Answered step by step

Verified Expert Solution

Question

1 Approved Answer

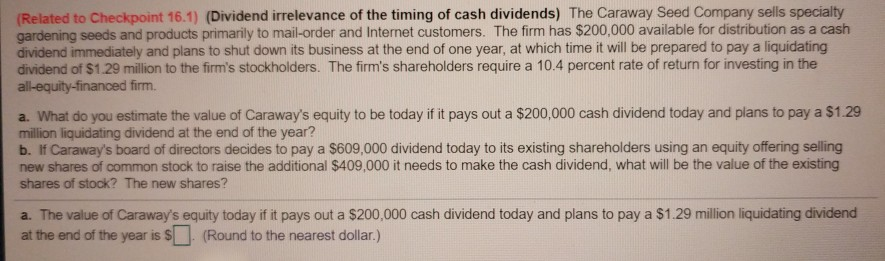

need parts a and b (Related to Checkpoint 16.1) (Dividend irrelevance of the timing of cash dividends) The Caraway Seed Company sells specialty gardening seeds

need parts a and b

(Related to Checkpoint 16.1) (Dividend irrelevance of the timing of cash dividends) The Caraway Seed Company sells specialty gardening seeds and products primarily to mail-order and Internet customers. The firm has $200,000 available for distribution as a cash dividend immediately and plans to shut down its business at the end of one year, at which time it will be prepared to pay a liquidating dividend of $1.29 million to the firm's stockholders. The firm's shareholders require a 10.4 percent rate of return for investing in the a. What do you estimate the value of Caraway's equity to be today if it pays out a $200,000 cash dividend today and plans to pay a $1.29 million liquidating dividend at the end of the year? b. If Caraway's board of directors decides to pay a $609,000 dividend today to its existing shareholders using an equity offering selling new shares of common stock to raise the additional $409,000 it needs to make the cash dividend, what will be the value of the existing shares of stock? The new shares? a. The value of Caraway's equity today if it pays out a $200,000 cash dividend today and plans to pay a $1.29 milion liquidating dividend at the end of the year is (Round to the nearest dollar.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started