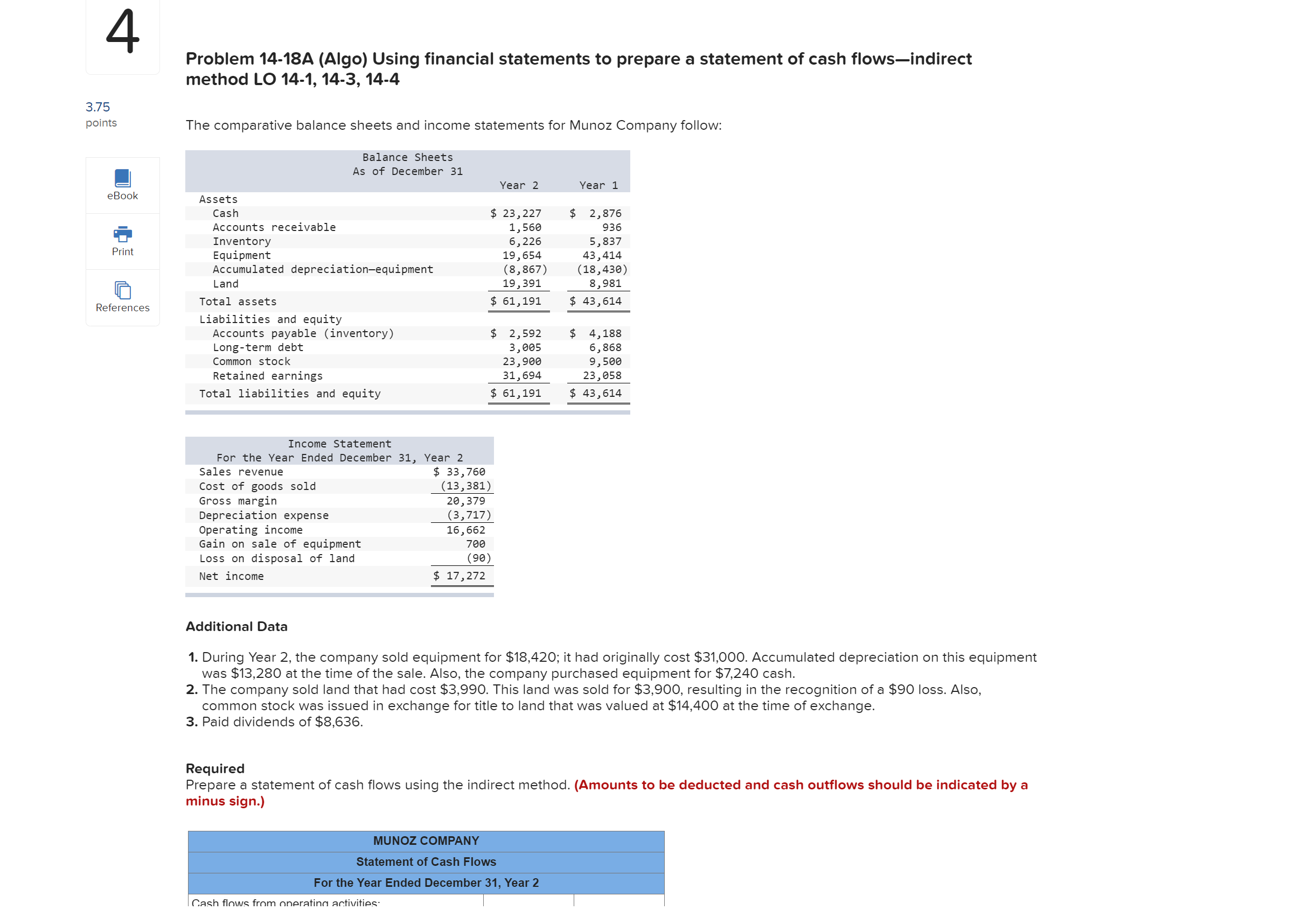

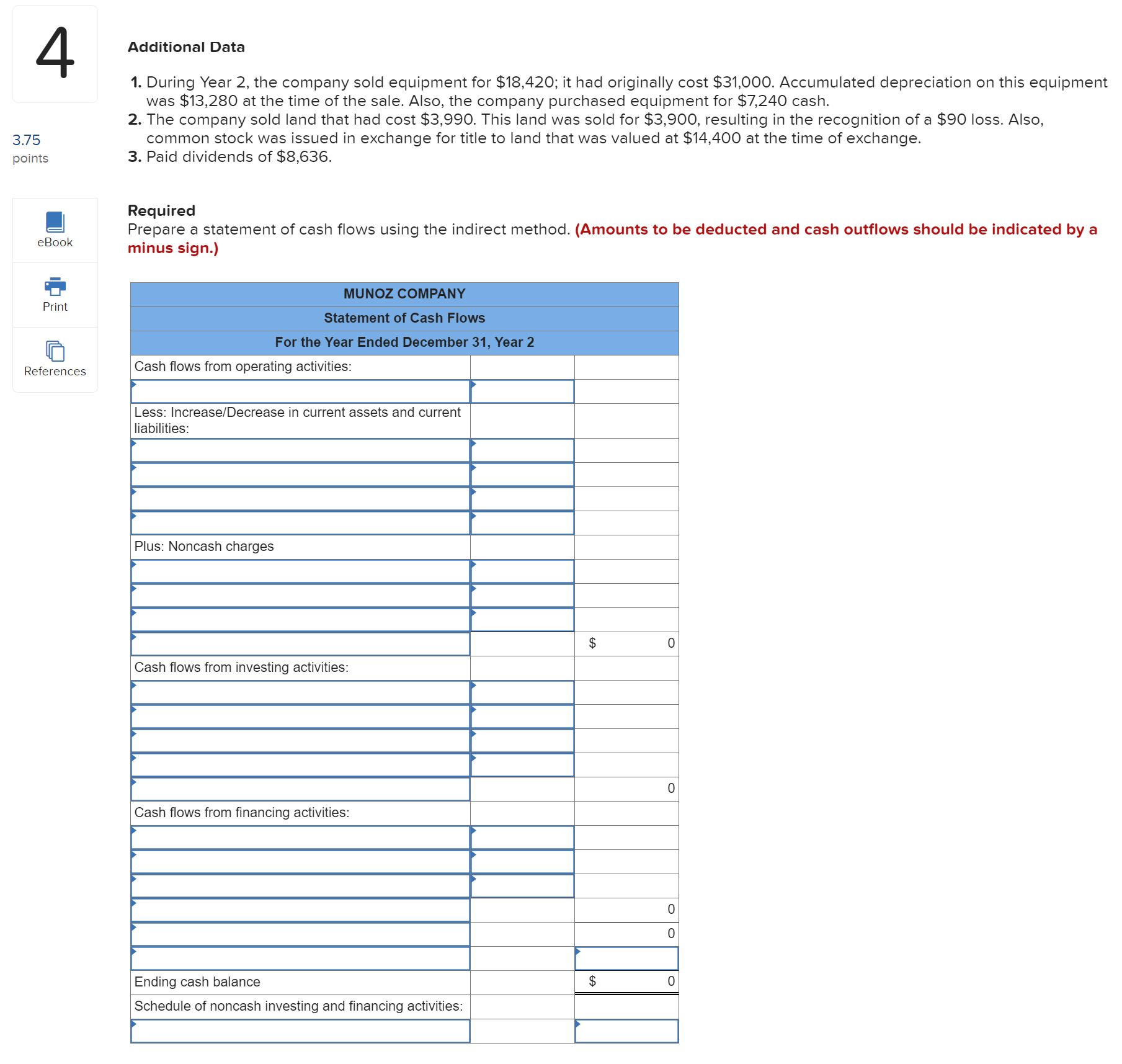

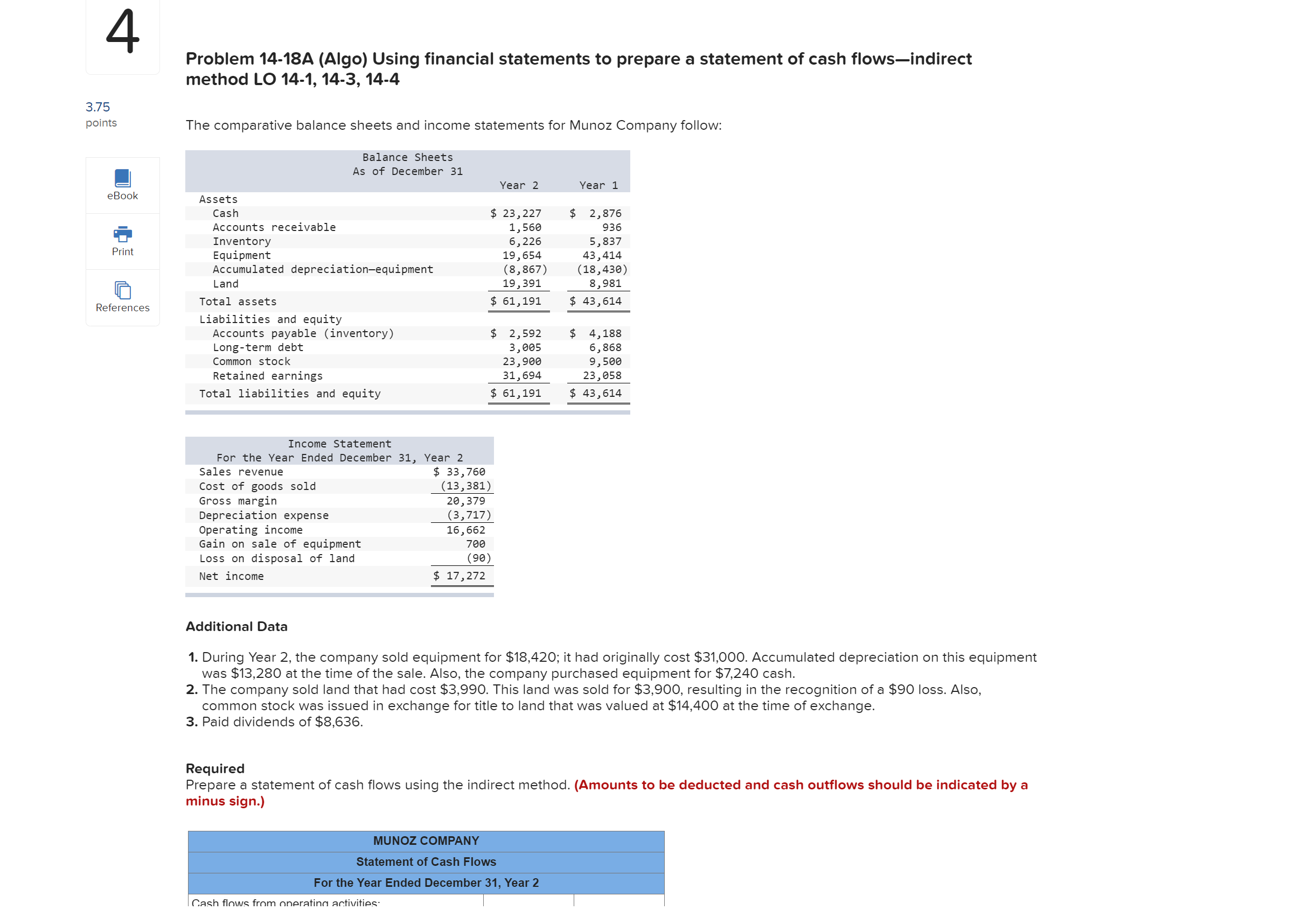

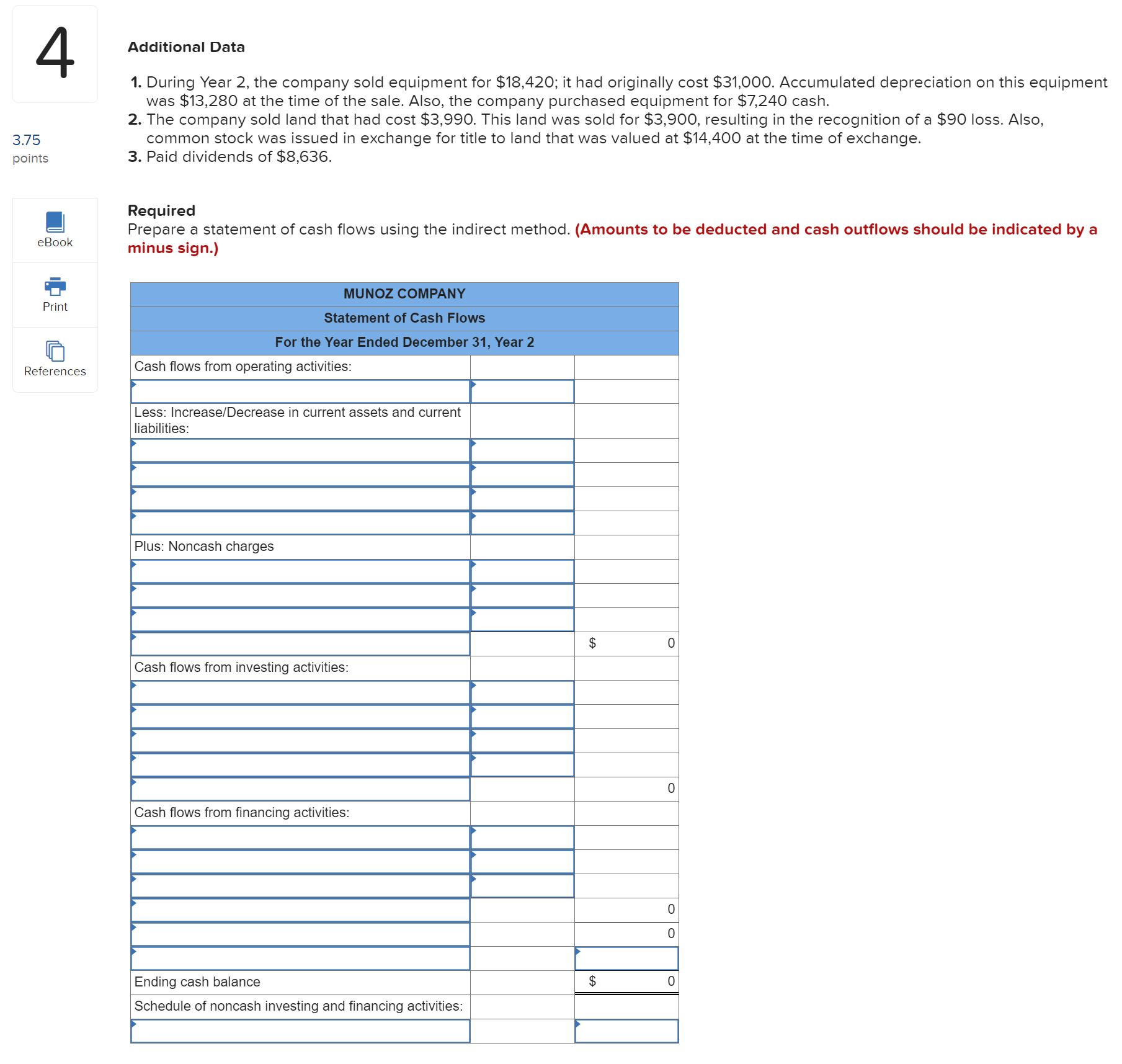

4 Problem 14-18A (Algo) Using financial statements to prepare a statement of cash flows-indirect method LO 14-1, 14-3, 14-4 3.75 points The comparative balance sheets and income statements for Munoz Company follow: Balance Sheets As of December 31 Year 2 Year 1 eBook Print Assets Cash Accounts receivable Inventory Equipment Accumulated depreciation-equipment Land Total assets Liabilities and equity Accounts payable (inventory) Long-term debt Common stock Retained earnings Total liabilities and equity $ 23,227 1,560 6,226 19,654 (8,867) 19,391 $ 61, 191 $ 2,876 936 5,837 43,414 (18,430) 8,981 $ 43,614 References $ 2,592 3,005 23,900 31,694 $ 61,191 $ 4,188 6,868 9,500 23,058 $ 43,614 Income Statement For the Year Ended December 31, Year 2 Sales revenue $ 33,760 Cost of goods sold (13,381) Gross margin 20,379 Depreciation expense (3,717) Operating income 16,662 Gain on sale of equipment 700 Loss on disposal of land (90) Net income $ 17,272 Additional Data 1. During Year 2, the company sold equipment for $18,420; it had originally cost $31,000. Accumulated depreciation on this equipment was $13,280 at the time of the sale. Also, the company purchased equipment for $7,240 cash. 2. The company sold land that had cost $3,990. This land was sold for $3,900, resulting in the recognition of a $90 loss. Also, common stock was issued in exchange for title to land that was valued at $14,400 at the time of exchange. 3. Paid dividends of $8,636. Required Prepare a statement of cash flows using the indirect method. (Amounts to be deducted and cash outflows should be indicated by a minus sign.) MUNOZ COMPANY Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: 4 Additional Data 1. During Year 2, the company sold equipment for $18,420; it had originally cost $31,000. Accumulated depreciation on this equipment was $13,280 at the time of the sale. Also, the company purchased equipment for $7,240 cash. 2. The company sold land that had cost $3,990. This land was sold for $3,900, resulting in the recognition of a $90 loss. Also, common stock was issued in exchange for title to land that was valued at $14,400 at the time of exchange. 3. Paid dividends of $8,636. 3.75 points Required Prepare a statement of cash flows using the indirect method. (Amounts to be deducted and cash outflows should be indicated by a minus sign.) eBook MUNOZ COMPANY Print Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: References Less: Increase/Decrease in current assets and current liabilities: Plus: Noncash charges $ 0 Cash flows from investing activities: 0 Cash flows from financing activities: 0 0 Ending cash balance TELE $ Schedule of noncash investing and financing activities