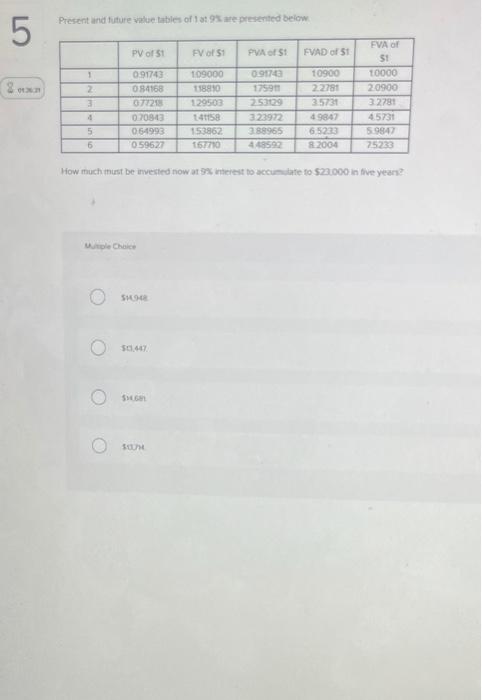

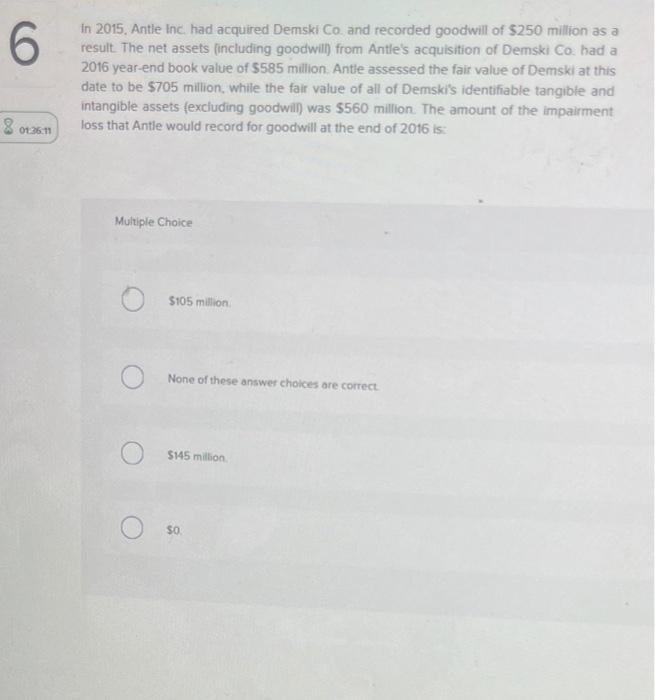

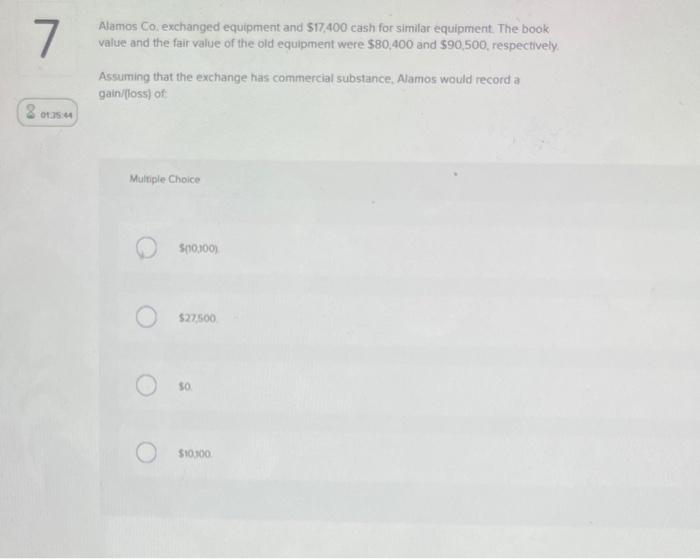

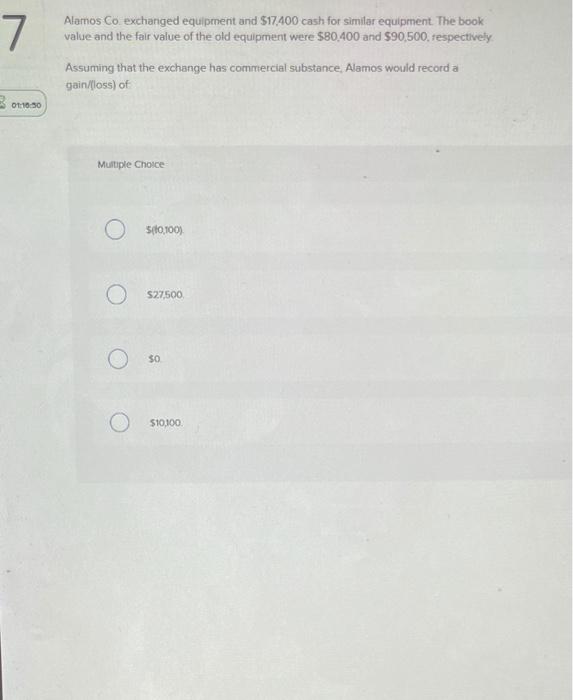

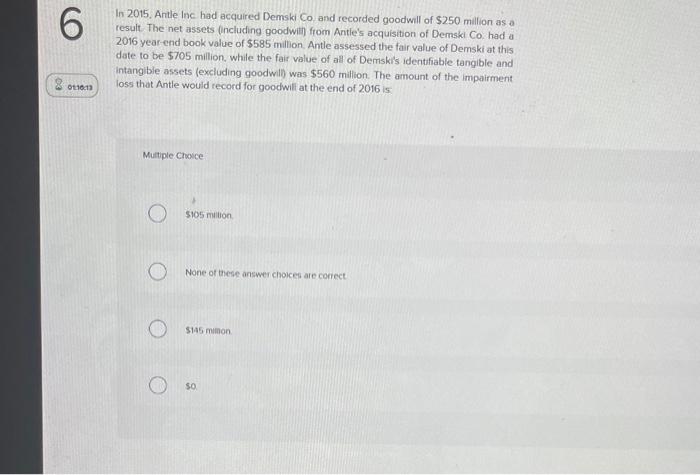

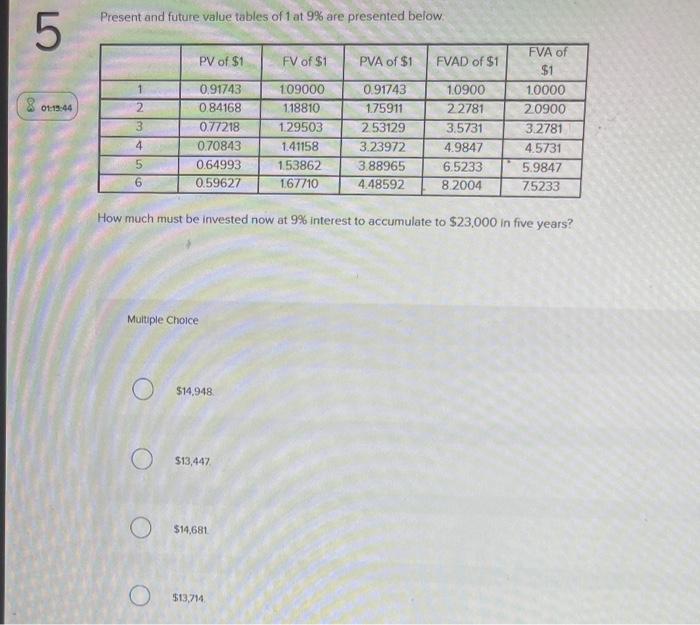

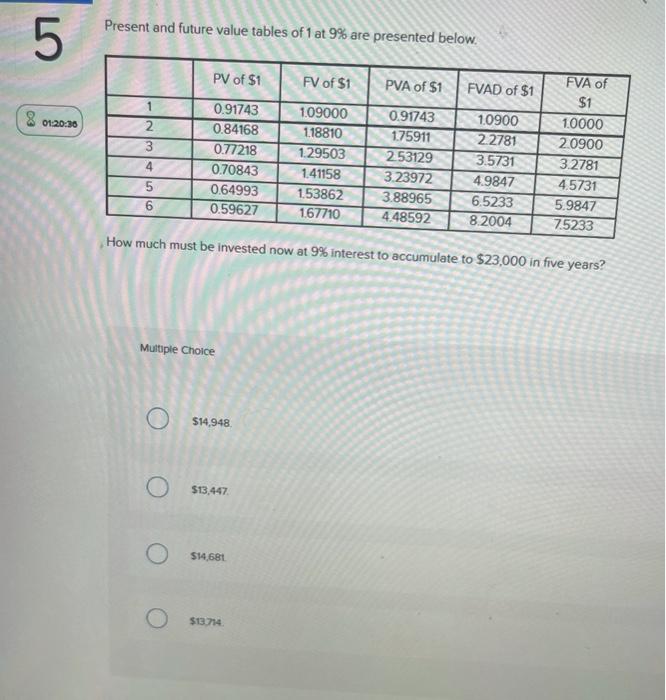

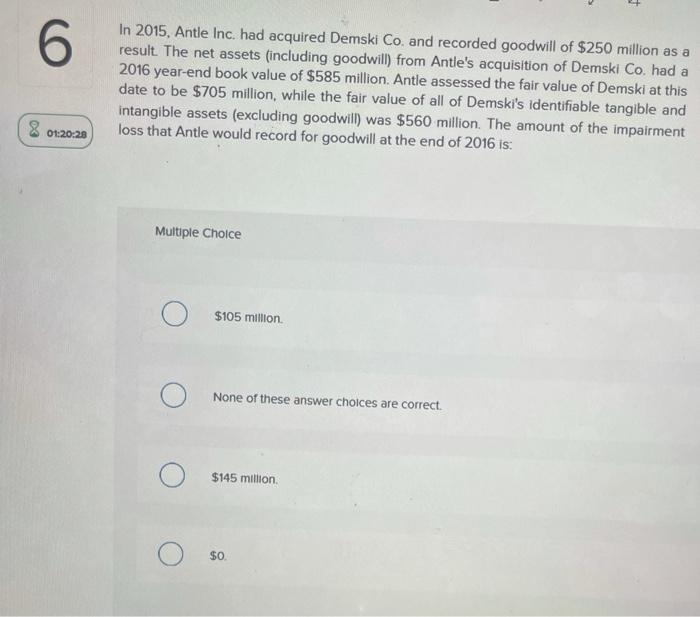

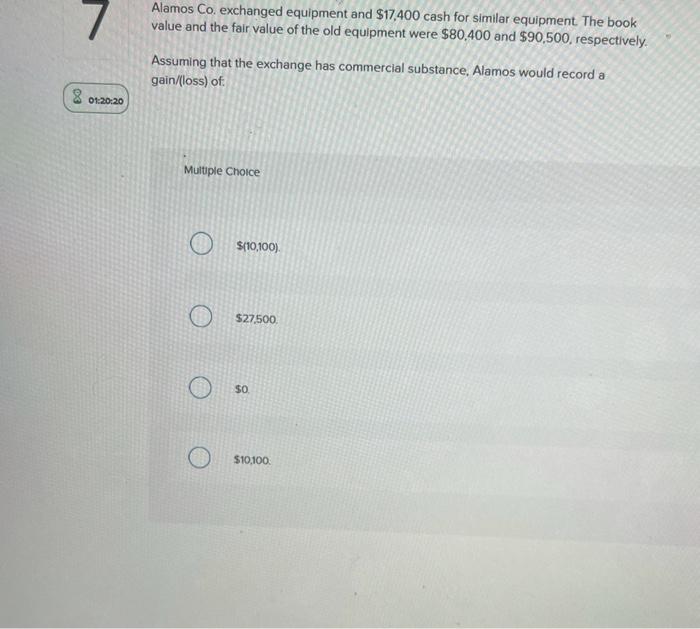

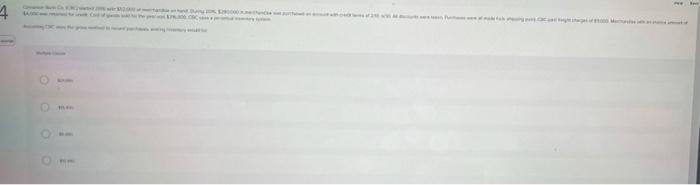

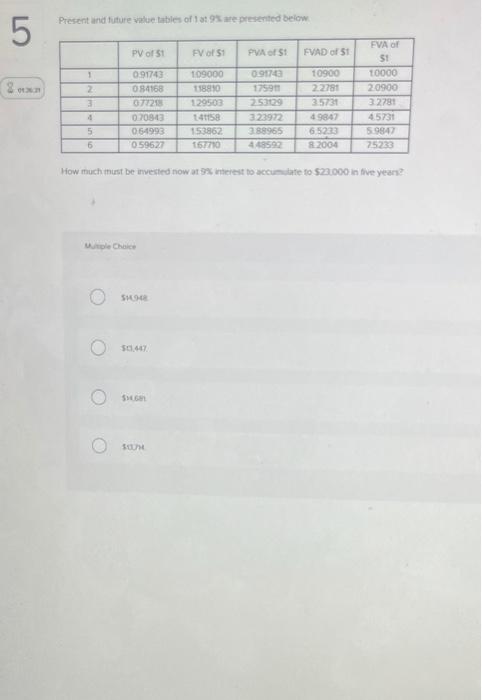

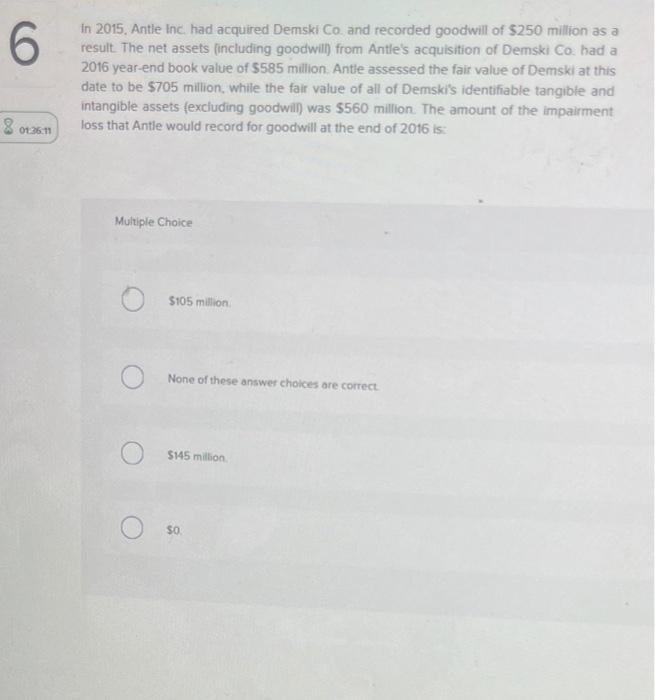

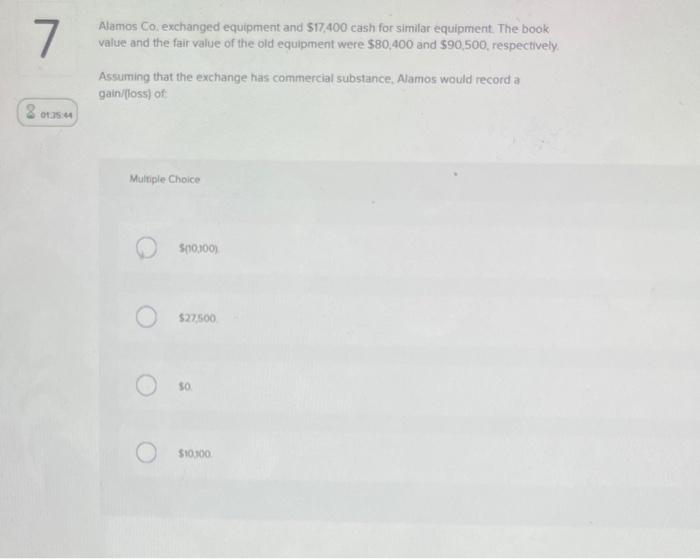

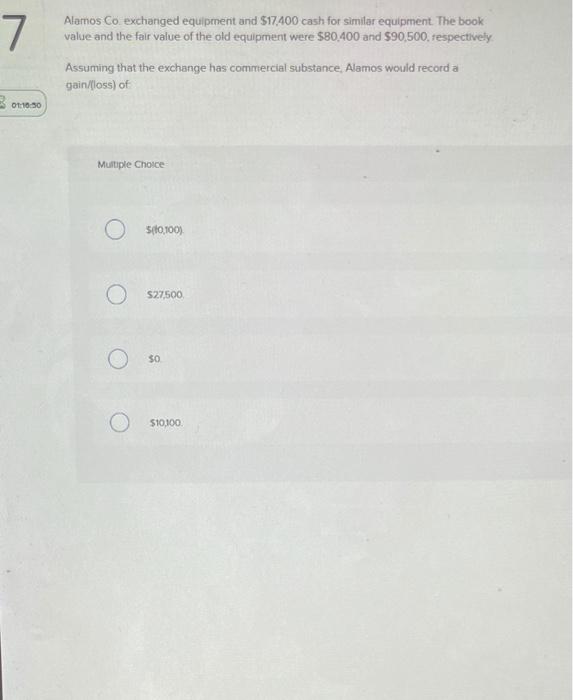

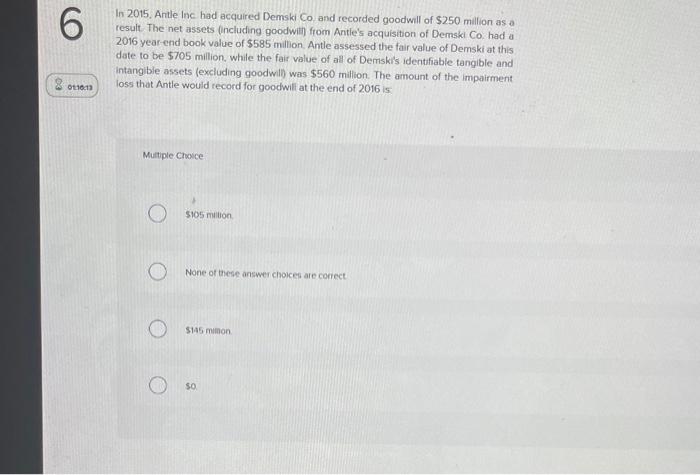

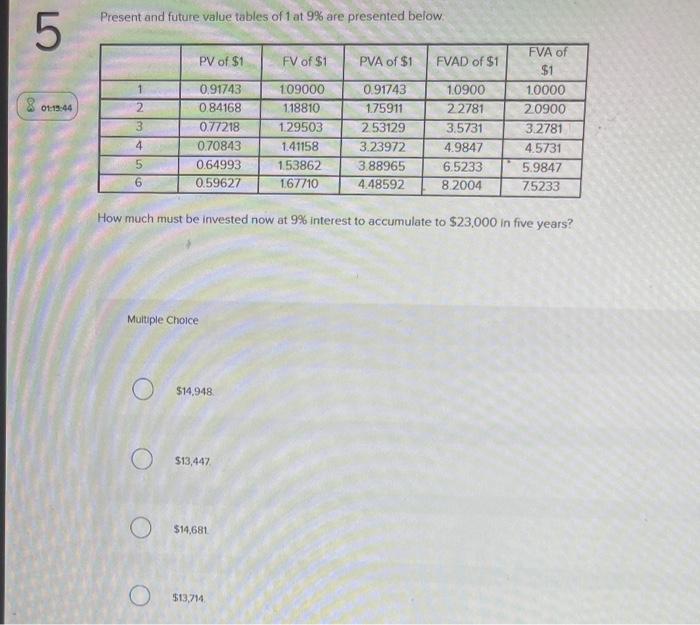

4 Present and future value tables of 19 are presented below 5 PV of 51 FV 51 PVA of S: FVAD OF 51 1 2 3 091743 084168 37129 020803 064993 059627 109000 118810 129503 141158 153862 167710 091743 17595 2.53029 322972 288965 448597 10900 22781 3.5731 49847 65223 2004 EVA O 51 10000 20900 3.2781 45731 5.9847 25233 4 5 6 How much must be invested now at 9% interest to accumulate to $22.000 in five year? le Choice SH o 6 In 2015. Antle Inc. had acquired Demski Co and recorded goodwill of $250 million as a result. The net assets (including goodwill) from Antle's acquisition of Demski Co had a 2016 year-end book value of $585 million Antle assessed the fair value of Demski at this date to be $705 million, while the fair value of all of Demski's identifiable tangible and intangible assets (excluding goodwill) was 5560 million. The amount of the impairment loss that Antle would record for goodwill at the end of 2016 is: 0126.11 Multiple Choice $105 million None of these answer choices are correct $145 million SO 7 Alamos co exchanged equipment and $17,400 cash for similar equipment. The book value and the fair value of the old equipment were $80,400 and $90,500, respectively, Assuming that the exchange has commercial substance. Alamos would record a gain (loss) of 01.25.4 Multiple Choice 500,100) $27500 50 $10.00 7 Alamos Co exchanged equipment and $17.400 cash for similar equipment. The book value and the fair value of the old equipment were $80.400 and $90,500, respectively Assuming that the exchange has commercial substance Alamos would record a gain/loss) of 01:10-30 Multiple Choice 510,100) S27,500 50 $10,100 6 In 2015. Antle Inc had acquired Demski Co and recorded goodwill of $250 million as a result. The net assets including goodwith from Antle's acquisition of Demski Co. had a 2016 year-end book value of $585 million Antle assessed the fair value of Demski at this date to be 5705 million, while the fair value of all of Demski's identifiable tangible and Intangible assets (excluding goodwill) was $560 million. The amount of the impairment loss that Antle would record for goodwill at the end of 2016 is 01.10.13 Multiple Choice $105 million None of these answer choices are correct $145 million SO Present and future value tables of 1 at 9% are presented below. 5 PV of $1 FV of $1 PVA of $1 FVAD of $1 109000 1 2 01:13.44 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 3 0.91743 175911 253129 3.23972 3.88965 4.48592 118810 129503 1.41158 1.53862 167710 FVA of $1 1.0000 20900 3.2781 4.5731 5.9847 75233 1.0900 22781 3.5731 4.9847 6.5233 8. 2004 4 5 6 How much must be invested now at 9% interest to accumulate to $23,000 in five years? Multiple Choice $14,948 0 $13,447 $14,681 O $13,714 Present and future value tables of 1 at 9% are presented below. 5 PV of $1 FV of $1 PVA of $1 FVAD of $1 03 01:20:36 2 3 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 1.09000 1.18810 1.29503 1.41158 1.53862 1.67710 4 0.91743 175911 253129 3.23972 3.88965 4.48592 FVA of $1 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 1.0900 22781 3.5731 4.9847 6.5233 8.2004 5 6 How much must be invested now at 9% interest to accumulate to $23,000 in five years? Multiple Choice $14,948 O $13,447 O $14,681 O $13.714 6 In 2015, Antle Inc. had acquired Demski Co. and recorded goodwill of $250 million as a result. The net assets (including goodwill) from Antle's acquisition of Demski Co. had a 2016 year-end book value of $585 million. Antle assessed the fair value of Demski at this date to be $705 million, while the fair value of all of Demski's identifiable tangible and intangible assets (excluding goodwill) was $560 million. The amount of the impairment loss that Antle would record for goodwill at the end of 2016 is. 2 01:20:28 Multiple Choice $105 million None of these answer choices are correct. $145 million $0 7 Alamos Co. exchanged equipment and $17,400 cash for similar equipment. The book value and the fair value of the old equipment were $80,400 and $90,500, respectively. Assuming that the exchange has commercial substance, Alamos would record a gain/loss) of: 8 01:20:20 01:20:20 Multiple Choice $(10,100). $27500 $0 $10,100 4