Question

4. Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine.

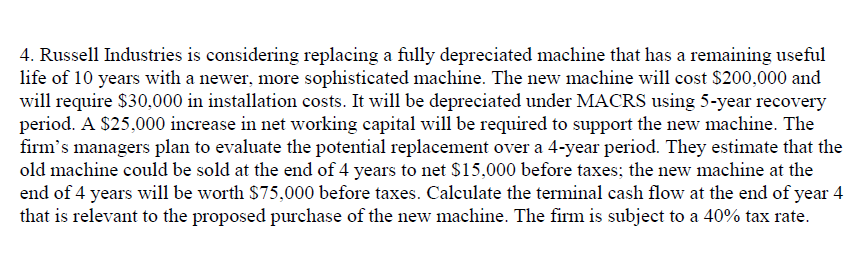

4. Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $200,000 and will require $30,000 in installation costs. It will be depreciated under MACRS using 5-year recovery period. A $25,000 increase in net working capital will be required to support the new machine. The firms managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $15,000 before taxes; the new machine at the end of 4 years will be worth $75,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% tax rate.

- please explin how to solev it step by step, bc i need to study this for final exam.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started