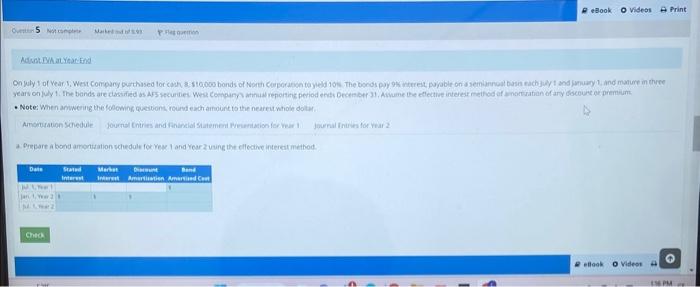

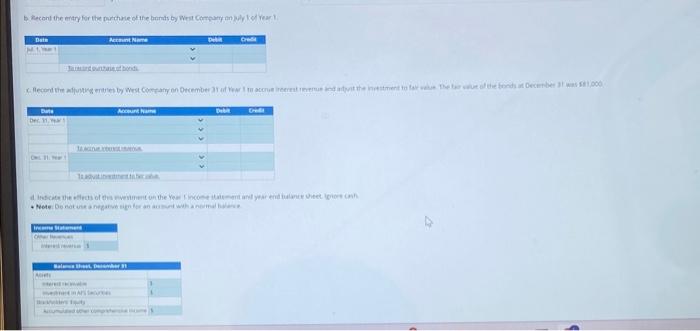

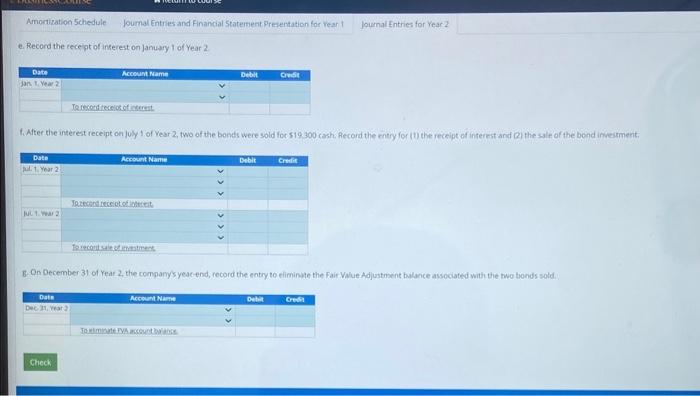

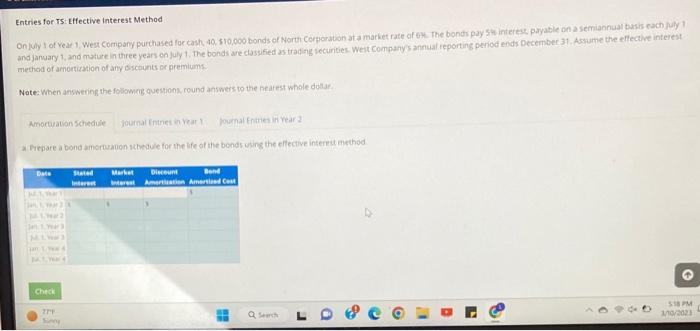

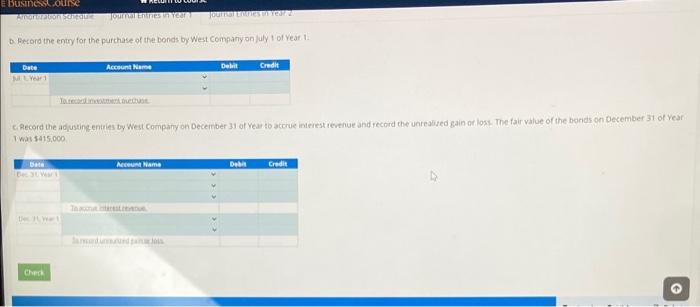

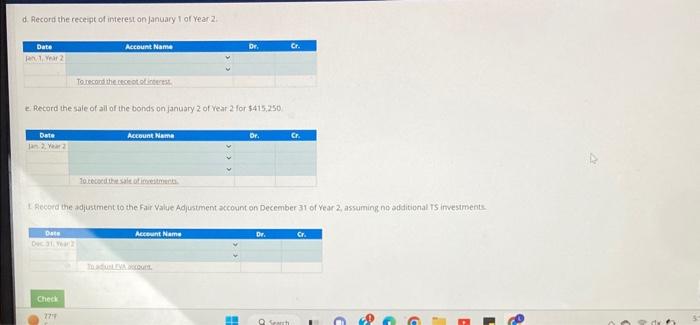

4. Prgeare a bond arsontzation whedule for ve 1 and year 2 vuire the ellective intereit method: e. Record the ieceipt of inkerest on January 1 of Year 2 t. Attee the ingerest receipt onj juyy f of Vear 2, two of the bonds were sold foc s19 300 cash. Record the entry for (1) the recelpt of interent and 2 i the sale E. On Decenber 31 of Yeat 2 , the companys yeacend, record the entry to eliminhe the Fair Vilue Adjustment bulance associated with the two bonds sold. Entries for Ts: Effective interest Method and jarwary 1 , and muture in three years on july 1 . The bonds are classied as tradig iecurities. Weit companys annual teporting period ends December 31 . Asume the effective interest method of amontization of any sscounts or premiums. Note: Woen ansering the followerg questionk, round answers to the nearest whole dodalaf a Fiepare a bond amertuauon schedule for the ife of the bonds uting the effecive internu method b. feesond the entry for the purchase of the bonds by West compary on fuly t of vear 1 . C. Record the adusingeniries by West Company on Deceinber 31 of Yeat to accrue inteiestrevenue and record the unrealised gain or loss. The fair value of the bonds on December 31 of Vear 1.wars4is,000 d. Aecord the receipt of interest on january 1 of Year 2 . e. Pecord the saie of ail of the bonds on january 2 of vear 2 for $415.250 I Record the adjustment to the fair value Adjustment account on December 31 of Year 2 assuming no additional Is imesuments 4. Prgeare a bond arsontzation whedule for ve 1 and year 2 vuire the ellective intereit method: e. Record the ieceipt of inkerest on January 1 of Year 2 t. Attee the ingerest receipt onj juyy f of Vear 2, two of the bonds were sold foc s19 300 cash. Record the entry for (1) the recelpt of interent and 2 i the sale E. On Decenber 31 of Yeat 2 , the companys yeacend, record the entry to eliminhe the Fair Vilue Adjustment bulance associated with the two bonds sold. Entries for Ts: Effective interest Method and jarwary 1 , and muture in three years on july 1 . The bonds are classied as tradig iecurities. Weit companys annual teporting period ends December 31 . Asume the effective interest method of amontization of any sscounts or premiums. Note: Woen ansering the followerg questionk, round answers to the nearest whole dodalaf a Fiepare a bond amertuauon schedule for the ife of the bonds uting the effecive internu method b. feesond the entry for the purchase of the bonds by West compary on fuly t of vear 1 . C. Record the adusingeniries by West Company on Deceinber 31 of Yeat to accrue inteiestrevenue and record the unrealised gain or loss. The fair value of the bonds on December 31 of Vear 1.wars4is,000 d. Aecord the receipt of interest on january 1 of Year 2 . e. Pecord the saie of ail of the bonds on january 2 of vear 2 for $415.250 I Record the adjustment to the fair value Adjustment account on December 31 of Year 2 assuming no additional Is imesuments