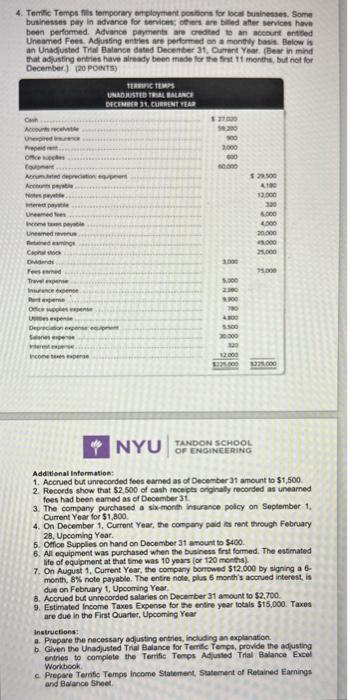

4. Temilic Temps fils temporay erployment posifons for locit tuainesses. Somm businesses pay in advance for sendoet: others are billed ather services have been performed. Advance pryment are crested to an accourt entced Uneamed Feet. Adjuiting entlet ars pertormed on a monttwy bosit. Below is an Unadusted Tital Balance dated Decenter 31, Curment Year. (Bear in mind that adusfing enteies have already been made lor the fint 11 montht, but not for December.) (20 poevts) NYU TANDONSCMOOLOFENOINEERING Additional information: Additional information: 1. Aocnued but unrecorded fees ewmed as of December 31 amount to $1,500. 2. Records show that $2,500 of cash receipta onghaly recorded as unearned fees had been eamed as of Docember 3t. 3. The company purchased a sid-month inturance policy on September 1 , Current Year for $1.800. 4. On Docember 1, Curront Yoac, the compeny paid is rent through Februay 28. Upcoming Year. 5. Ctice Supplies on hand on December 3t amount to $400. 6. All equipment was purchased when the business frat formed. The eutimated life of equipment at that time was 10 years (or 120 moeths) 7. On August 1, Current Year, the compary bonowed 512.000 by signing a 6. month, 8% note payable. The entre note. plis 6 month's accrued interest, is due on February 1, Upeoming Year. 6. Acorued but unrecorded salaries on December 31 amount to \$2.700: 9. Estimated Income Taxes Expense for the enthe year totals $15,000. Taxes are due in the First Quartec, Upcoming Year Instructions: a. Prepare the necessary adjusting entries, including an explanation. b. Given the Unadjusted Thal Balance for Terite Tenpt, provide the adjusting entrios to complete the Terrific Temps Adfusted Trial Bslance Excel Workbok. c. Prepare Terntic Tempe income Statement, Statement of Retained Farnings and Buance Sheed 4. Temilic Temps fils temporay erployment posifons for locit tuainesses. Somm businesses pay in advance for sendoet: others are billed ather services have been performed. Advance pryment are crested to an accourt entced Uneamed Feet. Adjuiting entlet ars pertormed on a monttwy bosit. Below is an Unadusted Tital Balance dated Decenter 31, Curment Year. (Bear in mind that adusfing enteies have already been made lor the fint 11 montht, but not for December.) (20 poevts) NYU TANDONSCMOOLOFENOINEERING Additional information: Additional information: 1. Aocnued but unrecorded fees ewmed as of December 31 amount to $1,500. 2. Records show that $2,500 of cash receipta onghaly recorded as unearned fees had been eamed as of Docember 3t. 3. The company purchased a sid-month inturance policy on September 1 , Current Year for $1.800. 4. On Docember 1, Curront Yoac, the compeny paid is rent through Februay 28. Upcoming Year. 5. Ctice Supplies on hand on December 3t amount to $400. 6. All equipment was purchased when the business frat formed. The eutimated life of equipment at that time was 10 years (or 120 moeths) 7. On August 1, Current Year, the compary bonowed 512.000 by signing a 6. month, 8% note payable. The entre note. plis 6 month's accrued interest, is due on February 1, Upeoming Year. 6. Acorued but unrecorded salaries on December 31 amount to \$2.700: 9. Estimated Income Taxes Expense for the enthe year totals $15,000. Taxes are due in the First Quartec, Upcoming Year Instructions: a. Prepare the necessary adjusting entries, including an explanation. b. Given the Unadjusted Thal Balance for Terite Tenpt, provide the adjusting entrios to complete the Terrific Temps Adfusted Trial Bslance Excel Workbok. c. Prepare Terntic Tempe income Statement, Statement of Retained Farnings and Buance Sheed