Answered step by step

Verified Expert Solution

Question

1 Approved Answer

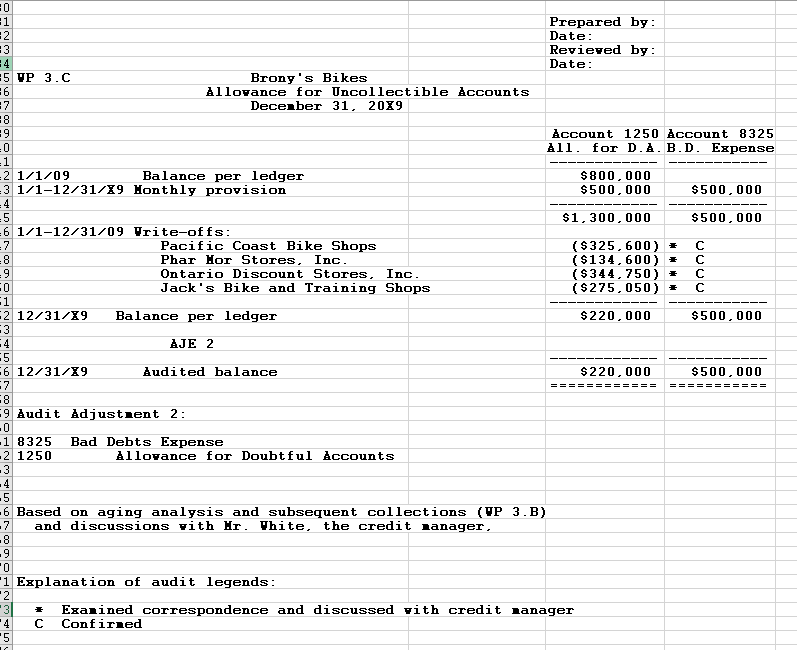

4. Scroll to WP 3.C, Allowance for Uncollectible Accounts. a. What type of correspondence would you examine to satisfy yourself as to the accounts receivable

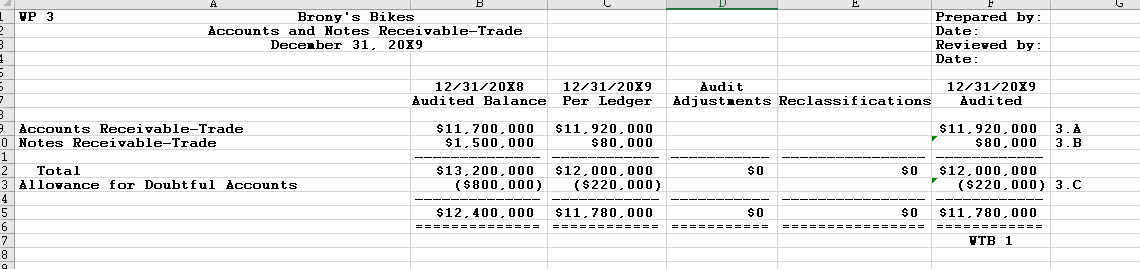

4. Scroll to WP 3.C, Allowance for Uncollectible Accounts. a. What type of correspondence would you examine to satisfy yourself as to the accounts receivable write-offs? b. Draft the suggested Audit Adjustment 2. Are you satisfied that the balance in the allowance is adequate after your recommended adjustment? c. Scroll to WP 3, Accounts and Notes ReceivableTrade (lead schedule). Post Reclassification Entry A and Audit Adjustment 2 to the appropriate locations in the lead schedule.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started