Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P Co acquired a 90% ownership interest in Y Co on 1 January 20x3. At the date of acquisition, the share capital of Y

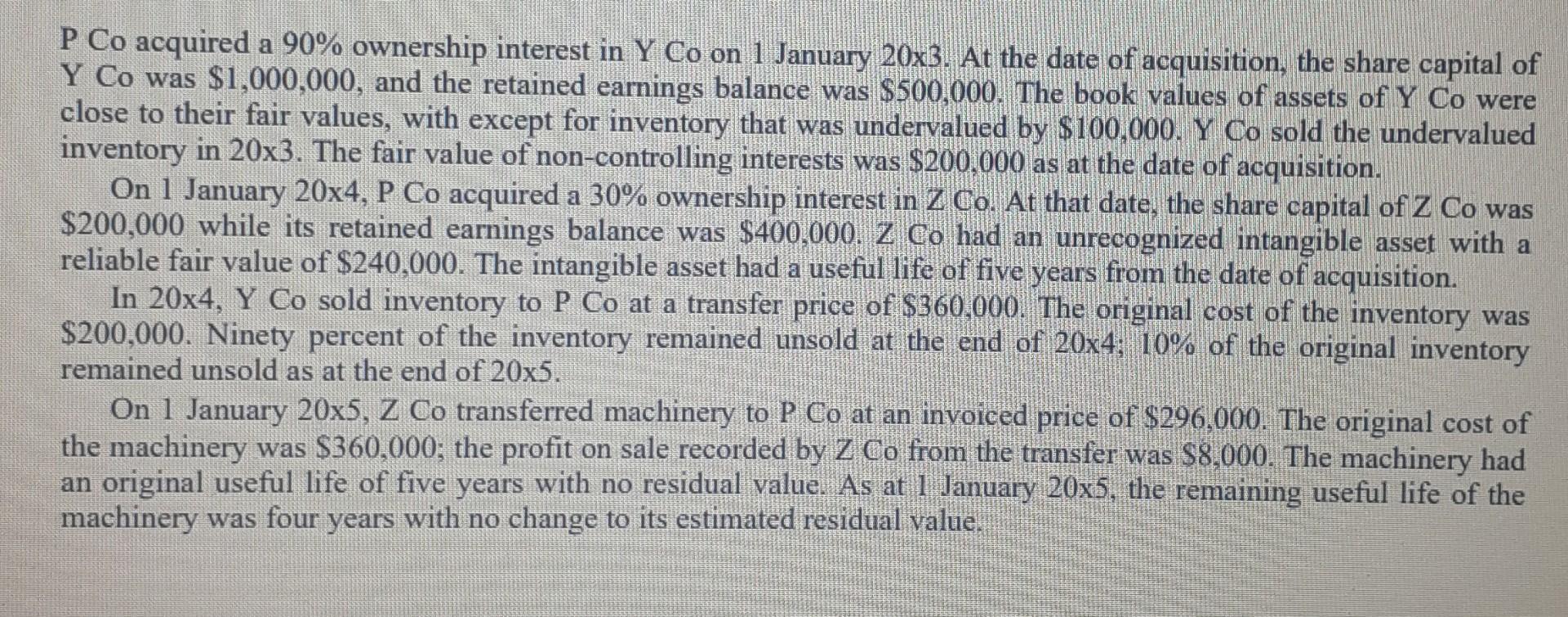

P Co acquired a 90% ownership interest in Y Co on 1 January 20x3. At the date of acquisition, the share capital of Y Co was $1,000,000, and the retained earnings balance was $500,000. The book values of assets of Y Co were close to their fair values, with except for inventory that was undervalued by $100,000. Y Co sold the undervalued inventory in 20x3. The fair value of non-controlling interests was $200,000 as at the date of acquisition. On 1 January 20x4, P Co acquired a 30% ownership interest in Z Co. At that date, the share capital of Z Co was $200,000 while its retained earnings balance was $400,000. Z Co had an unrecognized intangible asset with a reliable fair value of $240,000. The intangible asset had a useful life of five years from the date of acquisition. In 20x4, Y Co sold inventory to P Co at a transfer price of $360,000. The original cost of the inventory was $200,000. Ninety percent of the inventory remained unsold at the end of 20x4; 10% of the original inventory remained unsold as at the end of 20x5. On 1 January 20x5, Z Co transferred machinery to P Co at an invoiced price of $296,000. The original cost of the machinery was $360,000; the profit on sale recorded by Z Co from the transfer was $8,000. The machinery had an original useful life of five years with no residual value. As at 1 January 20x5, the remaining useful life of the machinery was four years with no change to its estimated residual value.

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given information the following are the accounting entries that should be recorded Acqu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started