Question

Pleas help me with this, please do in excel. pat inc. purchased the $100.000 face value outstanding bonds of slinger company, its 80%-owned subsidiary, fo

Pleas help me with this, please do in excel.

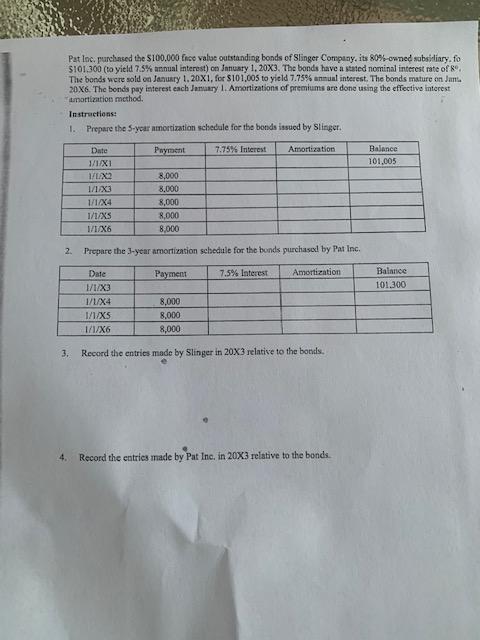

pat inc. purchased the $100.000 face value outstanding bonds of slinger company, its 80%-owned subsidiary, fo $101.300 (to yield 7.5% annual interest) on january 1, 20x3. the bonds have a stated nominal interest rate of 8. the bonds were sold on january 1, 20x1, for $101,005 to yield 7.75% annual interest. the bonds mature on janu 20x6. the bonds pay interest each january 1. amortizations of premiums are done using the effective interest "amortization method. instructions: 1. prepare the 5-year amortization schedule for the bonds issued by slinger.

Pat loc, purchened the $100.000 fiso value outstanding bonds of Slinger Conpany, its 80%-omned sabsiliary, fo $101,300 (to yitld 7.5\% annual interest) on Jantusyy 1, 20X3, The bonds have a sated nominal interest rate of 8%, The bonds were sold on Jevury 1, 20X1, for $101,005 to yield 7.75% annual interest. The bonds mature on Jams. 20.X6. The bonds pay iaterest each January 1. Amonizations of premiums are done using the effective literest tmattiation method. Instractions: 1. Prepare the S-year amerimation schedule foe the bonds issued by slinger. 2. Prepare the 3-year amortization sebedule for the bunds purchased by Pat Inc. 3. Record the entries made by Slinger in 203 relative to the bonds. 4. Record the entries made by Pat Ine, in 20X3 relative to the bonds. Pat loc, purchened the $100.000 fiso value outstanding bonds of Slinger Conpany, its 80%-omned sabsiliary, fo $101,300 (to yitld 7.5\% annual interest) on Jantusyy 1, 20X3, The bonds have a sated nominal interest rate of 8%, The bonds were sold on Jevury 1, 20X1, for $101,005 to yield 7.75% annual interest. The bonds mature on Jams. 20.X6. The bonds pay iaterest each January 1. Amonizations of premiums are done using the effective literest tmattiation method. Instractions: 1. Prepare the S-year amerimation schedule foe the bonds issued by slinger. 2. Prepare the 3-year amortization sebedule for the bunds purchased by Pat Inc. 3. Record the entries made by Slinger in 203 relative to the bonds. 4. Record the entries made by Pat Ine, in 20X3 relative to the bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started