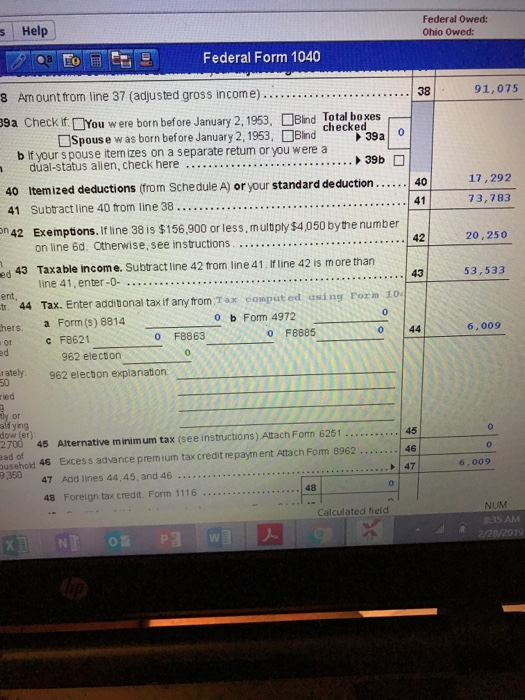

4 Quality of evidence: Show your work in an Excel attachment for the following line item: Form 1040 Line 44. (When calculating the tax amount, make sure you consider the preferential tax rates for long-term capital gains and qualified dividends. If your tax amount calculated in your Excel worksheet is slightly different from the tax amount calculated by the software, just make a note of it on the spreadsheet. It may be a rounding difference, but you should not be off by too much.) Federal Owed: Ohio Owed: s Help Federal Form 1040 8 Amount from line 37 (adjusted gross income) 38 91,075 . 9a Checki DYou w ere born before January 2,1953, Blind Total boxes DSpouse was born bef ore January 2, 1953, Bi o b If your s pouse item izes on a separate retum or you were a dual-status alien, check here 39b 40 itemized deductions (from Schedule A) or your standar deduction... 40 17,292 73,783 41 n 42 Exemptons.If line 38 is $156,900 or less, multbply $4,050 bythe number 20,250 Taxable income. Subtract line 42 trom line 41 If line 42 is more than line 41,enter-0- ed 43 .. 43 53,533 tr. 44 Tax. Enter addibonal tax if any trom Tax eomput ed using Form 10 thers a Form (s) 8814 0 0 b Fom 4972 c F8621 0 F8863 o F8885 0 44 6,009 or ed rately. 962 electon explanation ried 962 electon alf yng dow (er) 2700 45 Alternative minimum tax (see instructions) Attach Forn 6251 ead of ousehoid 46 Excess advance premium tax credit re paym ent Attach Fom 8962. 9 350 45 46 0 6,009 Add lines 44,45, and 46 47 48 Foreign tax credit. Form 1116 0 48 NUM Calculated field 835 AM 4 Quality of evidence: Show your work in an Excel attachment for the following line item: Form 1040 Line 44. (When calculating the tax amount, make sure you consider the preferential tax rates for long-term capital gains and qualified dividends. If your tax amount calculated in your Excel worksheet is slightly different from the tax amount calculated by the software, just make a note of it on the spreadsheet. It may be a rounding difference, but you should not be off by too much.) Federal Owed: Ohio Owed: s Help Federal Form 1040 8 Amount from line 37 (adjusted gross income) 38 91,075 . 9a Checki DYou w ere born before January 2,1953, Blind Total boxes DSpouse was born bef ore January 2, 1953, Bi o b If your s pouse item izes on a separate retum or you were a dual-status alien, check here 39b 40 itemized deductions (from Schedule A) or your standar deduction... 40 17,292 73,783 41 n 42 Exemptons.If line 38 is $156,900 or less, multbply $4,050 bythe number 20,250 Taxable income. Subtract line 42 trom line 41 If line 42 is more than line 41,enter-0- ed 43 .. 43 53,533 tr. 44 Tax. Enter addibonal tax if any trom Tax eomput ed using Form 10 thers a Form (s) 8814 0 0 b Fom 4972 c F8621 0 F8863 o F8885 0 44 6,009 or ed rately. 962 electon explanation ried 962 electon alf yng dow (er) 2700 45 Alternative minimum tax (see instructions) Attach Forn 6251 ead of ousehoid 46 Excess advance premium tax credit re paym ent Attach Fom 8962. 9 350 45 46 0 6,009 Add lines 44,45, and 46 47 48 Foreign tax credit. Form 1116 0 48 NUM Calculated field 835 AM