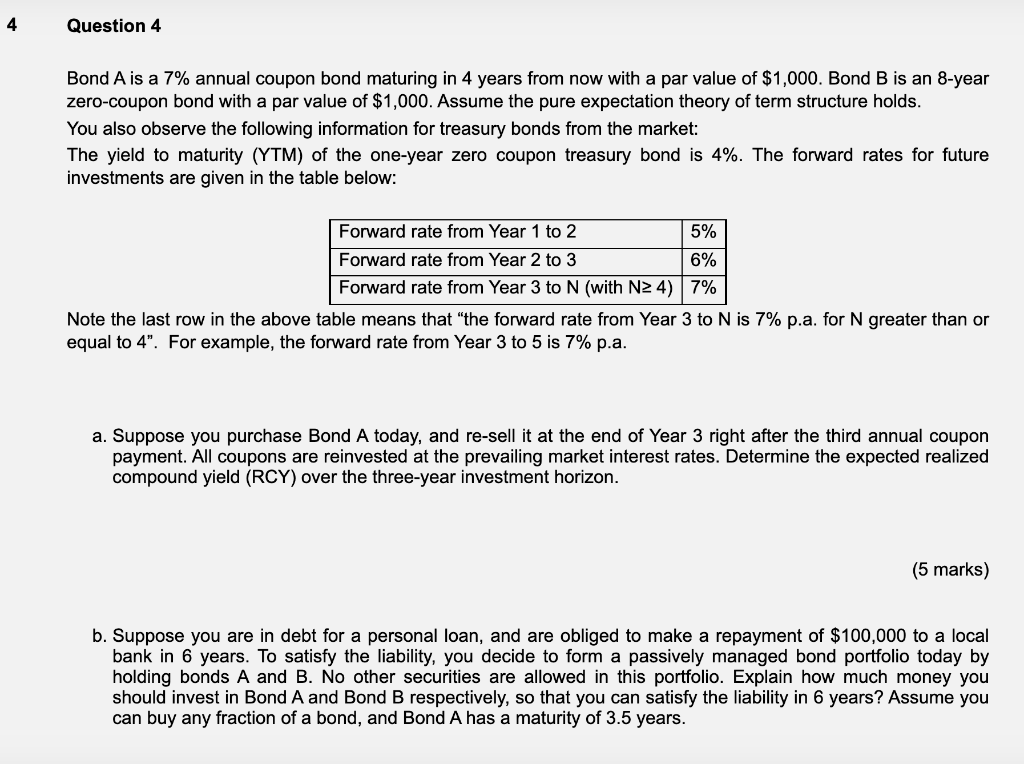

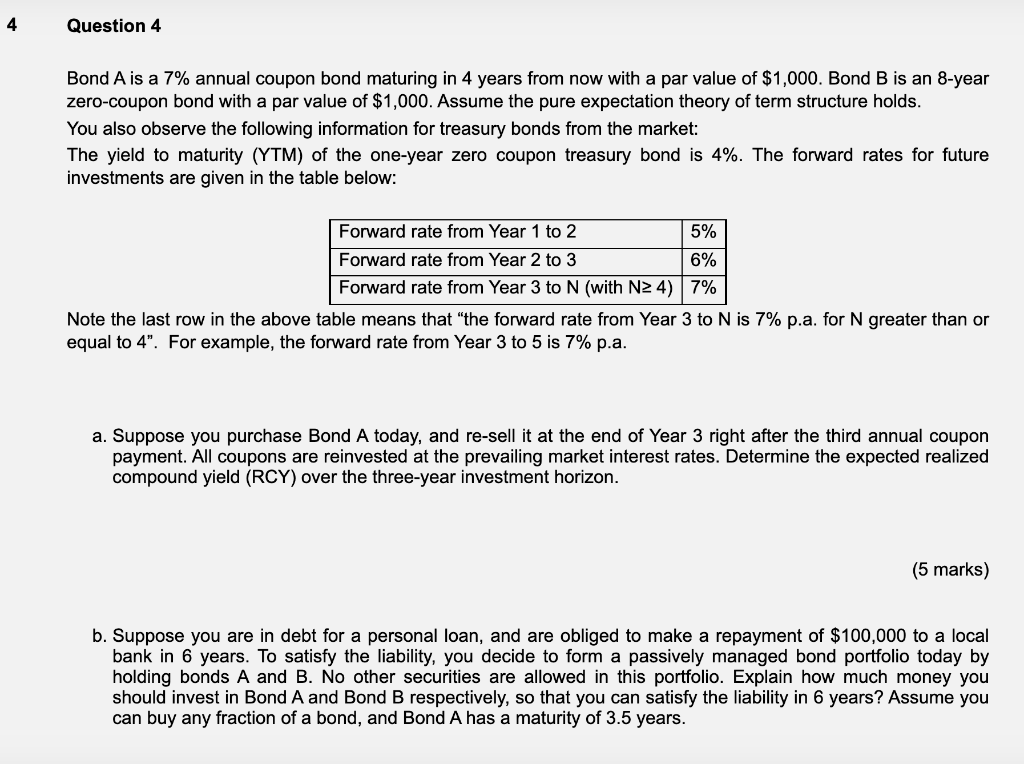

4 Question 4 Bond A is a 7% annual coupon bond maturing in 4 years from now with a par value of $1,000. Bond B is an 8-year zero-coupon bond with a par value of $1,000. Assume the pure expectation theory of term structure holds. You also observe the following information for treasury bonds from the market: The yield to maturity (YTM) of the one-year zero coupon treasury bond is 4%. The forward rates for future investments are given in the table below: Forward rate from Year 1 to 2 5% Forward rate from Year 2 to 3 6% Forward rate from Year 3 to N (with NZ 4) 7% Note the last row in the above table means that "the forward rate from Year 3 to N is 7% p.a. for N greater than or equal to 4". For example, the forward rate from Year 3 to 5 is 7% p.a. a. Suppose you purchase Bond A today, and re-sell it at the end of Year 3 right after the third annual coupon payment. All coupons are reinvested at the prevailing market interest rates. Determine the expected realized compound yield (RCY) over the three-year investment horizon. (5 marks) b. Suppose you are in debt for a personal loan, and are obliged to make a repayment of $100,000 to a local bank in 6 years. To satisfy the liability, you decide to form a passively managed bond portfolio today by holding bonds A and B. No other securities are allowed in this portfolio. Explain how much money you should invest in Bond A and Bond B respectively, so that you can satisfy the liability in 6 years? Assume you can buy any fraction of a bond, and Bond A has a maturity of 3.5 years. 4 Question 4 Bond A is a 7% annual coupon bond maturing in 4 years from now with a par value of $1,000. Bond B is an 8-year zero-coupon bond with a par value of $1,000. Assume the pure expectation theory of term structure holds. You also observe the following information for treasury bonds from the market: The yield to maturity (YTM) of the one-year zero coupon treasury bond is 4%. The forward rates for future investments are given in the table below: Forward rate from Year 1 to 2 5% Forward rate from Year 2 to 3 6% Forward rate from Year 3 to N (with NZ 4) 7% Note the last row in the above table means that "the forward rate from Year 3 to N is 7% p.a. for N greater than or equal to 4". For example, the forward rate from Year 3 to 5 is 7% p.a. a. Suppose you purchase Bond A today, and re-sell it at the end of Year 3 right after the third annual coupon payment. All coupons are reinvested at the prevailing market interest rates. Determine the expected realized compound yield (RCY) over the three-year investment horizon. (5 marks) b. Suppose you are in debt for a personal loan, and are obliged to make a repayment of $100,000 to a local bank in 6 years. To satisfy the liability, you decide to form a passively managed bond portfolio today by holding bonds A and B. No other securities are allowed in this portfolio. Explain how much money you should invest in Bond A and Bond B respectively, so that you can satisfy the liability in 6 years? Assume you can buy any fraction of a bond, and Bond A has a maturity of 3.5 years