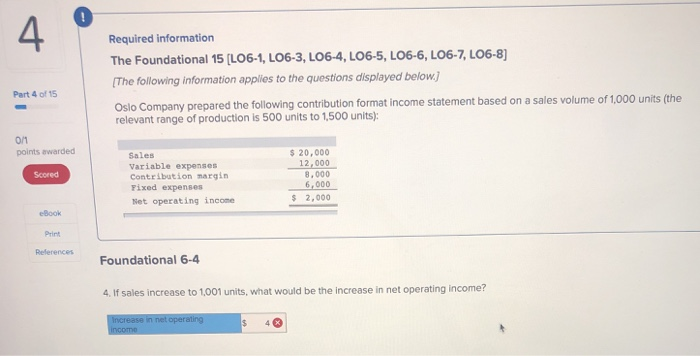

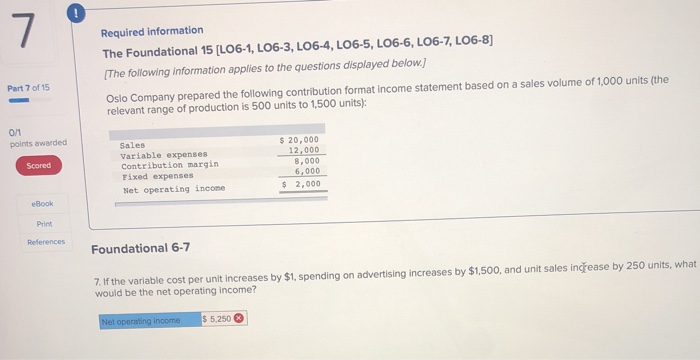

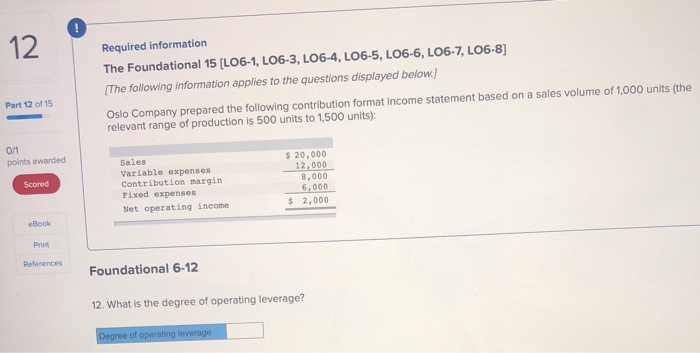

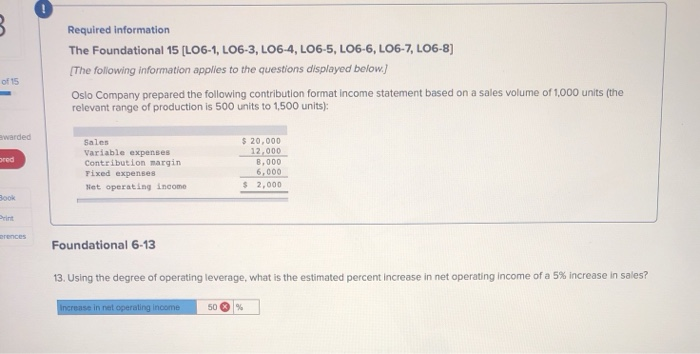

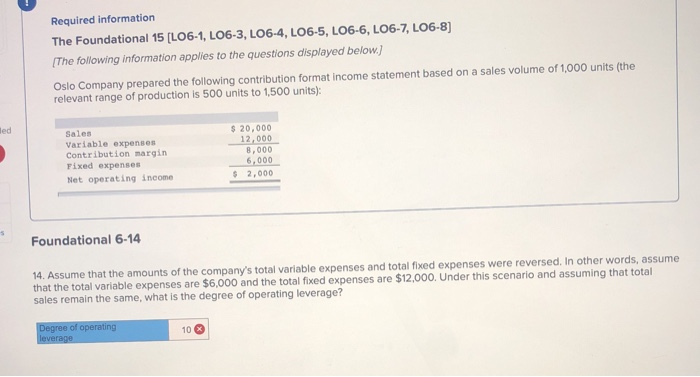

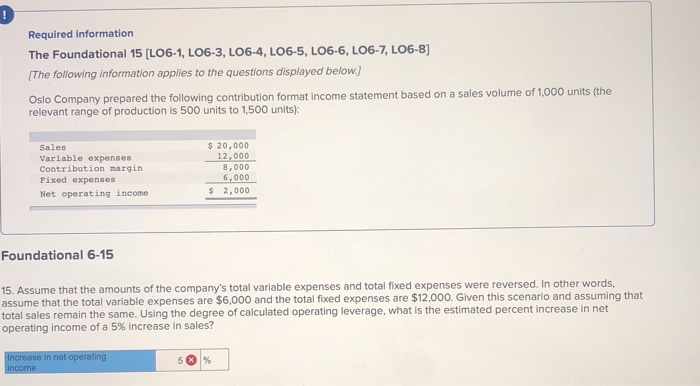

4 Required information The Foundational 15 [LO6-1, L06-3, L06-4, L06-5, L06-6, LO6-7, LO6-8) [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units); Part 4 of 15 On points awarded Scored Sales Variable expenses Contribution margin Fixed expenses Het operating income $ 20,000 12,000 8.000 6,000 $ 2,000 eBook Print References Foundational 6-4 4. If sales increase to 1,001 units, what would be the increase in net operating income? Increase in net operating incomo $ 0 7 Required information The Foundational 15 [L06-1, L06-3, L06-4, LO6-5, L06-6, LO6-7, LO6-8] [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1500 units): Part 7 of 15 011 points awarded Scored Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 BOOK Print References Foundational 6-7 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,500, and unit sales increase by 250 units, what would be the net operating income? Net operating income $ 5,250 12 Required information The Foundational 15 [L06-1, L06-3, L06-4, L06-5, L06-6, LO6-7, L06-8] [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Part 12 of 15 011 points awarded Scored Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 eBook Print References Foundational 6-12 12. What is the degree of operating leverage? Degree of operating leverage Required information The Foundational 15 [L06-1, LO6-3, L06-4, L06-5, L06-6, LO6-7, LO6-8) [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): of 15 awarded Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12.000 8,000 6,000 $ 2,000 Book erences Foundational 6-13 13. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% increase in sales? Increase in net operating income 50% Required information The Foundational 15 [L06-1, L06-3, L06-4, LO6-5, LO6-6, LO6-7, LO6-8] [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): led Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 5 Foundational 6-14 14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $6,000 and the total fixed expenses are $12,000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? Degree of operating leverage 10 Required information The Foundational 15 (LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8] [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Foundational 6-15 15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $6,000 and the total fixed expenses are $12,000. Given this scenario and assuming that total sales remain the same. Using the degree of calculated operating leverage, what is the estimated percent increase in net operating income of a 5% increase in sales? Increase in net operating income 5 %