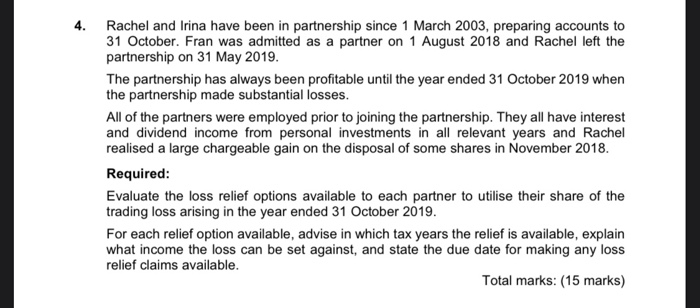

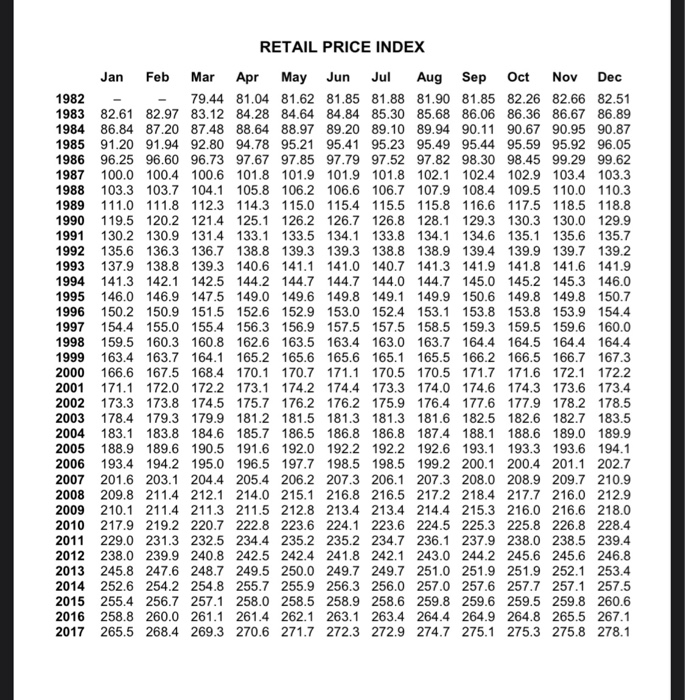

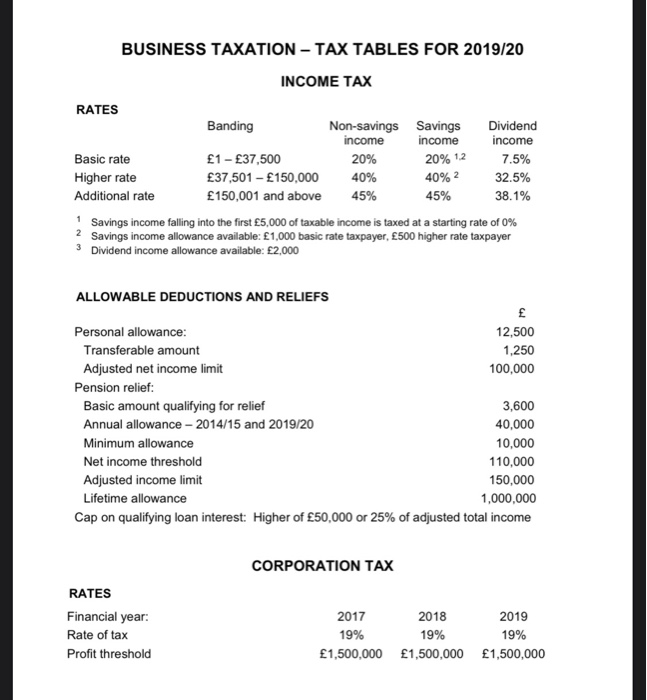

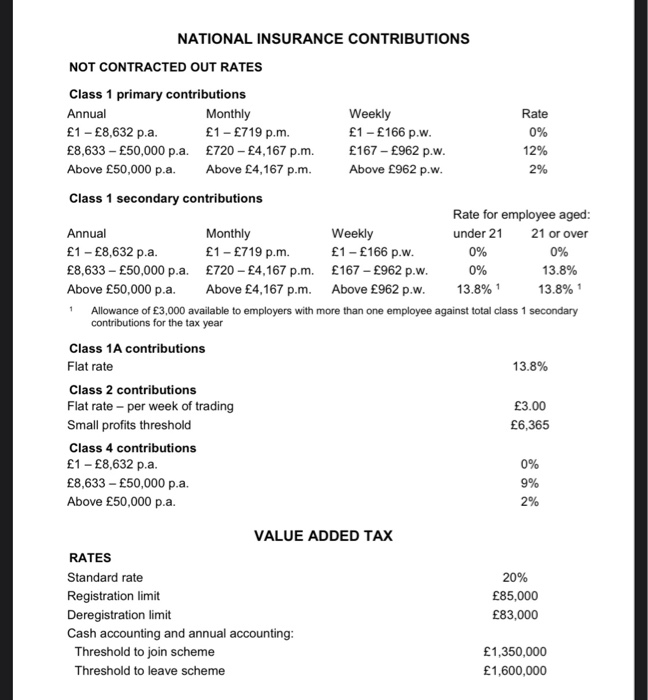

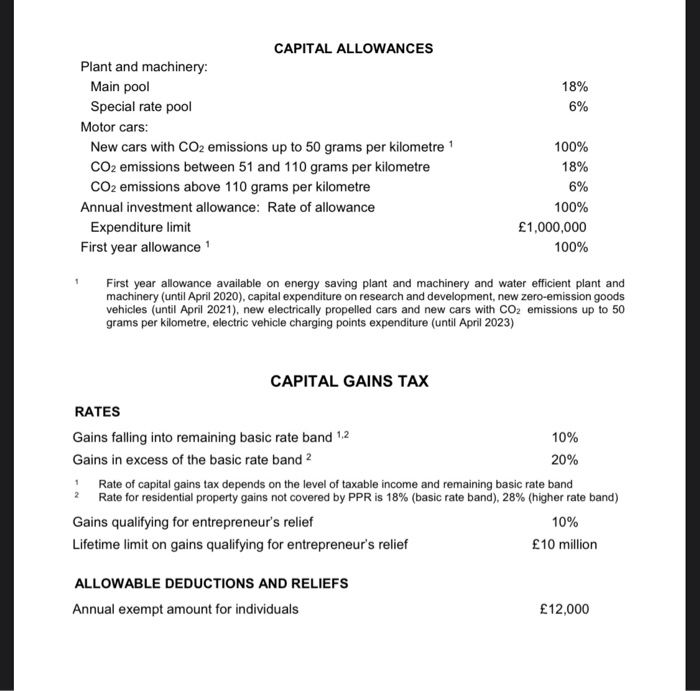

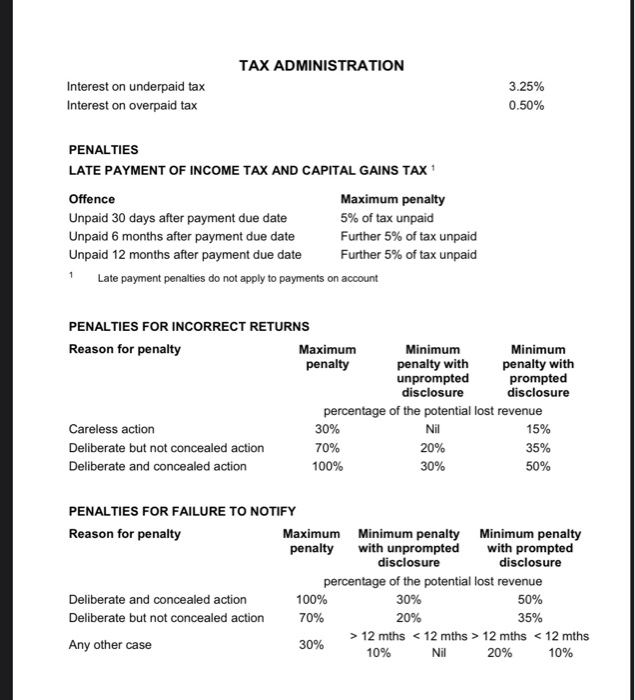

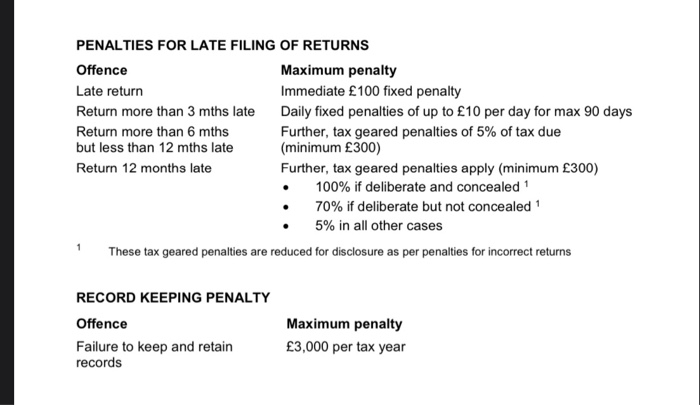

4. Rachel and Irina have been in partnership since 1 March 2003, preparing accounts to 31 October. Fran was admitted as a partner on 1 August 2018 and Rachel left the partnership on 31 May 2019. The partnership has always been profitable until the year ended 31 October 2019 when the partnership made substantial losses. All of the partners were employed prior to joining the partnership. They all have interest and dividend income from personal investments in all relevant years and Rachel realised a large chargeable gain on the disposal of some shares in November 2018. Required: Evaluate the loss relief options available to each partner to utilise their share of the trading loss arising in the year ended 31 October 2019. For each relief option available, advise in which tax years the relief is available, explain what income the loss can be set against, and state the due date for making any loss relief claims available. Total marks: (15 marks) RETAIL PRICE INDEX Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1982 - - 79.44 81.04 81.62 81.85 81.88 81.90 81.85 82.26 82.66 82.51 1983 82.61 82.97 83.12 84.28 84.64 84.84 85.30 85.68 86.06 86.36 86.67 86.89 1984 86.84 87.20 87.48 88.64 88.97 89.20 89.10 89.94 90.11 90.67 90.95 90.87 1985 91.20 91.94 92.80 94.78 95.21 95.41 95.23 95.49 95.44 95.59 95.92 96.05 1986 96.25 96.60 96.73 97.67 97.85 97.79 97.52 97.82 98.30 98.45 99.29 99.62 1987 100.0 100.4 100.6 101.8 101.9 101.9 101.8 102.1 102.4 102.9 103.4 103.3 1988 103.3 103.7 104.1 105.8 106.2 106.6 106.7 107.9 108.4 109.5 110.0 110.3 1989 111.0 111.8 112.3 114.3 115.0 115.4 115.5 115.8 116.6 117.5 118.5 118.8 1990 119.5 120.2 121.4 125.1 126.2 126.7 126.8 128.1 129.3 130.3 130.0 129.9 1991 130.2 130.9 131.4 133.1 133.5 134.1 133.8 134.1 134.6 135.1 135.6 135.7 1992 135.6 136.3 136.7 138.8 139.3 139.3 138.8 138.9 139.4 139.9 139.7 139.2 1993 137.9 138.8 139.3 140.6 141.1 141.0 140.7 141.3 141.9 141.8 141.6 141.9 1994 141.3 142.1 142.5 144.2 144.7 144.7 144.0 144.7 145.0 145.2 145.3 146.0 1995 146.0 146.9 147.5 149.0 149.6 149.8 149.1 149.9 150.6 149.8 149.8 150.7 1996 150.2 150.9 151.5 152.6 152.9 153.0 152.4 153.1 153.8 153.8 153.9 154.4 1997 154.4 155.0 155.4 156.3 156.9 157.5 157.5 158.5 159.3 159.5 159.6 160.0 1998 159. 5 160.3 160.8 162.6 163,5 163.4 163.0 163.7 164.4 164.5 164.4 164.4 1999 163.4 163.7 164.1 165.2 165.6 165.6 165.1 165.5 166.2 166.5 166.7 167.3 2000 166.6 167.5 168.4 170.1 170.7 171.1 170.5 170.5 171.7 171.6 172.1 172.2 2001 171.1 172.0 172.2 173.1 1742 174.4 173.3 174.0 174.6 174.3 173.6 173.4 2002 173.3 173.8 174.5 175.7 176.2 176.2 175.9 176.4 177.6 177.9 178.2 178.5 2003 178. 4 179.3 179.9 181.2 181.5 181.3 181.3 181.6 182.5 182.6 182.7 183.5 2004 183.1 183.8 184.6 185.7 186.5 186.8 186.8 187.4 188.1 188.6 189.0 189.9 188.9 189.6 190.5 191.6 192.0 192.2 192.2 192.6 1931 193.3 193.6 194.1 2006 193.4 194.2 195.0 196.5 197.7 198.5 198.5 199.2 2001 200.4 201.1 202.7 2007 201.6 203.1 204.4 205.4 206.2 207.3 206.1 207.3 208.0 208.9 209.7 210.9 2008 209.8 211.4 212.1 214.0 215.1 216.8 216.5 217.2 218.4 217.7 216.0 212.9 2009 210.1 211.4 211.3 211.5 212.8 213.4 213.4 214.4 215.3 216.0 216.6 218.0 2010 217.9 219.2 220.7 222.8 223.6 224.1 223.6 224.5 225.3 225.8 226.8 228.4 2011 229.0 231.3 232.5 234.4 235.2 235.2 234.7 236.1 237.9 238.0 238.5 239.4 2012 238.0 239.9 240.8 242.5 242.4 241.8 242.1 243.0 244.2 245.6 245.6 246.8 2013 245.8 247.6 248.7 249.5 250.0 249.7 249.7 251.0 251.9 251.9 252.1 253.4 2014 252.6 254.2 254.8 255.7 255.9 256.3 256.0 257.0 257.6 257.7 257.1 257.5 2015 255.4 256.7 257.1 258.0 258.5 258.9 258.6 259.8 259.6 259.5 259.8 260.6 2016 258.8 260.0 261.1 261.4 262.1 263.1 263.4 264.4 264.9 264.8 265.5 267.1 2017 265.5 268.4 269.3 270.6 271.7 272.3 272.9 274.7 275.1 275.3 275.8 278.1 BUSINESS TAXATION - TAX TABLES FOR 2019/20 INCOME TAX RATES Basic rate Higher rate Additional rate Banding Non-savings income 1- 37,500 20% 37,501 - 150,000 150,001 and above 45% Savings income 20% 12 40% 2 45% Dividend income 7.5% 32.5% 38.1% 1 Savings income falling into the first 5,000 of taxable income is taxed at a starting rate of 0% 2 Savings income allowance available: 1,000 basic rate taxpayer, 500 higher rate taxpayer 3 Dividend income allowance available: 2,000 ALLOWABLE DEDUCTIONS AND RELIEFS Personal allowance: 12,500 Transferable amount 1,250 Adjusted net income limit 100,000 Pension relief: Basic amount qualifying for relief 3,600 Annual allowance - 2014/15 and 2019/20 40,000 Minimum allowance 10,000 Net income threshold 110,000 Adjusted income limit 150,000 Lifetime allowance 1,000,000 Cap on qualifying loan interest: Higher of 50,000 or 25% of adjusted total income CORPORATION TAX RATES Financial year: Rate of tax Profit threshold 2017 19% 1,500,000 2018 2019 19% 19% 1,500,000 1,500,000 NATIONAL INSURANCE CONTRIBUTIONS NOT CONTRACTED OUT RATES Class 1 primary contributions Annual Monthly 1 - 8,632 p.a. 1 - 719 p.m. 8,633 - 50,000 p.a. 720 - 4,167 p.m. Above 50,000 p.a. Above 4,167 p.m. Weekly 1 - 166 p.w. 167 - 962 p.w. Above 962 p.w. Rate 0% 12% 2% Class 1 secondary contributions Rate for employee aged: Annual Monthly Weekly under 21 21 or over 1 - 8,632 p.a. 1 - 719 p.m. 1 - 166 p.w. 0% 8,633 - 50,000 p.a. 720 - 4,167 p.m. 167 - 962 p.w. 0% 13.8% Above 50,000 p.a. Above 4,167 p.m. Above 962 p.w. 13.8% 1 13.8% 1 Allowance of 3,000 available to employers with more than one employee against total class 1 secondary contributions for the tax year Class 1A contributions Flat rate 13.8% 3.00 6,365 Class 2 contributions Flat rate - per week of trading Small profits threshold Class 4 contributions 1 - 8,632 p.a. 8,633 - 50,000 p.a. Above 50,000 p.a. 0% VALUE ADDED TAX RATES Standard rate Registration limit Deregistration limit Cash accounting and annual accounting: Threshold to join scheme Threshold to leave scheme 20% 85,000 83,000 1,350,000 1,600,000 18% 6% CAPITAL ALLOWANCES Plant and machinery: Main pool Special rate pool Motor cars: New cars with CO2 emissions up to 50 grams per kilometre 1 CO2 emissions between 51 and 110 grams per kilometre CO2 emissions above 110 grams per kilometre Annual investment allowance: Rate of allowance Expenditure limit First year allowance 1 100% 18% 6% 100% 1,000,000 100% First year allowance available on energy saving plant and machinery and water efficient plant and machinery (until April 2020), capital expenditure on research and development, new zero-emission goods vehicles (until April 2021), new electrically propelled cars and new cars with CO2 emissions up to 50 grams per kilometre, electric vehicle charging points expenditure (until April 2023) CAPITAL GAINS TAX RATES Gains falling into remaining basic rate band 1.2 10% Gains in excess of the basic rate band 2 20% 1 Rate of capital gains tax depends on the level of taxable income and remaining basic rate band 2 Rate for residential property gains not covered by PPR is 18% (basic rate band), 28% (higher rate band) Gains qualifying for entrepreneur's relief 10% Lifetime limit on gains qualifying for entrepreneur's relief 10 million ALLOWABLE DEDUCTIONS AND RELIEFS Annual exempt amount for individuals 12,000 TAX ADMINISTRATION Interest on underpaid tax Interest on overpaid tax 3.25% 0.50% PENALTIES LATE PAYMENT OF INCOME TAX AND CAPITAL GAINS TAX Offence Maximum penalty Unpaid 30 days after payment due date 5% of tax unpaid Unpaid 6 months after payment due date Further 5% of tax unpaid Unpaid 12 months after payment due date Further 5% of tax unpaid 1 Late payment penalties do not apply to payments on account PENALTIES FOR INCORRECT RETURNS Reason for penalty Maximum Minimum Minimum penalty penalty with penalty with unprompted prompted disclosure disclosure percentage of the potential lost revenue Careless action 30% Nil 15% Deliberate but not concealed action 70% 20% 35% Deliberate and concealed action 100% 30% 50% PENALTIES FOR FAILURE TO NOTIFY Reason for penalty Maximum Minimum penalty Minimum penalty penalty with unprompted with prompted disclosure percentage of the potential lost revenue Deliberate and concealed action 100% 30% 50% Deliberate but not concealed action 70% 20% 35% > 12 mths 12 mths 12 mths 12 mths