December 31 Received a $1.10 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$29.75; PepsiCo, $49.25; and Xerox, $14.00. 5. Identify the dollar increase or decrease from Rose's short-term stock investments on (a) its income statement for this year and (b) the equity section of its balance sheet at this year-end. Record the year-end adjusting entry for the securities portfolio. Note: Enter debits before credits. 4. Prepare the current asset section of the balance sheet for the fair value adjustment for Rose's short-term investments. Note: Amounts to be deducted should be entered with a minus sign. 2. Prepare a table to compare the year-end cost and fair values of Rose's short-term stock investments. Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 [The following information applies to the questions displayed below.] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence. April 16 Purchased 8,000 shares of Gem Company stock at $27.50 per share. July 7 Purchased 4,000 shares of Pepsico stopk at $52.00 per share. July 20 Purchased 2 , 600 shares of Xerox stock- at $17.00 per share. August 15 Received a $0.80 per share cash dividend on the Gem Coepany stock. August 28 Sold 4 , 800 shares of Gem Company stock at $34.25 per share. October 1 Received a $1.70 per share cash dividend on the Pepsico shares. December 15 Received a $0.95 per share cash dividend on the remaining Gem Company shares. December 31 Received a $1.10 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$29.75; PepsiCo, $49.25; and Xerox, $14.00. 5. Identify the dollar increase or decrease from Rose's short-term stock investments on (a) its income statement for this year and (b) the equity section of its balance sheet at this year-end. Record the year-end adjusting entry for the securities portfolio. Note: Enter debits before credits