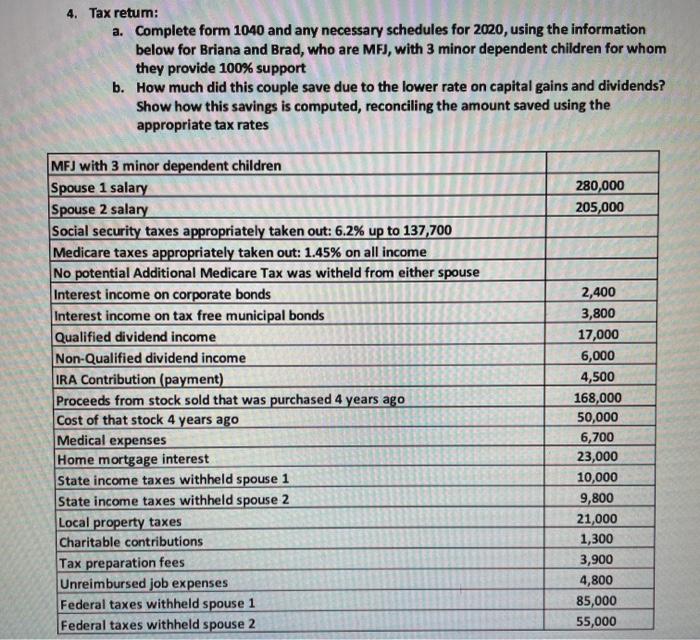

4. Tax retum: a. Complete form 1040 and any necessary schedules for 2020, using the information below for Briana and Brad, who are MF, with 3 minor dependent children for whom they provide 100% support b. How much did this couple save due to the lower rate on capital gains and dividends? Show how this savings is computed, reconciling the amount saved using the appropriate tax rates 280,000 205,000 MFJ with 3 minor dependent children Spouse 1 salary Spouse 2 salary Social security taxes appropriately taken out: 6.2% up to 137,700 Medicare taxes appropriately taken out: 1.45% on all income No potential Additional Medicare Tax was witheld from either spouse Interest income on corporate bonds Interest income on tax free municipal bonds Qualified dividend income Non-Qualified dividend income IRA Contribution (payment) Proceeds from stock sold that was purchased 4 years ago Cost of that stock 4 years ago Medical expenses Home mortgage interest State income taxes withheld spouse 1 State income taxes withheld spouse 2 Local property taxes Charitable contributions Tax preparation fees Unreimbursed job expenses Federal taxes withheld spouse 1 Federal taxes withheld spouse 2 2,400 3,800 17,000 6,000 4,500 168,000 50,000 6,700 23,000 10,000 9,800 21,000 1,300 3,900 4,800 85,000 55,000 4. Tax retum: a. Complete form 1040 and any necessary schedules for 2020, using the information below for Briana and Brad, who are MF, with 3 minor dependent children for whom they provide 100% support b. How much did this couple save due to the lower rate on capital gains and dividends? Show how this savings is computed, reconciling the amount saved using the appropriate tax rates 280,000 205,000 MFJ with 3 minor dependent children Spouse 1 salary Spouse 2 salary Social security taxes appropriately taken out: 6.2% up to 137,700 Medicare taxes appropriately taken out: 1.45% on all income No potential Additional Medicare Tax was witheld from either spouse Interest income on corporate bonds Interest income on tax free municipal bonds Qualified dividend income Non-Qualified dividend income IRA Contribution (payment) Proceeds from stock sold that was purchased 4 years ago Cost of that stock 4 years ago Medical expenses Home mortgage interest State income taxes withheld spouse 1 State income taxes withheld spouse 2 Local property taxes Charitable contributions Tax preparation fees Unreimbursed job expenses Federal taxes withheld spouse 1 Federal taxes withheld spouse 2 2,400 3,800 17,000 6,000 4,500 168,000 50,000 6,700 23,000 10,000 9,800 21,000 1,300 3,900 4,800 85,000 55,000