Answered step by step

Verified Expert Solution

Question

1 Approved Answer

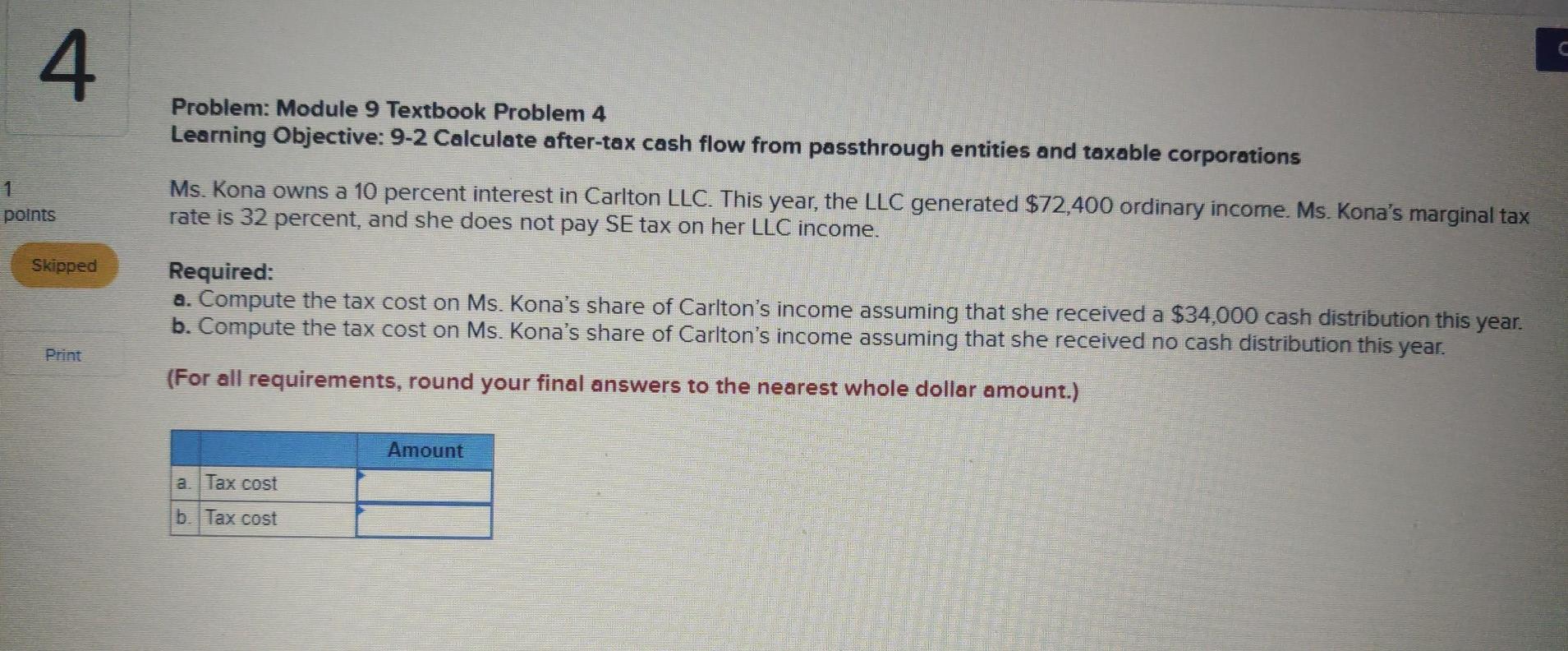

4 Problem: Module 9 Textbook Problem 4 Learning Objective: 9-2 Calculate after-tax cash flow from passthrough entities and taxable corporations 1 points Ms. Kona owns

4 Problem: Module 9 Textbook Problem 4 Learning Objective: 9-2 Calculate after-tax cash flow from passthrough entities and taxable corporations 1 points Ms. Kona owns a 10 percent interest in Carlton LLC. This year, the LLC generated $72,400 ordinary income. Ms. Kona's marginal tax rate is 32 percent, and she does not pay SE tax on her LLC income. Skipped Required: a. Compute the tax cost on Ms. Kona's share of Carlton's income assuming that she received a $34,000 cash distribution this year. b. Compute the tax cost on Ms. Kona's share of Carlton's income assuming that she received no cash distribution this year. Print (For all requirements, round your final answers to the nearest whole dollar amount.) Amount a. Tax cost b. Tax cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started