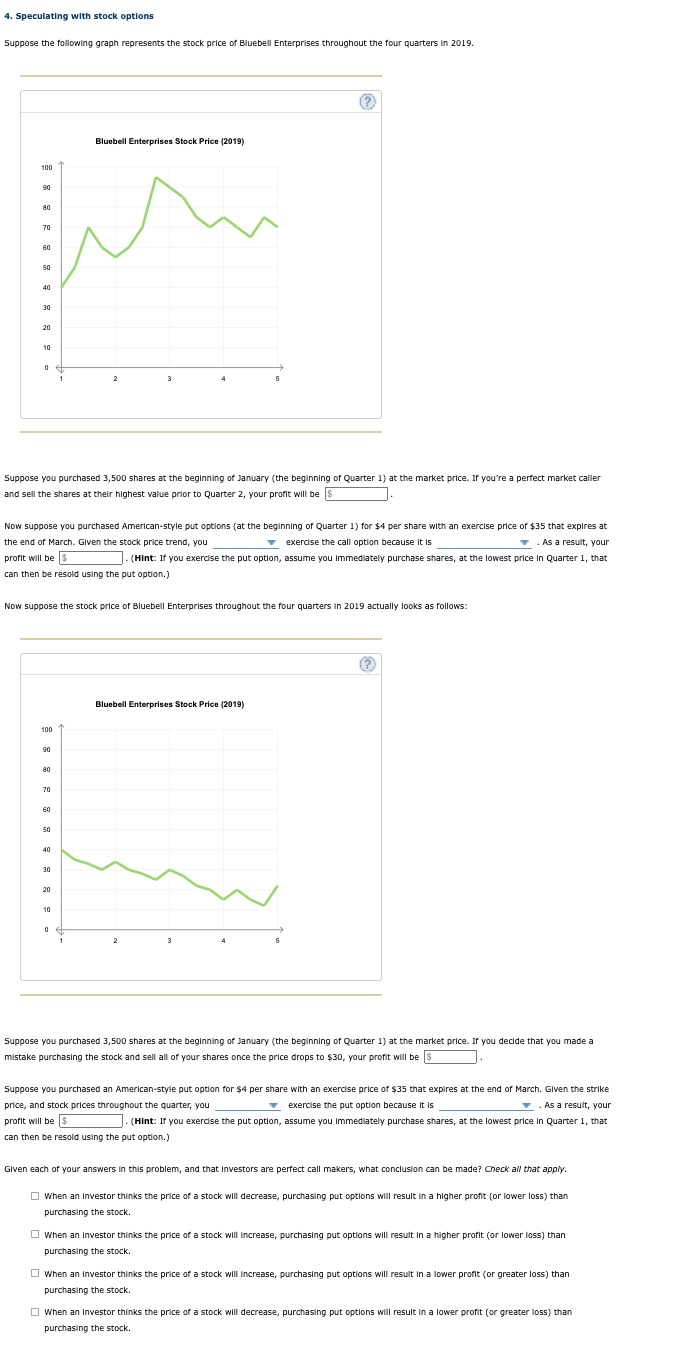

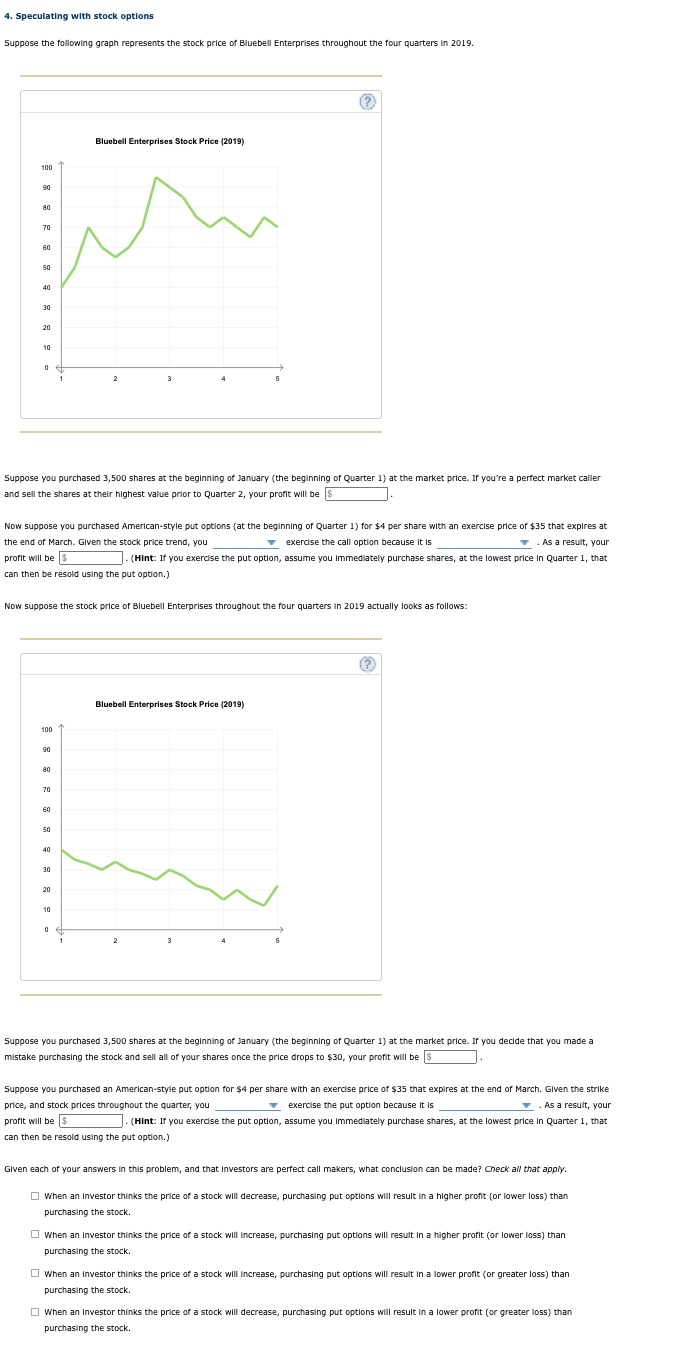

4. Speculating with stock options Suppose the following graph represents the stock price of Bluebell Enterprises throughout the four quarters in 2019. Bluebell Enterprises Stock Price (2019) 100 90 80 70 60 50 40 30 20 10 0 1 Suppose you purchased 3,500 shares at the beginning of January (the beginning of Quarter 1) at the market price. If you're a perfect market caller 1 and sell the shares at their highest value prior to Quarter 2, your profit will be Now suppose you purchased American-style put options (at the beginning of Quarter 1) for $4 per share with an exercise price of $35 that expires at the end of March. Given the stock price trend, you exercise the call option because it is As a result, your profit will be s ]. (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Now suppose the stock price of Bluebell Enterprises throughout the four quarters in 2019 actually looks as follows: Bluebell Enterprises Stock Price (2019) 1001 90 80 70 60 50 40 30 20 10 1 Suppose you purchased 3,500 shares at the beginning of January (the beginning of Quarter 1) at the market price. If you decide that you made a . a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be s Suppose you purchased an American-style put option for $4 per share with an exercise price of $35 that expires at the end of March. Given the strike price, and stock prices throughout the quarter, you exercise the put option because it is As a result, your profit will be S (Hint: If you exercise the put option, assume you Immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Given each of your answers in this problem, and that investors are perfect call makers, what conclusion can be made? Check all that apply. When an Investor thinks the price of a stock will decrease, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock When an Investor thinks the price of a stock will increase, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock When an investor thinks the price of a stock will increase, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an Investor thinks the price of a stock will decrease, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. 4. Speculating with stock options Suppose the following graph represents the stock price of Bluebell Enterprises throughout the four quarters in 2019. Bluebell Enterprises Stock Price (2019) 100 90 80 70 60 50 40 30 20 10 0 1 Suppose you purchased 3,500 shares at the beginning of January (the beginning of Quarter 1) at the market price. If you're a perfect market caller 1 and sell the shares at their highest value prior to Quarter 2, your profit will be Now suppose you purchased American-style put options (at the beginning of Quarter 1) for $4 per share with an exercise price of $35 that expires at the end of March. Given the stock price trend, you exercise the call option because it is As a result, your profit will be s ]. (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Now suppose the stock price of Bluebell Enterprises throughout the four quarters in 2019 actually looks as follows: Bluebell Enterprises Stock Price (2019) 1001 90 80 70 60 50 40 30 20 10 1 Suppose you purchased 3,500 shares at the beginning of January (the beginning of Quarter 1) at the market price. If you decide that you made a . a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be s Suppose you purchased an American-style put option for $4 per share with an exercise price of $35 that expires at the end of March. Given the strike price, and stock prices throughout the quarter, you exercise the put option because it is As a result, your profit will be S (Hint: If you exercise the put option, assume you Immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Given each of your answers in this problem, and that investors are perfect call makers, what conclusion can be made? Check all that apply. When an Investor thinks the price of a stock will decrease, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock When an Investor thinks the price of a stock will increase, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock When an investor thinks the price of a stock will increase, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an Investor thinks the price of a stock will decrease, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock