Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 questions 6. Which of the following types of interest is not deductible in 2022? a. Qualified mortgage interest on residence b. Qualified mortgage interest

4 questions

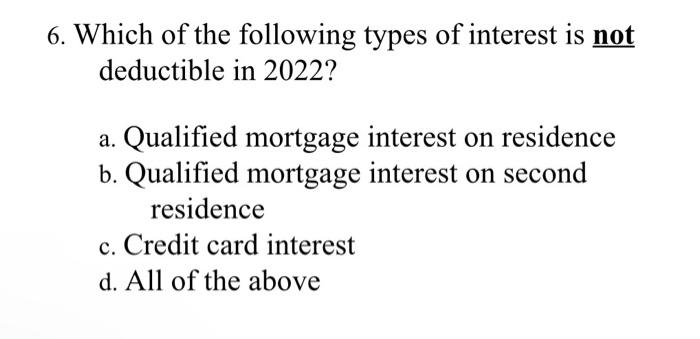

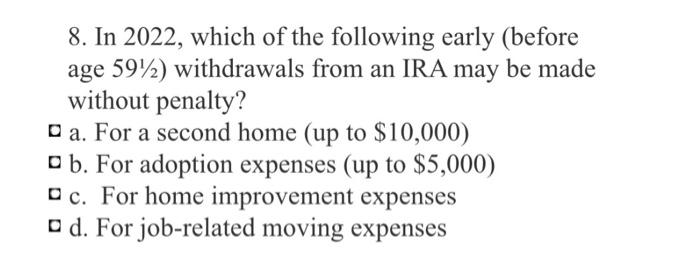

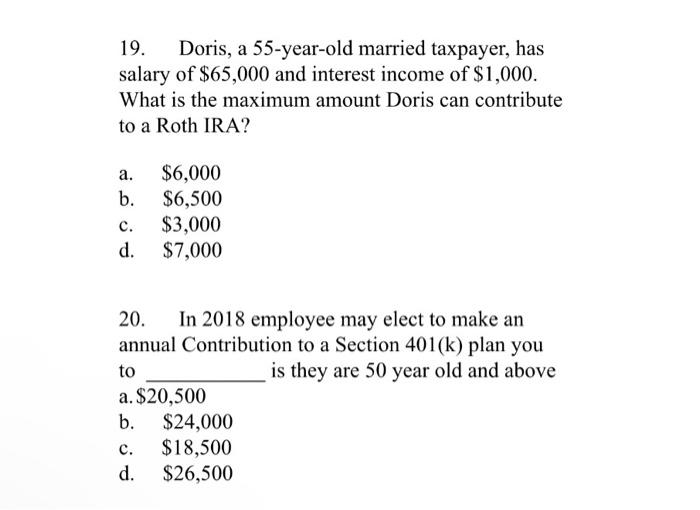

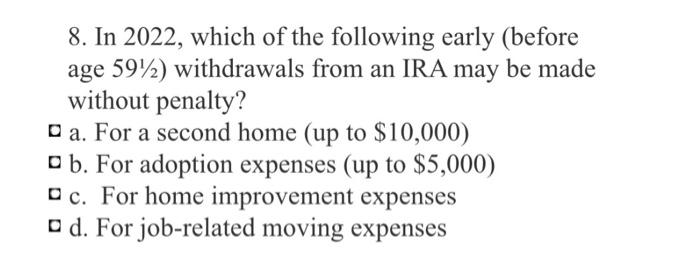

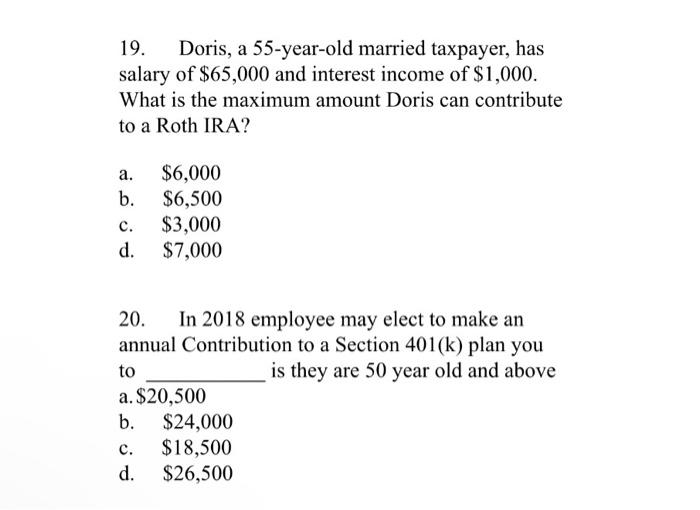

6. Which of the following types of interest is not deductible in 2022? a. Qualified mortgage interest on residence b. Qualified mortgage interest on second residence c. Credit card interest d. All of the above 8. In 2022 , which of the following early (before age 591/2 ) withdrawals from an IRA may be made without penalty? D a. For a second home (up to $10,000 ) b b. For adoption expenses (up to $5,000 ) D c. For home improvement expenses D d. For job-related moving expenses 19. Doris, a 55-year-old married taxpayer, has salary of $65,000 and interest income of $1,000. What is the maximum amount Doris can contribute to a Roth IRA? a. $6,000 b. $6,500 c. $3,000 d. $7,000 20. In 2018 employee may elect to make an annual Contribution to a Section 401(k) plan you to is they are 50 year old and above a. $20,500 b. $24,000 c. $18,500 d. $26,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started