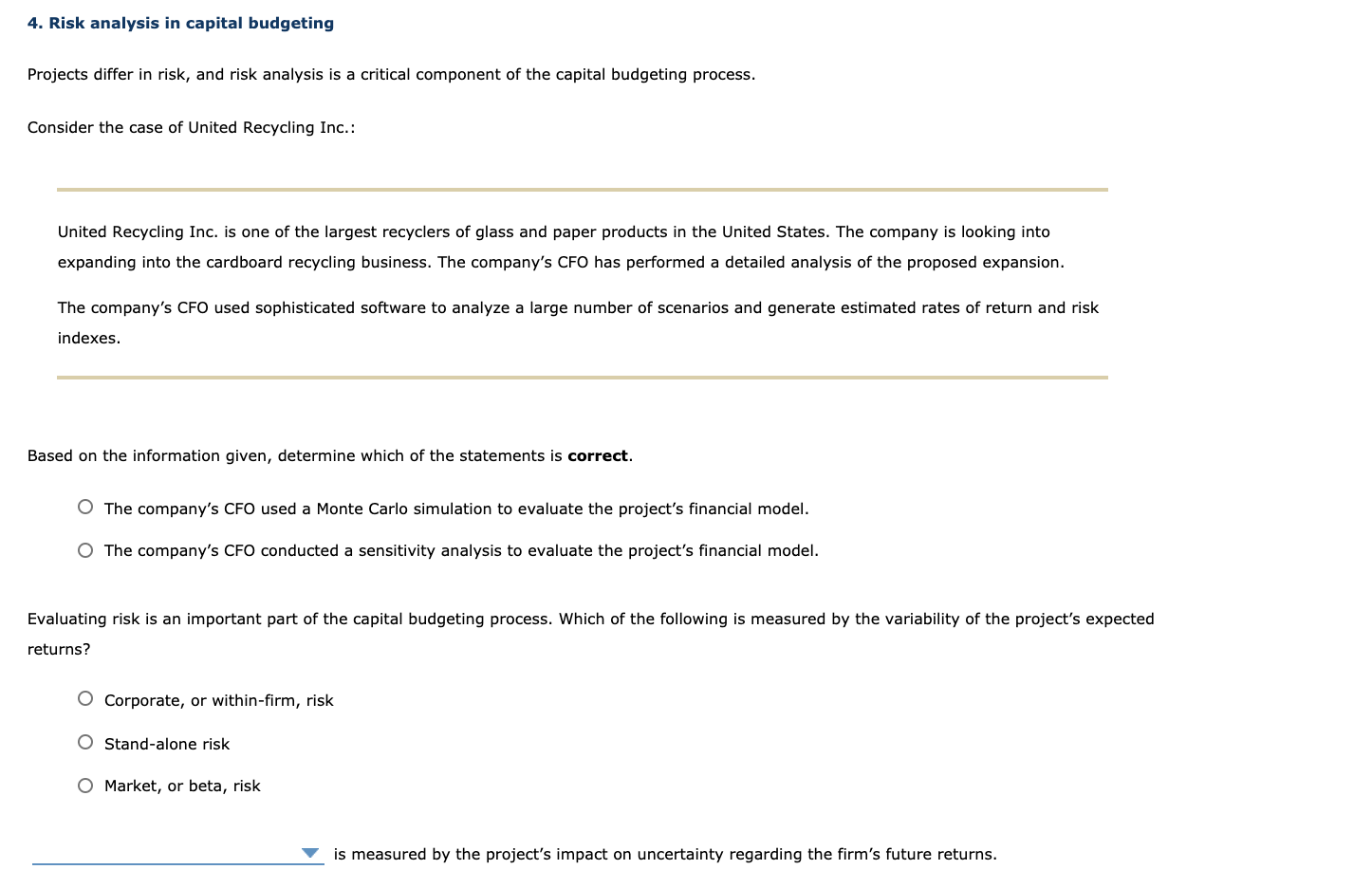

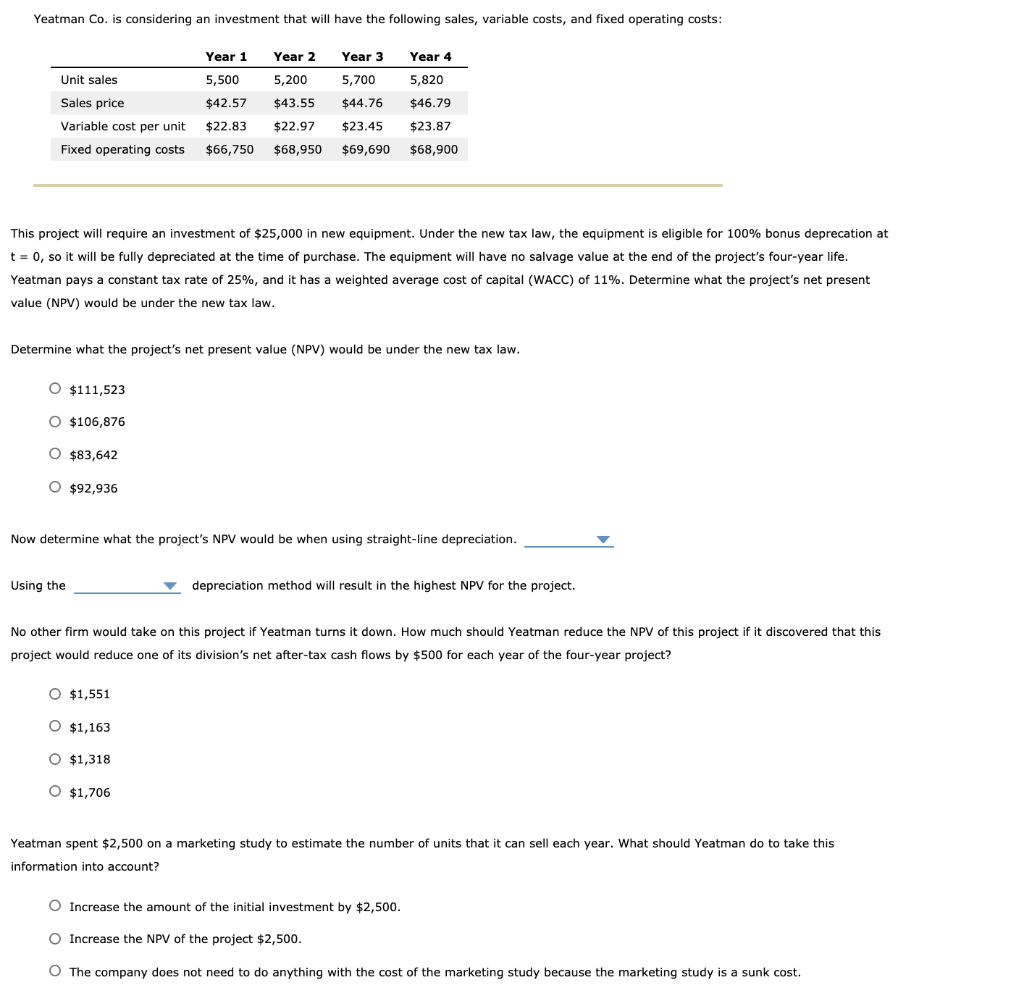

4. Risk analysis in capital budgeting Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc.: United Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion. The company's CFO used sophisticated software to analyze a large number of scenarios and generate estimated rates of return and risk indexes. Based on the information given, determine which of the statements is correct. O The company's CFO used a Monte Carlo simulation to evaluate the project's financial model. O The company's CFO conducted a sensitivity analysis to evaluate the project's financial model. Evaluating risk is an important part of the capital budgeting process. Which of the following is measured by the variability of the project's expected returns? O Corporate, or within-firm, risk O Stand-alone risk O Market, or beta, risk is measured by the project's impact on uncertainty regarding the firm's future returns. Yeatman Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: Year 1 Year 4 Year 2 5,200 Unit sales Year 3 5,700 $44.76 5,500 $42.57 5,820 $43.55 $46.79 Sales price Variable cost per unit Fixed operating costs $22.83 $22.97 $23.45 $23.87 $66,750 $68,950 $69,690 $68,900 This project will require an investment of $25,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at t = 0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Yeatman pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. Determine what the project's net present value (NPV) would be under the new tax law. O $111,523 O $106,876 O $83,642 O $92,936 Now determine what the project's NPV would be when using straight-line depreciation. Using the depreciation method will result in the highest NPV for the project. No other firm would take on this project if Yeatman turns it down. How much should Yeatman reduce the NPV of this project if it discovered that this project would reduce one of its division's net after-tax cash flows by $500 for each year of the four-year project? O $1,551 O $1,163 O $1,318 O $1,706 Yeatman spent $2,500 on a marketing study to estimate the number of units that it can sell each year. What should Yeatman do to take this information into account? O Increase the amount of the initial investment by $2,500. O Increase the NPV of the project $2,500. The company does not need to do anything with the cost of the marketing study because the marketing study is a sunk cost