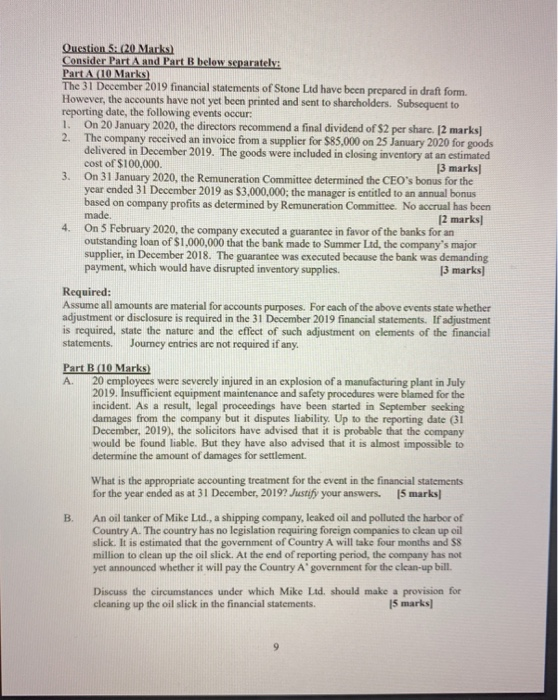

4. Question 5:20 Marks) Consider Part A and Part B below separately: Part A LO Marks The 31 December 2019 financial statements of Stone Ltd have been prepared in draft form. However, the accounts have not yet been printed and sent to sharcholders. Subsequent to reporting date, the following events occur: 1. On 20 January 2020, the directors recommend a final dividend of $2 per share. [2 marks] 2. The company received an invoice from a supplier for $85,000 on 25 January 2020 for goods delivered in December 2019. The goods were included in closing inventory at an estimated cost of $100,000 [3 marks] 3. On 31 January 2020, the Remuneration Committee determined the CEO's bonus for the year ended 31 December 2019 as $3,000,000, the manager is entitled to an annual bonus based on company profits as determined by Remuneration Committee. No accrual has been made. [2 marks] On 5 February 2020, the company executed a guarantee in favor of the banks for an outstanding loan of $1,000,000 that the bank made to Summer Ltd, the company's major supplier, in December 2018. The guarantee was executed because the bank was demanding payment, which would have disrupted inventory supplies. [3 marks Required: Assume all amounts are material for accounts purposes. For each of the above events state whether adjustment or disclosure is required in the 31 December 2019 financial statements. If adjustment is required, state the nature and the effect of such adjustment on elements of the financial statements Journey entries are not required if any. Part B. (10 Marks) A 20 employees were severely injured in an explosion of a manufacturing plant in July 2019. Insufficient equipment maintenance and safety procedures were blamed for the incident. As a result, legal proceedings have been started in September seeking damages from the company but it disputes liability. Up to the reporting date (31 December, 2019), the solicitors have advised that it is probable that the company would be found liable. But they have also advised that it is almost impossible to determine the amount of damages for settlement. What is the appropriate accounting treatment for the event in the financial statements for the year ended as at 31 December, 20192 Justify your answers. 15 marks] An oil tanker of Mike Ltd., a shipping company, leaked oil and polluted the harbor of Country A. The country has no legislation requiring foreign companies to clean up oil slick. It is estimated that the government of Country A will take four months and $8 million to clean up the oil slick. At the end of reporting period, the company has not yet announced whether it will pay the Country A government for the clean-up bill. Discuss the circumstances under which Mike Ltd, should make a provision for cleaning up the oil slick in the financial statements. 15 marks)