Answered step by step

Verified Expert Solution

Question

1 Approved Answer

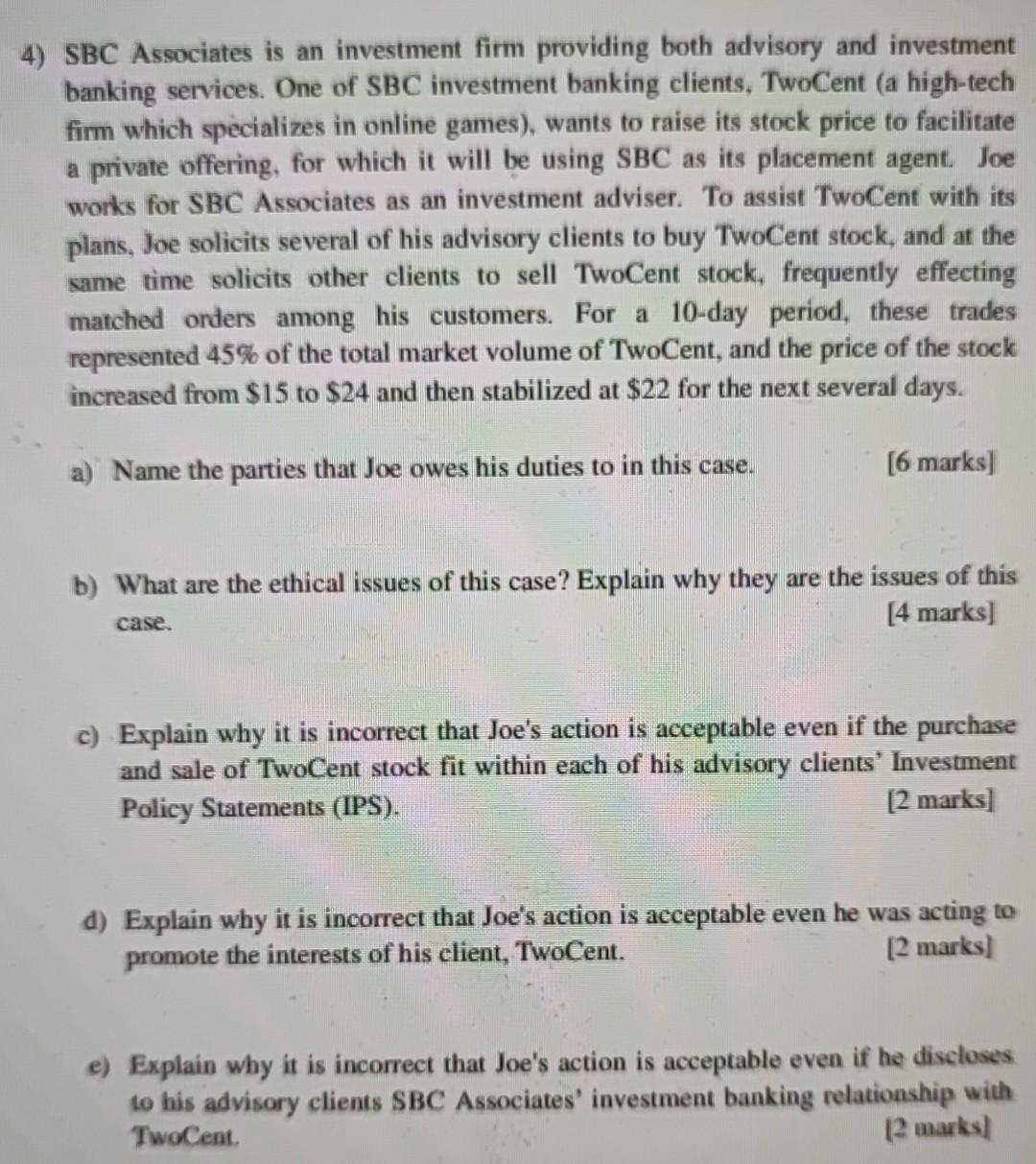

4) SBC Associates is an investment firm providing both advisory and investment banking services. One of SBC investment banking clients, TwoCent (a high-tech firm which

4) SBC Associates is an investment firm providing both advisory and investment banking services. One of SBC investment banking clients, TwoCent (a high-tech firm which specializes in online games), wants to raise its stock price to facilitate a private offering, for which it will be using SBC as its placement agent. Joe works for SBC Associates as an investment adviser. To assist TwoCent with its plans, Joe solicits several of his advisory clients to buy TwoCent stock, and at the same time solicits other clients to sell TwoCent stock, frequently effecting matched orders among his customers. For a 10-day period, these trades represented 45% of the total market volume of TwoCent, and the price of the stock increased from $15 to $24 and then stabilized at $22 for the next several days. Name the parties that Joe owes his duties to in this case. [6 marks] b) What are the ethical issues of this case? Explain why they are the issues of this [4 marks] case. c) Explain why it is incorrect that Joe's action is acceptable even if the purchase and sale of TwoCent stock fit within each of his advisory clients' Investment Policy Statements (IPS). [2 marks] d) Explain why it is incorrect that Joe's action is acceptable even he was acting to promote the interests of his client, TwoCent. [2 marks] e) Explain why it is incorrect that Joe's action is acceptable even if he discloses to his advisory clients SBC Associates' investment banking relationship with TwoCent. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started