Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Question 9 Which of the following methods of evaluating capital budgeting proposals rests on the assumption that income is uniform over the life of

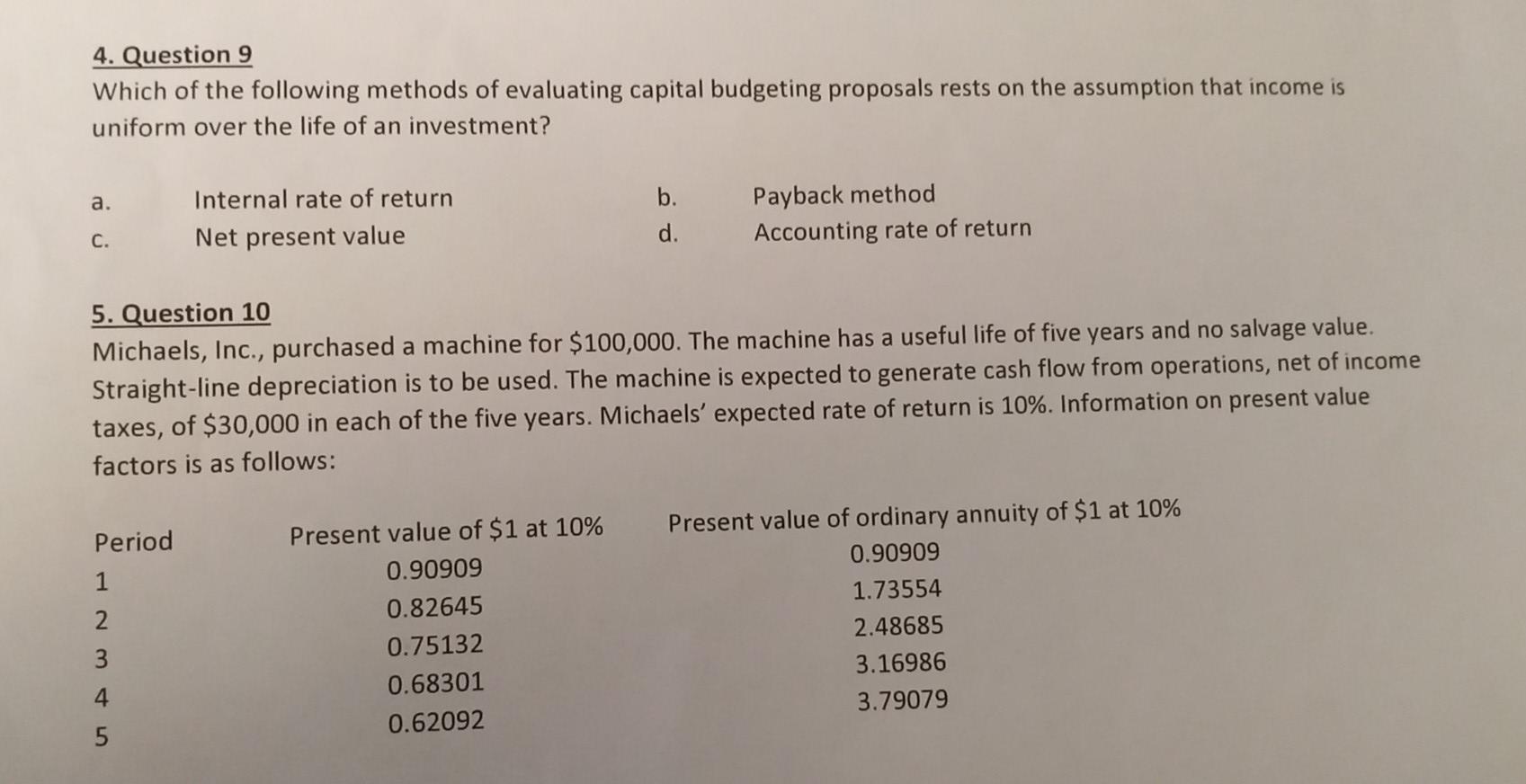

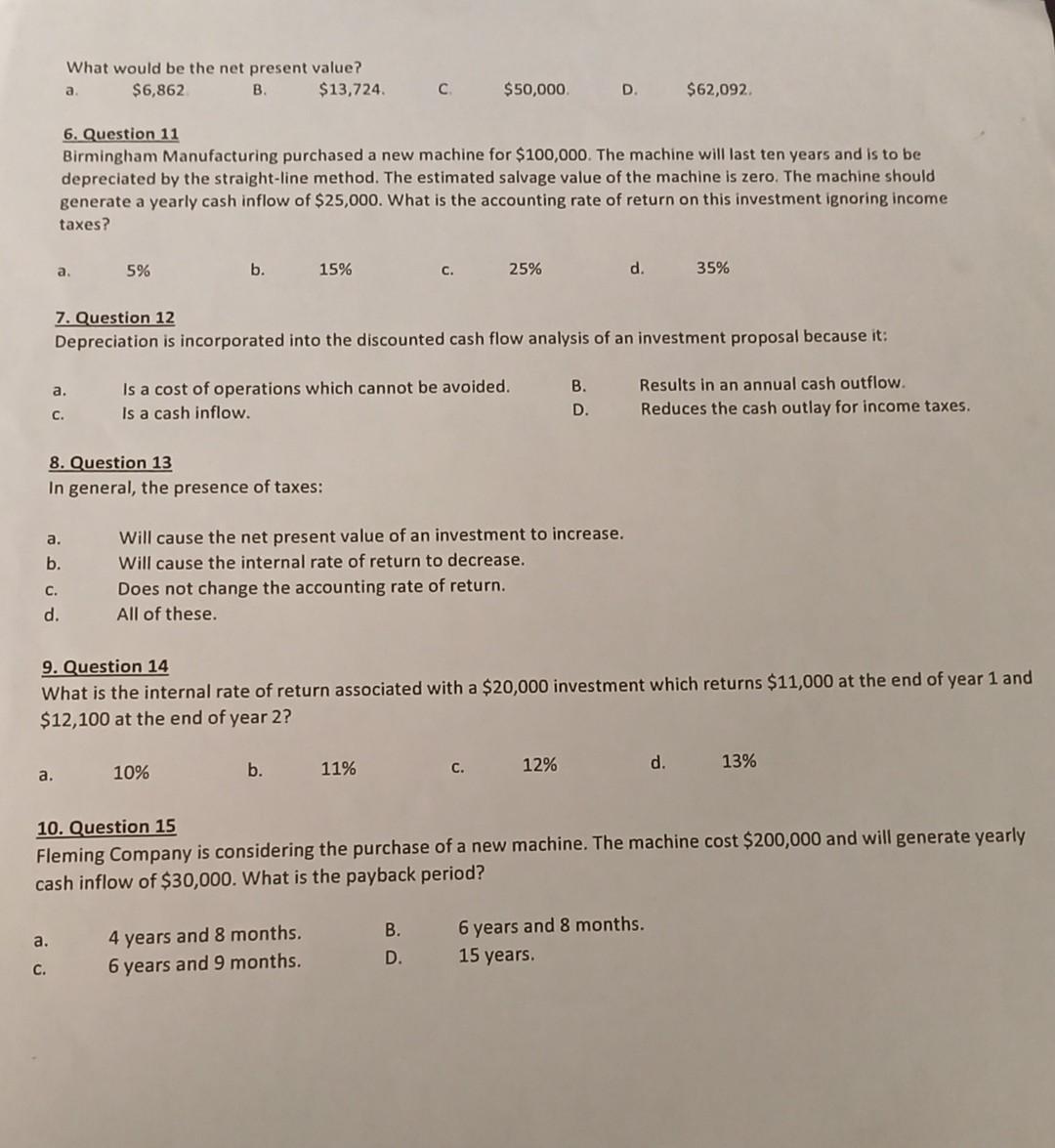

4. Question 9 Which of the following methods of evaluating capital budgeting proposals rests on the assumption that income is uniform over the life of an investment? a. Internal rate of return Net present value b. d. Payback method Accounting rate of return C. 5. Question 10 Michaels, Inc., purchased a machine for $100,000. The machine has a useful life of five years and no salvage value. Straight-line depreciation is to be used. The machine is expected to generate cash flow from operations, net of income taxes, of $30,000 in each of the five years. Michaels' expected rate of return is 10%. Information on present value factors is as follows: Period 1 2 Present value of $1 at 10% 0.90909 0.82645 0.75132 0.68301 0.62092 Present value of ordinary annuity of $1 at 10% 0.90909 1.73554 2.48685 3.16986 3.79079 What would be the net present value? a $6,862 B. $13,724. . $50,000 D $62,092 6. Question 11 Birmingham Manufacturing purchased a new machine for $100,000. The machine will last ten years and is to be depreciated by the straight-line method. The estimated salvage value of the machine is zero. The machine should generate a yearly cash inflow of $25,000. What is the accounting rate of return on this investment ignoring income taxes? a. 5% b. 15% C. 25% d. 35% 7. Question 12 Depreciation is incorporated into the discounted cash flow analysis of an investment proposal because it: a. B Is a cost of operations which cannot be avoided. is a cash inflow. Results in an annual cash outflow. Reduces the cash outlay for income taxes. D C. 8. Question 13 In general, the presence of taxes: a. b. Will cause the net present value of an investment to increase. Will cause the internal rate of return to decrease. Does not change the accounting rate of return. All of these. C. d. 9. Question 14 What is the internal rate of return associated with a $20,000 investment which returns $11,000 at the end of year 1 and $12,100 at the end of year 2? b. 11% 10% C. 12% d. 13% a. 10. Question 15 Fleming Company is considering the purchase of a new machine. The machine cost $200,000 and will generate yearly cash inflow of $30,000. What is the payback period? B. a. 4 years and 8 months. 6 years and 9 months. 6 years and 8 months. 15 years. D. c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started