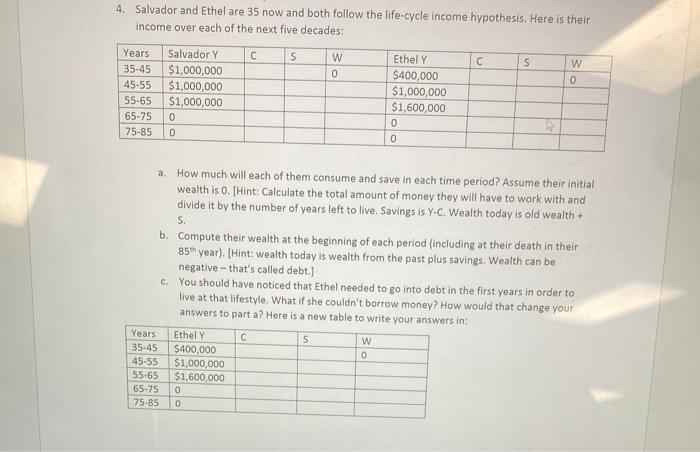

4. Salvador and Ethel are 35 now and both follow the life-cycle income hypothesis. Here is their income over each of the next five decades: C s w 0 S w 0 Years 35-45 45-55 55-65 65-75 75-85 Salvador y $1,000,000 $1,000,000 $1,000,000 0 0 Ethel Y $400,000 $1,000,000 $1,600,000 0 0 a How much will each of them consume and save in each time period? Assume their initial wealth is O. (Hint: Calculate the total amount of money they will have to work with and divide it by the number of years left to live. Savings is Y-C. Wealth today is old wealth + S. b. Compute their wealth at the beginning of each period (including at their death in their 85 year). (Hint: wealth today is wealth from the past plus savings. Wealth can be negative - that's called debt.) c. You should have noticed that Ethel needed to go into debt in the first years in order to live at that lifestyle. What if she couldn't borrow money? How would that change your answers to part a? Here is a new table to write your answers in: Years Ethely w 35-45 $400,000 45-55 $1,000,000 55-65 $1,600,000 65-75 75-85 S 0 0 0 4. Salvador and Ethel are 35 now and both follow the life-cycle income hypothesis. Here is their income over each of the next five decades: C s w 0 S w 0 Years 35-45 45-55 55-65 65-75 75-85 Salvador y $1,000,000 $1,000,000 $1,000,000 0 0 Ethel Y $400,000 $1,000,000 $1,600,000 0 0 a How much will each of them consume and save in each time period? Assume their initial wealth is O. (Hint: Calculate the total amount of money they will have to work with and divide it by the number of years left to live. Savings is Y-C. Wealth today is old wealth + S. b. Compute their wealth at the beginning of each period (including at their death in their 85 year). (Hint: wealth today is wealth from the past plus savings. Wealth can be negative - that's called debt.) c. You should have noticed that Ethel needed to go into debt in the first years in order to live at that lifestyle. What if she couldn't borrow money? How would that change your answers to part a? Here is a new table to write your answers in: Years Ethely w 35-45 $400,000 45-55 $1,000,000 55-65 $1,600,000 65-75 75-85 S 0 0 0