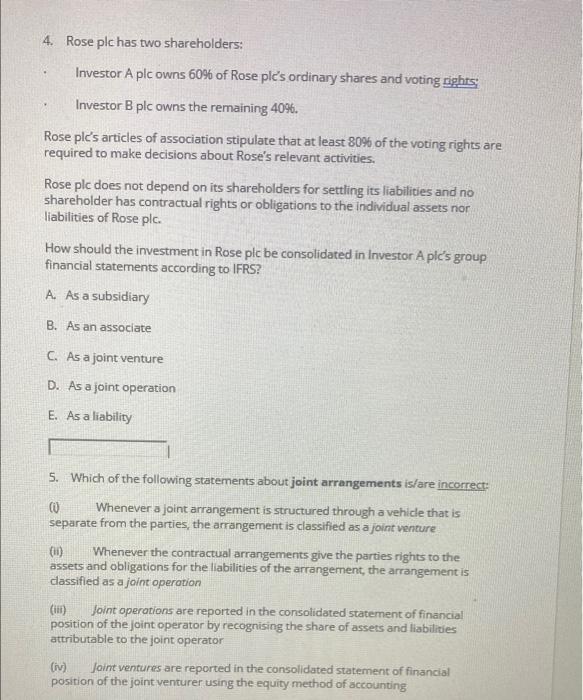

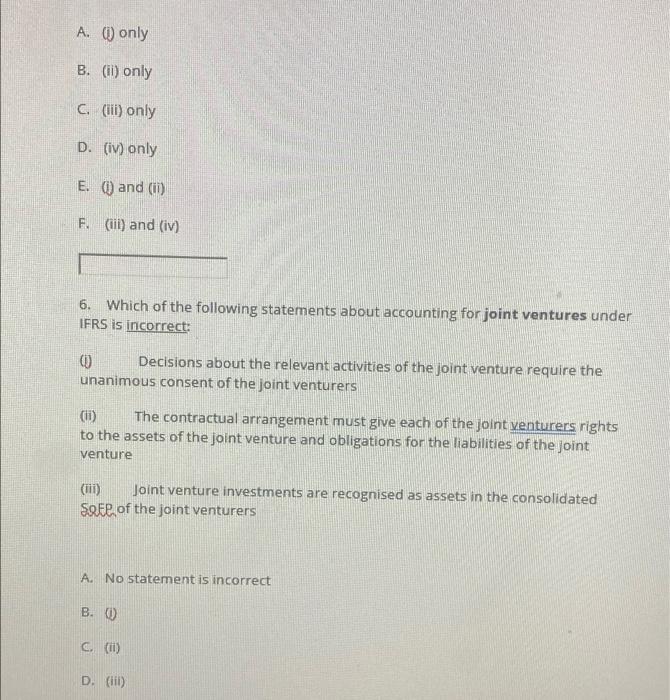

4. Rose plc has two shareholders: Investor A plc owns 60% of Rose ple's ordinary shares and voting rights Investor B plc owns the remaining 40%. Rose ple's articles of association stipulate that at least 80% of the voting rights are required to make decisions about Rose's relevant activities. Rose plc does not depend on its shareholders for settling its liabilities and no shareholder has contractual rights or obligations to the individual assets nor liabilities of Rose plc. How should the investment in Rose plcbe consolidated in Investor A ple's group financial statements according to IFRS? A. As a subsidiary B. As an associate C. As a joint venture D. As a joint operation E. As a liability 5. Which of the following statements about joint arrangements is/are incorrect: CD Whenever a joint arrangement is structured through a vehicle that is separate from the parties, the arrangement is classified as a joint venture a (11) Whenever the contractual arrangements give the parties rights to the assets and obligations for the liabilities of the arrangement, the arrangement is dassified as a joint operation (111) Joint operations are reported in the consolidated statement of financial position of the joint operator by recognising the share of assets and liabilities attributable to the joint operator (iv) Joint ventures are reported in the consolidated statement of financial position of the joint venturer using the equity method of accounting A. () only B. (ii) only C. (iii) only D. (iv) only E. () and (ii) F. (iii) and (iv) 6. Which of the following statements about accounting for joint ventures under IFRS is incorrect: Decisions about the relevant activities of the joint venture require the unanimous consent of the joint venturers (I) The contractual arrangement must give each of the joint venturers rights to the assets of the joint venture and obligations for the liabilities of the joint venture Joint venture investments are recognised as assets in the consolidated Sake of the joint venturers A. No statement is incorrect B. C. (1) D. (iil)