#4

#4

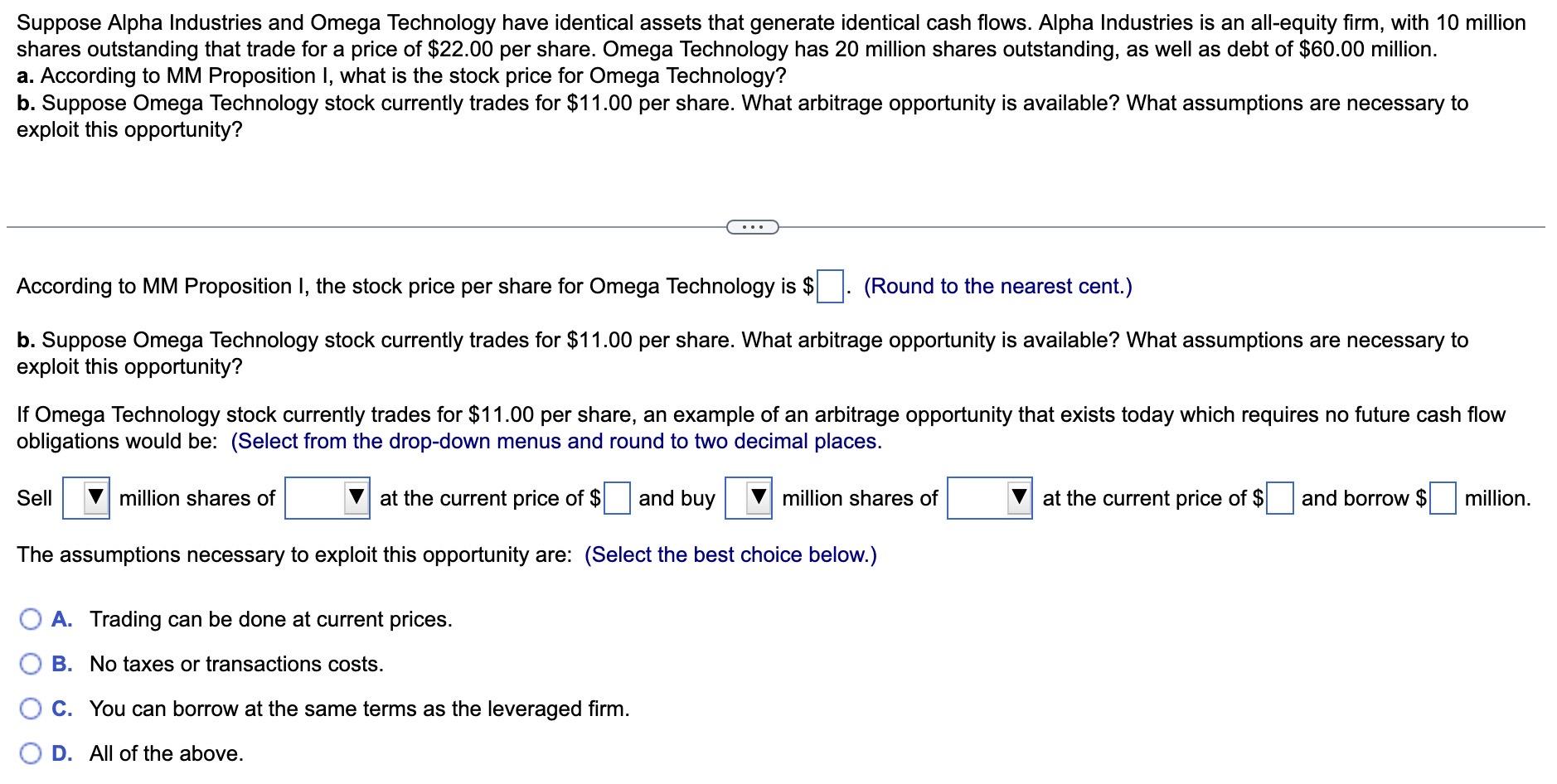

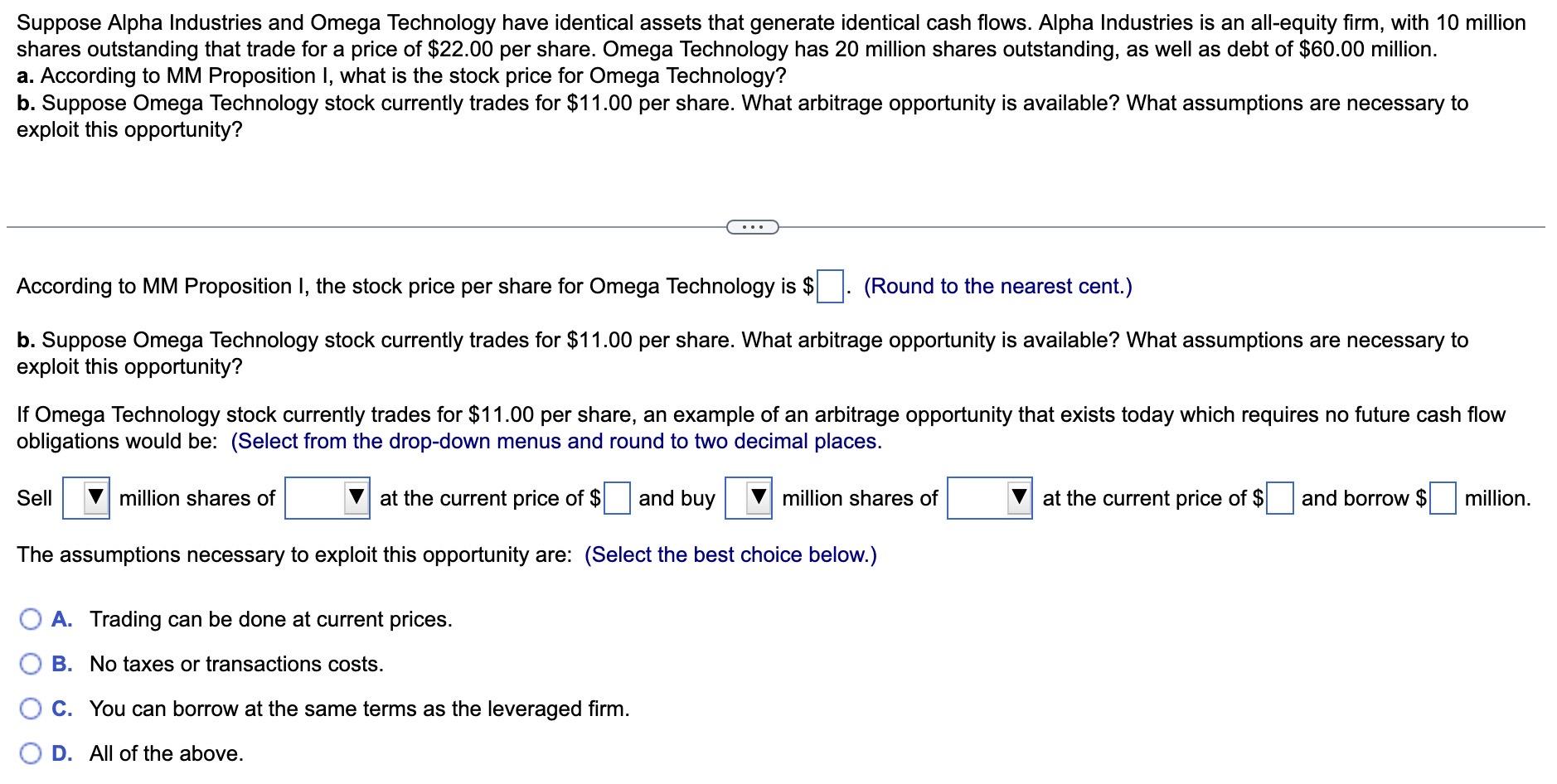

Suppose Alpha Industries and Omega Technology have identical assets that generate identical cash flows. Alpha Industries is an all-equity firm, with 10 million shares outstanding that trade for a price of $22.00 per share. Omega Technology has 20 million shares outstanding, as well as debt of $60.00 million. a. According to MM Proposition I, what is the stock price for Omega Technology? b. Suppose Omega Technology stock currently trades for $11.00 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity? According to MM Proposition I, the stock price per share for Omega Technology is $. (Round to the nearest cent.) b. Suppose Omega Technology stock currently trades for $11.00 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity? If Omega Technology stock currently trades for $11.00 per share, an example of an arbitrage opportunity that exists today which requires no future cash flow obligations would be: (Select from the drop-down menus and round to two decimal places. Sell million shares of at the current price of $ and buy million. The assumptions necessary to exploit this opportunity are: (Select the best choice below.) A. Trading can be done at current prices. B. No taxes or transactions costs. C. You can borrow at the same terms as the leveraged firm. D. All of the above. Suppose Alpha Industries and Omega Technology have identical assets that generate identical cash flows. Alpha Industries is an all-equity firm, with 10 million shares outstanding that trade for a price of $22.00 per share. Omega Technology has 20 million shares outstanding, as well as debt of $60.00 million. a. According to MM Proposition I, what is the stock price for Omega Technology? b. Suppose Omega Technology stock currently trades for $11.00 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity? According to MM Proposition I, the stock price per share for Omega Technology is $. (Round to the nearest cent.) b. Suppose Omega Technology stock currently trades for $11.00 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity? If Omega Technology stock currently trades for $11.00 per share, an example of an arbitrage opportunity that exists today which requires no future cash flow obligations would be: (Select from the drop-down menus and round to two decimal places. Sell million shares of at the current price of $ and buy million. The assumptions necessary to exploit this opportunity are: (Select the best choice below.) A. Trading can be done at current prices. B. No taxes or transactions costs. C. You can borrow at the same terms as the leveraged firm. D. All of the above

#4

#4