Answered step by step

Verified Expert Solution

Question

1 Approved Answer

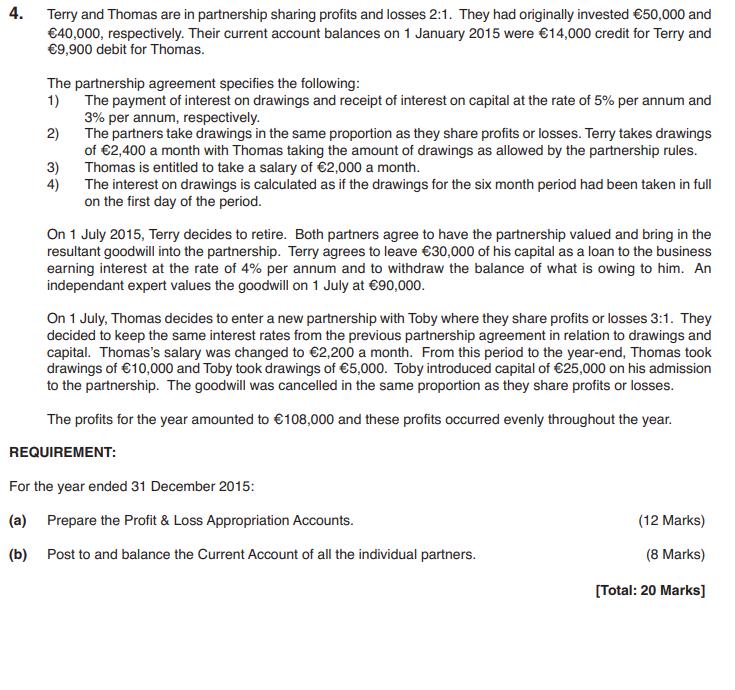

4. Terry and Thomas are in partnership sharing profits and losses 2:1. They had originally invested 50,000 and 40,000, respectively. Their current account balances

4. Terry and Thomas are in partnership sharing profits and losses 2:1. They had originally invested 50,000 and 40,000, respectively. Their current account balances on 1 January 2015 were 14,000 credit for Terry and 9,900 debit for Thomas. The partnership agreement specifies the following: 1) The payment of interest on drawings and receipt of interest on capital at the rate of 5% per annum and 3% per annum, respectively. 2) The partners take drawings in the same proportion as they share profits or losses. Terry takes drawings of 2,400 a month with Thomas taking the amount of drawings as allowed by the partnership rules. Thomas is entitled to take a salary of 2,000 a month. 3) 4) The interest on drawings is calculated as if the drawings for the six month period had been taken in full on the first day of the period. On 1 July 2015, Terry decides to retire. Both partners agree to have the partnership valued and bring in the resultant goodwill into the partnership. Terry agrees to leave 30,000 of his capital as a loan to the business earning interest at the rate of 4% per annum and to withdraw the balance of what is owing to him. An independant expert values the goodwill on 1 July at 90,000. On 1 July, Thomas decides to enter a new partnership with Toby where they share profits or losses 3:1. They decided to keep the same interest rates from the previous partnership agreement in relation to drawings and capital. Thomas's salary was changed to 2,200 a month. From this period to the year-end, Thomas took drawings of 10,000 and Toby took drawings of 5,000. Toby introduced capital of 25,000 on his admission to the partnership. The goodwill was cancelled in the same proportion as they share profits or losses. The profits for the year amounted to 108,000 and these profits occurred evenly throughout the year. REQUIREMENT: For the year ended 31 December 2015: (a) Prepare the Profit & Loss Appropriation Accounts. (b) Post to and balance the Current Account of all the individual partners. (12 Marks) (8 Marks) [Total: 20 Marks]

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Profit Loss Appropriation Accounts and post to and balance the Current Account of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started