Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and

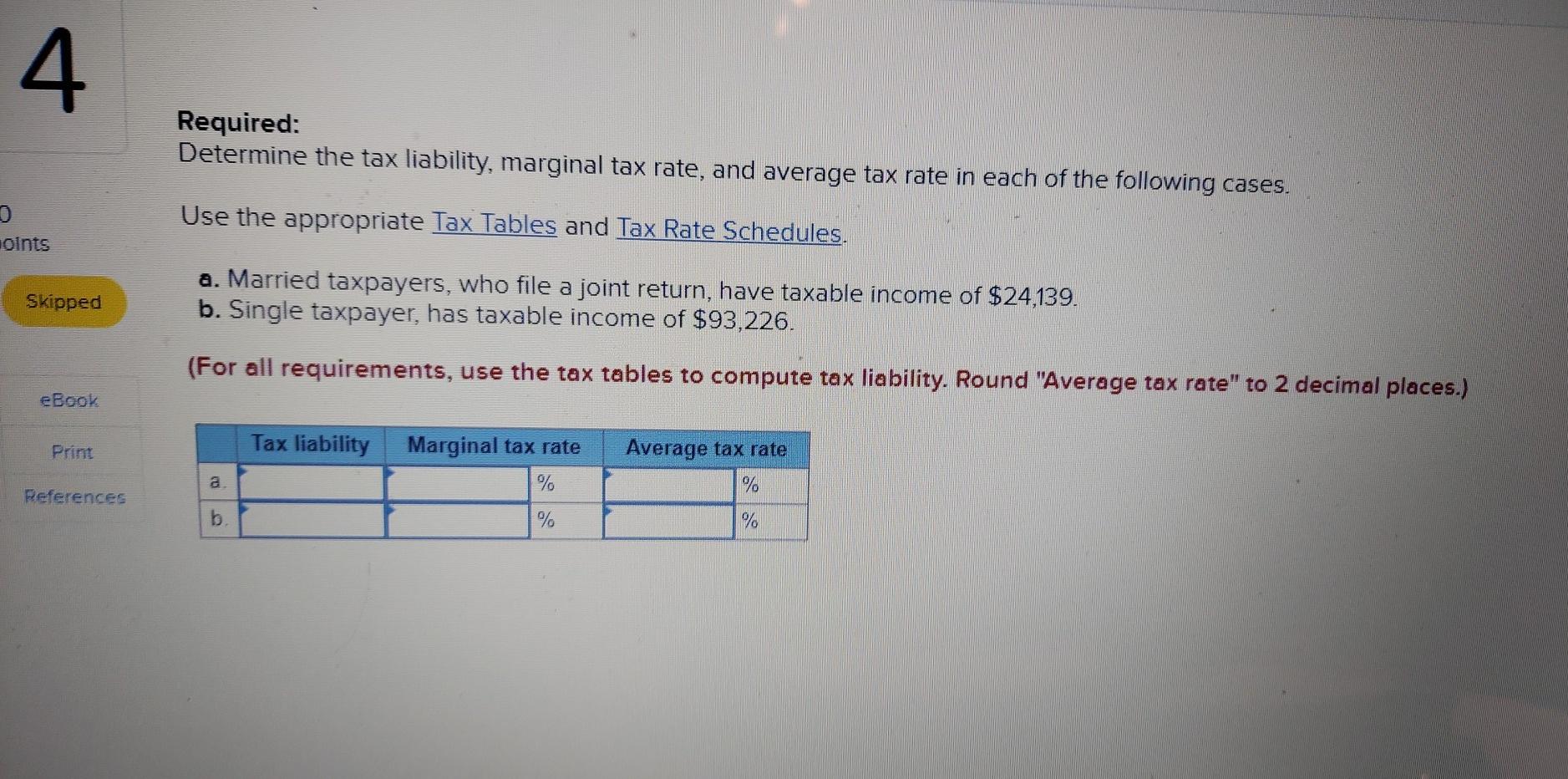

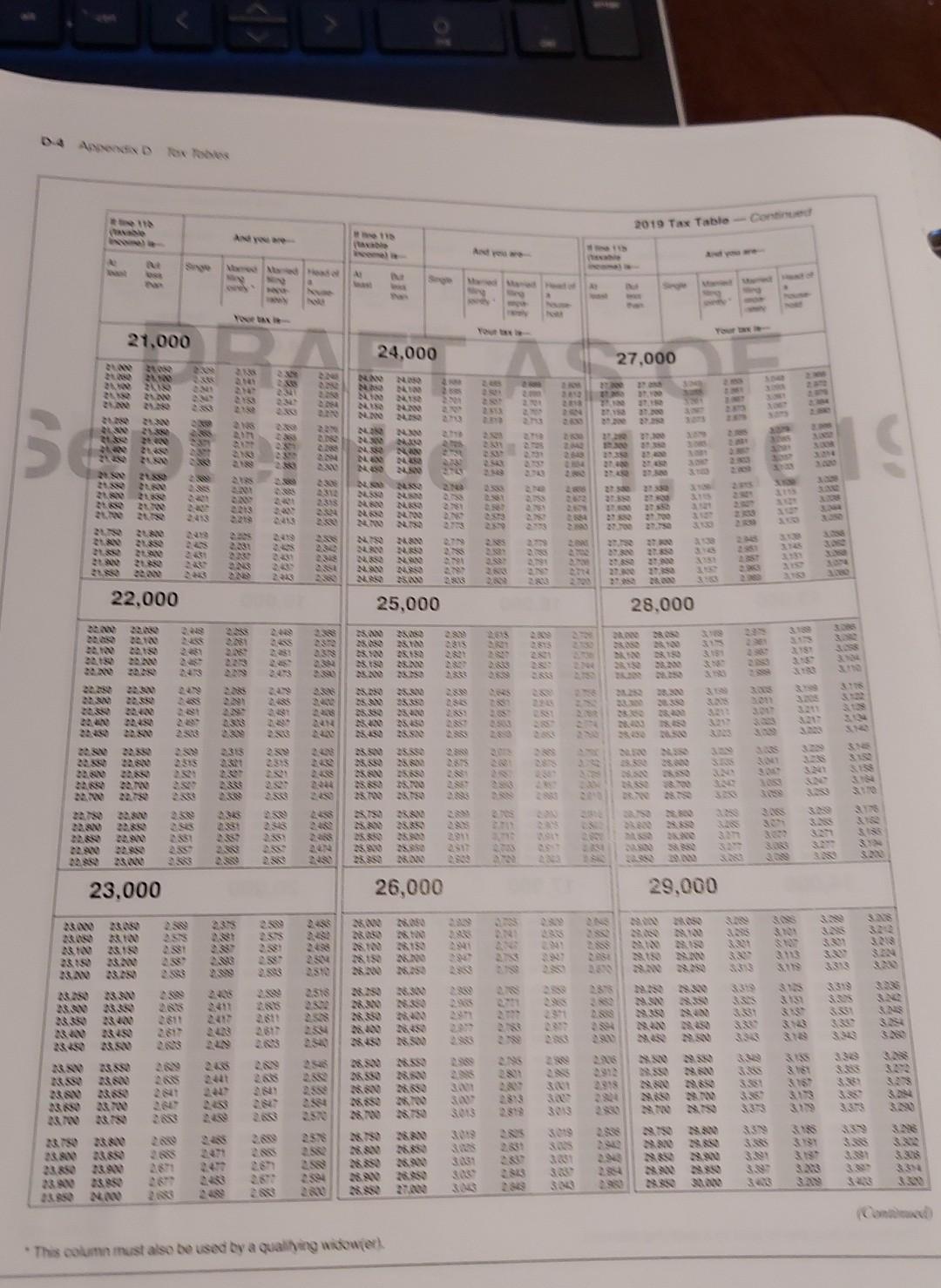

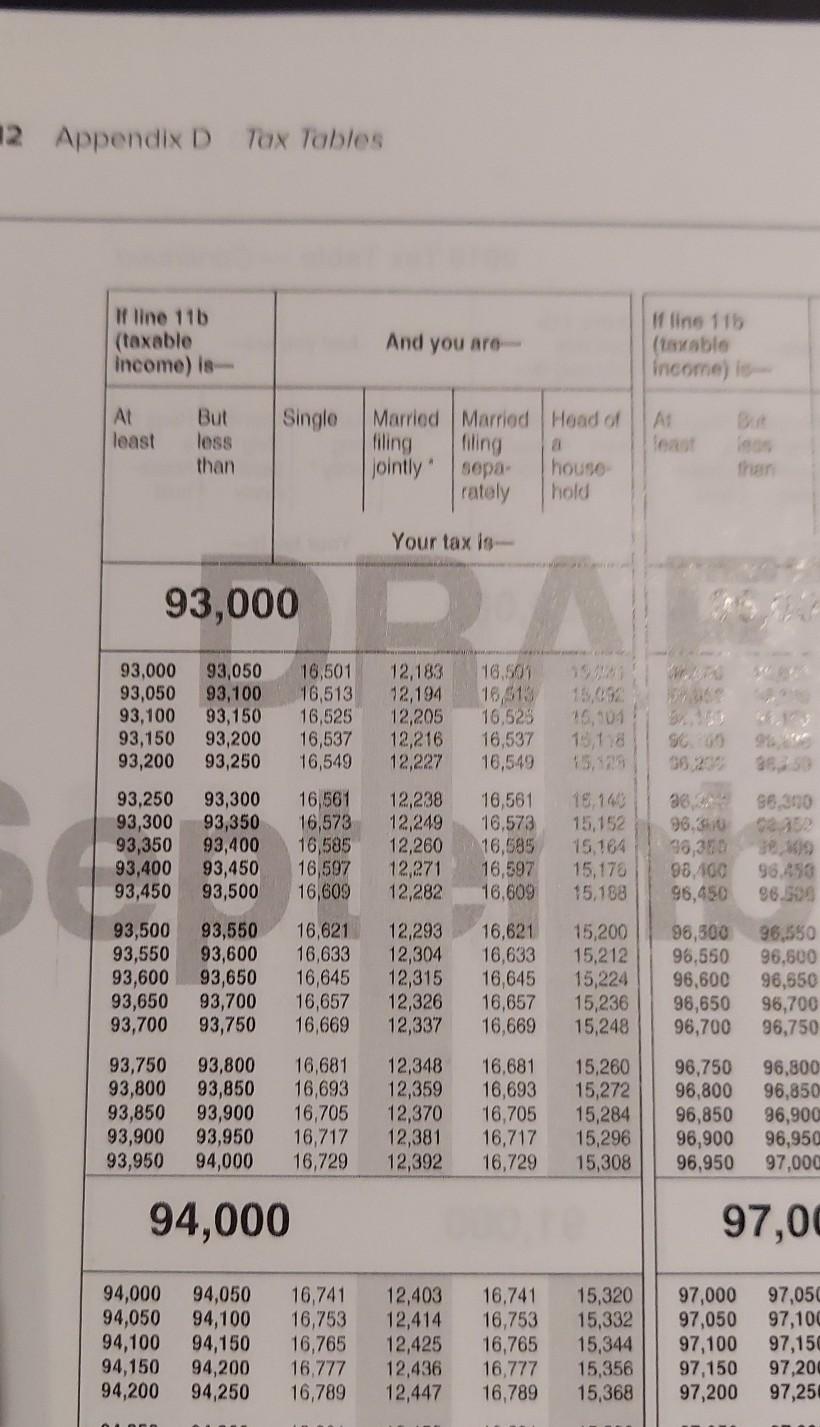

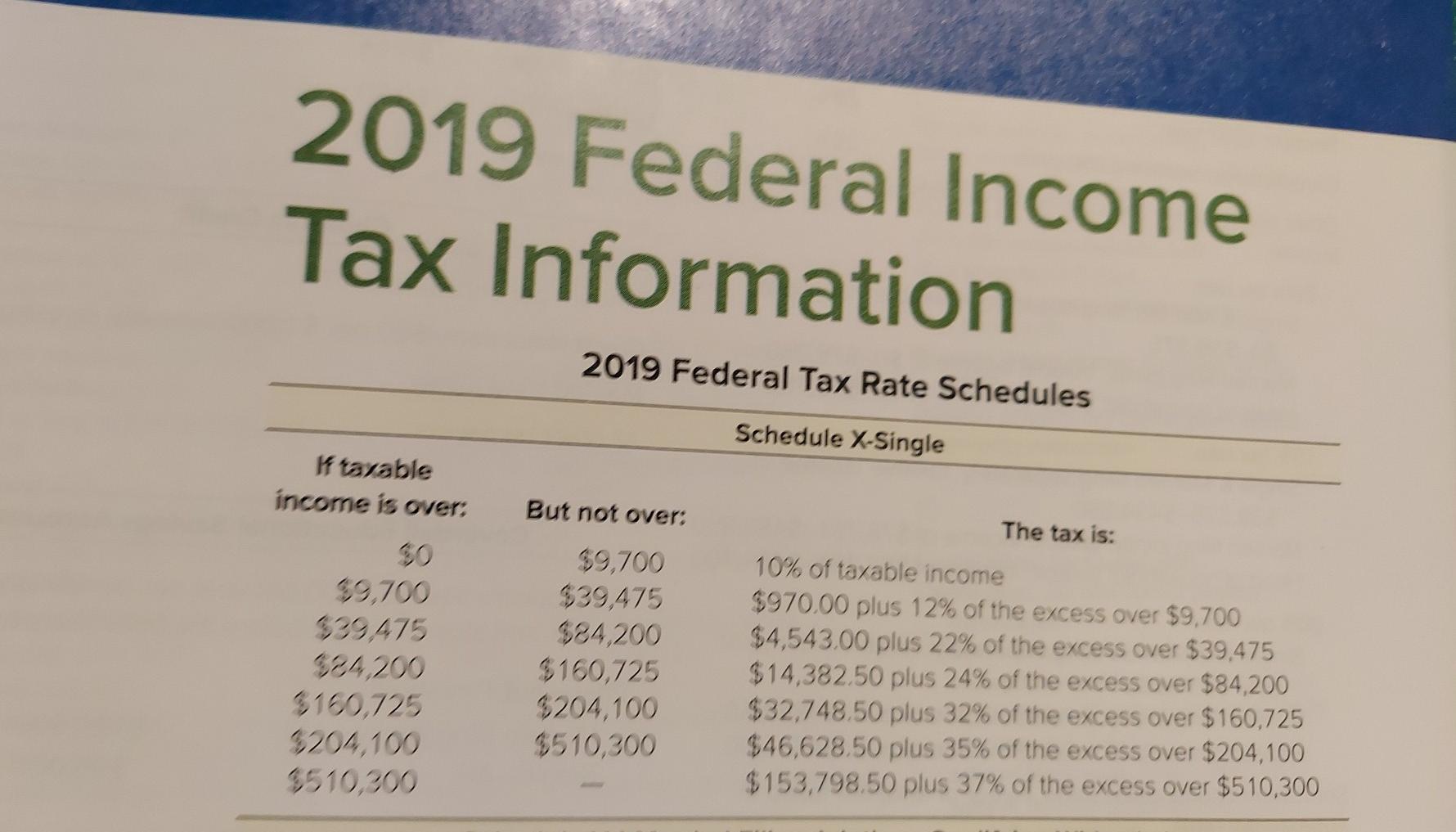

4 Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. oints Skipped a. Married taxpayers, who file a joint return, have taxable income of $24,139. b. Single taxpayer, has taxable income of $93,226. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Print Tax liability Marginal tax rate Average tax rate a % % References be % % 28 AN LANG 2005 2&S 8 *** 14 RIN . 220 245 R AN SOS } | ARA 4 RSS 22 iiii 23,000 ? ES 22.000 21.000 2322222 * This cou must also be used by a qualifying widower) Air Mass ? 2 , , ??? ?????? 14 8228 26,000 222222 25,000 22 24,000 SNS 32 And , 5 Jr TERRE ERPEREZ 30 ? | 3 2.2273 : 28.000 27.000 3 : 22222 2222 2019 Tax Tattooed 315 03 RE: 13 30 331 C%Ex 82552 EEEEE $33 12 Appendix D Tox Tables If line 116 (taxable income) is - And you are I line 116 (taxable Income) is | Al least But Single At less than Married Married Head of filing biling Jointly sepa house rately hold than Your tax is- 93,000 D 93,000 93,050 93,100 93,150 93,200 93,050 93,100 93,150 93,200 93,250 16,501 16,513 16,525 16,537 16,549 12,183 12,194 12,205 12,216 12,227 16.509 16,513 16,525 16,537 16,549 15,901 C. 60 38.2 56.300 02.12 93,250 93,300 93,350 93,400 93,450 93,300 93,350 93,400 93,450 93,500 16,561 16,573 16,585 16,597 16,609 12,238 12,249 12,260 12,271 12,282 16,561 16,573 16,585 16,597 16,609 18,140 15,152 15.184 15,178 15.188 96,3010 96,30 98.400 96,450 96.433 98.520 93,500 93,550 93,600 93,650 93,700 93,550 93,600 93,650 93,700 93,750 16,621 16,633 16,645 16,657 16,669 12,293 12,304 12,315 12,326 12,337 16,621 16,633 16,645 16,657 16,669 15,200 15,212 15,224 15,236 15,248 96,500 96.550 96,600 96,650 96,700 96.550 96,500 96,550 96,700 96,750 93,750 93,800 93,850 93,900 93,950 93,800 93,850 93,900 93,950 94,000 16,681 16,693 16,705 16,717 16,729 12,348 12,359 12,370 12,381 12,392 16,681 16,693 16,705 16,717 16,729 15,260 15,272 15,284 15,296 15,308 96,750 96,800 96,850 96,900 96,950 96,800 96,850 96,900 96,950 97,000 94,000 97,00 94,000 94,050 94,100 94,150 94,200 94,050 94,100 94,150 94,200 94,250 16,741 16,753 16,765 16,777 16,789 12,403 12,414 12,425 12,436 12,447 16,741 16,753 16,765 16,777 16,789 15,320 15,332 15,344 15,356 15,368 97,000 97,050 97,100 97,150 97,200 97,050 97,100 97,15 97,200 97,25 2019 Federal Income Tax Information 2019 Federal Tax Rate Schedules Schedule X-Single If taxable income is over: But not over: The tax is: $9,700 $39475 $84,200 $160,725 $204,100 $510,300 $9,700 $39,475 $84,200 $ 160,725 $204,100 $510,300 10% of taxable income $970,00 plus 12% of the excess over $9.700 $4,543.00 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $153,798,50 plus 37% of the excess over $510,300 4 Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. oints Skipped a. Married taxpayers, who file a joint return, have taxable income of $24,139. b. Single taxpayer, has taxable income of $93,226. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Print Tax liability Marginal tax rate Average tax rate a % % References be % % 28 AN LANG 2005 2&S 8 *** 14 RIN . 220 245 R AN SOS } | ARA 4 RSS 22 iiii 23,000 ? ES 22.000 21.000 2322222 * This cou must also be used by a qualifying widower) Air Mass ? 2 , , ??? ?????? 14 8228 26,000 222222 25,000 22 24,000 SNS 32 And , 5 Jr TERRE ERPEREZ 30 ? | 3 2.2273 : 28.000 27.000 3 : 22222 2222 2019 Tax Tattooed 315 03 RE: 13 30 331 C%Ex 82552 EEEEE $33 12 Appendix D Tox Tables If line 116 (taxable income) is - And you are I line 116 (taxable Income) is | Al least But Single At less than Married Married Head of filing biling Jointly sepa house rately hold than Your tax is- 93,000 D 93,000 93,050 93,100 93,150 93,200 93,050 93,100 93,150 93,200 93,250 16,501 16,513 16,525 16,537 16,549 12,183 12,194 12,205 12,216 12,227 16.509 16,513 16,525 16,537 16,549 15,901 C. 60 38.2 56.300 02.12 93,250 93,300 93,350 93,400 93,450 93,300 93,350 93,400 93,450 93,500 16,561 16,573 16,585 16,597 16,609 12,238 12,249 12,260 12,271 12,282 16,561 16,573 16,585 16,597 16,609 18,140 15,152 15.184 15,178 15.188 96,3010 96,30 98.400 96,450 96.433 98.520 93,500 93,550 93,600 93,650 93,700 93,550 93,600 93,650 93,700 93,750 16,621 16,633 16,645 16,657 16,669 12,293 12,304 12,315 12,326 12,337 16,621 16,633 16,645 16,657 16,669 15,200 15,212 15,224 15,236 15,248 96,500 96.550 96,600 96,650 96,700 96.550 96,500 96,550 96,700 96,750 93,750 93,800 93,850 93,900 93,950 93,800 93,850 93,900 93,950 94,000 16,681 16,693 16,705 16,717 16,729 12,348 12,359 12,370 12,381 12,392 16,681 16,693 16,705 16,717 16,729 15,260 15,272 15,284 15,296 15,308 96,750 96,800 96,850 96,900 96,950 96,800 96,850 96,900 96,950 97,000 94,000 97,00 94,000 94,050 94,100 94,150 94,200 94,050 94,100 94,150 94,200 94,250 16,741 16,753 16,765 16,777 16,789 12,403 12,414 12,425 12,436 12,447 16,741 16,753 16,765 16,777 16,789 15,320 15,332 15,344 15,356 15,368 97,000 97,050 97,100 97,150 97,200 97,050 97,100 97,15 97,200 97,25 2019 Federal Income Tax Information 2019 Federal Tax Rate Schedules Schedule X-Single If taxable income is over: But not over: The tax is: $9,700 $39475 $84,200 $160,725 $204,100 $510,300 $9,700 $39,475 $84,200 $ 160,725 $204,100 $510,300 10% of taxable income $970,00 plus 12% of the excess over $9.700 $4,543.00 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $153,798,50 plus 37% of the excess over $510,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started