Answered step by step

Verified Expert Solution

Question

1 Approved Answer

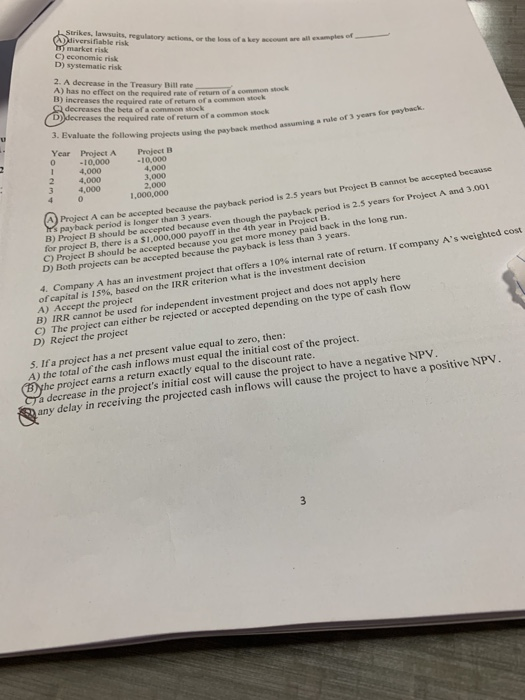

4 Strikes, lawsuits, regulatory actions of the loss of a key Diversifiable risk w market risk C) economic risk D) systematic risk 2. A decrease

4

Strikes, lawsuits, regulatory actions of the loss of a key Diversifiable risk w market risk C) economic risk D) systematic risk 2. A decrease in the Treasury Bit rate has no effect on the required rate of return of a common B) increases the required rate of return of a common stoc decreases the beta of a common stock decreases the required rate of return of a common stock 5. Evaluate the following projects using the payback method assum Year Project Project B 0 -10.000 10,000 1 4 ,000 4,000 2 4 ,000 3,000 3 4,000 2.000 4 0 1.000.000 ne the payback method assuming a rule of years for payback Project A can be accepted because the payback period is 2.5 years but Project B cannot be accepted because s payback period is longer than 3 years B) Project B should be accepted because even though the payback period is 25 years for Project A and 3.001 for project B, there is a S1.000.000 payoff in the 4th year in Project B C) Project B should be accepted because you get more money paid back in the long run. D) Both projects can be accepted because the payback is less than 3 years 4. Company A has an investment project that offers a 10% internal rate of return. If company A's weighted cost of capital is 15%, based on the IRR criterion what is the investment decision A) Accept the project B) IRR cannot be used for independent investment project and does not apply here C) The project can either be rejected or accepted depending on the type of cash flow D) Reject the project 5. If a project has a net present value equal to zero, then: A) the total of the cash inflows must equal the initial cost of the project. Bythe project earns a return exactly equal to the discount rate. Ca decrease in the project's initial cost will cause the project to have a negative NPV. any delay in receiving the projected cash inflows will cause the project to have a positive NPV Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started